The Bitcoin price has fallen back below the $24,000 level, while the US Dollar Index (DXY) has reached a seven-high. After BTC managed to defend the key support of $23,867 in the 1-day chart yesterday, the bulls now need to prove their strength again.

Otherwise, a drop to the $23,300 level might be inevitable, where larger amounts of liquidity might be waiting. As NewsBTC reported yesterday, the zone between $22,659 and $23,325 is currently the most important level of support, as 1.41 million addresses bought 711,550 BTC in this area.

DXY Vs. Bitcoin: Who Wins?

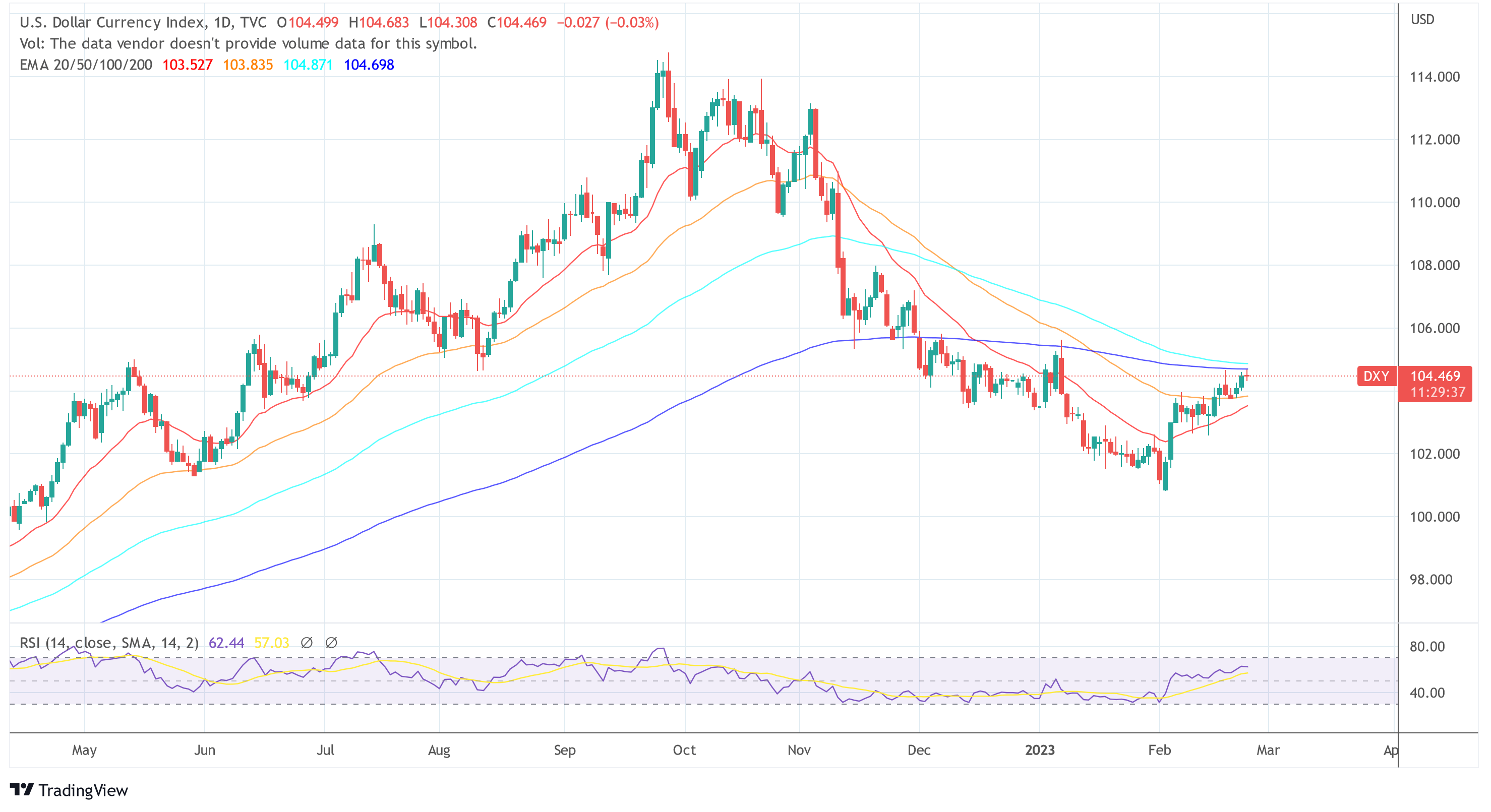

The Bitcoin market has decoupled from its correlation with the U.S. dollar index and the S&P 500 in recent weeks and managed to rally despite a strong DXY. This trend now needs to be defended, especially as the dollar index has posted a new seven-week high of 104.68.

At press time, the DXY was hovering around 104.52, hovering around the weekly high as a result of the Fed’s hawkish concerns in the FOMC Minutes released yesterday. The index climbed 0.36% on Wednesday after the minutes were released.

The FOMC Minutes that almost all Fed policymakers favored a slowdown in rate hikes. At the same time, they pointed out that lowering still-high inflation to 2% requires further rate hikes.

With that in mind, Fed officials signaled that a robust U.S. economy may prompt them to raise rates a bit more than expected to combat high inflation. As analyst LeClair noted via Twitter, rate cuts appear to be off the table for 2023.

Rate cuts are off the table for 2023.

— Dylan LeClair 🟠 (@DylanLeClair_)

This is likely to give further strength to the US dollar in the long run and put pressure on the sentiment on the Bitcoin market.

A trend-setting decision for the DXY or risk assets could come as early as tomorrow (Friday). That’s when the U.S. fourth quarter Personal Consumption Expenditure (PCE) estimate and preliminary U.S. Gross Domestic Product (GDP) numbers will be released.

QCP Capital’s Analysis

Singapore-based crypto options trading giant QCP Capital explained in its latest that for the dollar to strengthen, the NFP (nonfarm payroll), CPI and FOMC would need to support the move next month.

The market is already pricing a higher rate for 2023 than the Fed’s dots now, which means it would take another strong set of data and the FOMC to move up their median to kick off the next leg lower for risk assets.

Until then, according to QCP Capital, BTC will probably move in a range and wait for the next signal. On a longer time frame, QCP warns that Bitcoin could be in for another sell-off, based on the Elliott Wave Theory:

A potential double top is forming against the August 2022 correction high, and May 2022 reaction is low at 25,300. Above that we have the huge 28,800-30,000 resistance which is the Head and Shoulders neckline. Until these levels break, our 5 wave count still remains valid, with a final Wave 5 lower to come.