Bitcoin all exchanges reserve seems to be making a gradual downtrend, a sign that accumulation has been going on.

The Bitcoin All Exchanges Reserve Goes Down

As pointed out by a Crypto Quant , the BTC all exchanges reserve looks like it has gone down over the past couple of weeks.

The Bitcoin all exchanges reserve is a useful indicator that shows us the amount of BTC held in wallets of all exchanges.

When this quantity goes up, it means more investors are putting their BTC into exchange wallets for selling purposes, or exchanging it for altcoins.

Related Reading | Production Cost: Why $14K Is Likely The Absolute Floor For Bitcoin

On the other hand, when the all exchanges reserve goes down, it shows buyers are sending their BTC to personal wallets, possibly to accumulate.

Here is how the BTC all exchanges reserve chart has looked like over the past three months:

BTC all exchanges reserve seems to going down | Source:

As the above chart shows, it seems like whales are slowly starting to accumulate Bitcoin amidst the crashed price.

Another notable feature in the graph is that the 50% crash in May was accompanied by a sharp increase in the all exchanges reserve. This makes sense as investors selling off their BTC in hordes would strike the price down.

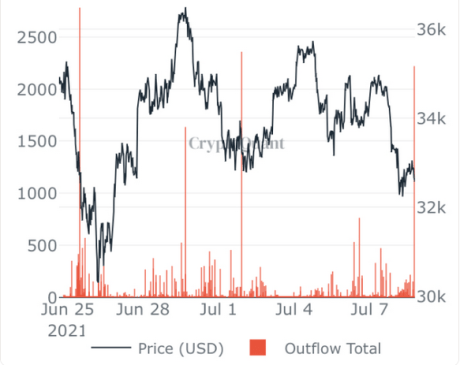

Now, here is another chart that shows the outflow of a popular Bitcoin exchange, Coinbase:

Coinbase shows a surge of outflow right now | Source:

The red lines show the amount of Bitcoin moving out of Coinbase. It seems that a lot of the coin is being withdrawn at the moment.

An interesting feature in this chart is that whenever the price has dropped in the $30k to $33k range, the red lines have spiked quite high.

Related Reading | Bloomberg Analyst Provides Blueprint Of Bitcoin Path To $100,000

This is probably because investors pump up the crypto whenever it shows signs of dropping so that the range can be maintained.

Bitcoin Price

At the time of writing, BTC’s price is going around $33k, down 3% in the past 7 days. Here is a chart showing the trend in its value:

Bitcoin seems to on a slight upwards trend right now | Source: BTCUSD on

BTC has been behaving as a range bound market for a while now, and as the all exchanges reserve chart shows, investors have already started pumping to go back to the $33k to $35k range.

As long as this range is maintained, a bull run could happen. According to an analyst, Bitcoin is coming closer to an intersection with a macro support curve. However, if the $30k to $33k support is lost, and the $30k line becomes resistance, a bear market could be ahead.