The world’s leading cryptocurrency, Bitcoin (BTC), has faced a significant resistance level of $28,600 for the past two weeks. However, despite local headwinds, Bitcoin’s natural volatility and ability to reach new local highs indicate that the resistance cluster is on the verge of breaking.

Bitcoin Trades Above Critical Levels

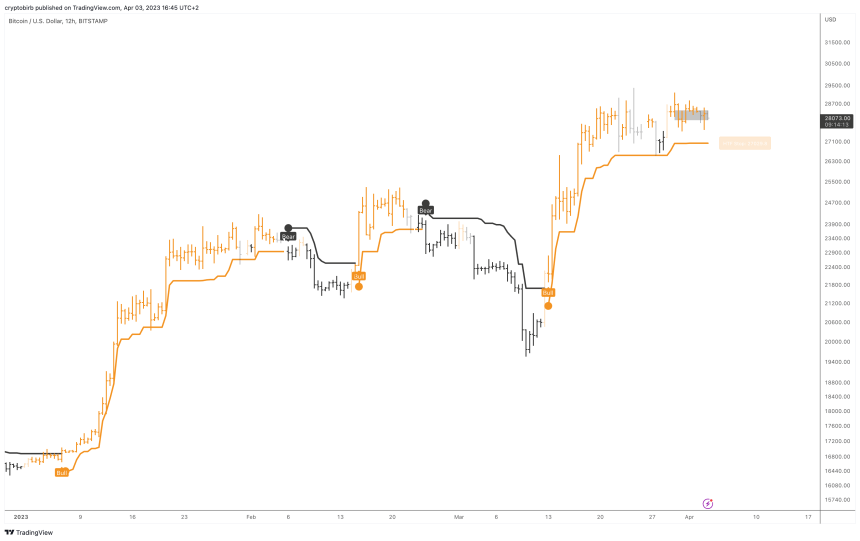

to the trading group “Birb Nest,” the recent surge in Bitcoin’s price, climbing to new yearly highs, has resulted in BTC trading above all critical long-term resistance, anchored at the 200-week and 50-week moving averages (MA), which suggests a positive outlook, as these resistance levels are crucial in determining the long-term direction of Bitcoin.

Furthermore, the trading group suggests that the daily chart indicates an “increasingly bullish outlook for Bitcoin.” This is because the primary trend represented by the 200-day MA is inclining upwards. This indicates a positive long-term trend for Bitcoin, which implies that the leading cryptocurrency in the market is leading the industry to a confirmed bull market.

Bitcoin’s Critical Anchors

In case of a potential price drop in Bitcoin’s price in the near term, the trading group has spotted critical support floors which can serve as an anchor. The BPRO baseline, a technical indicator used to analyze Bitcoin’s price movements, is inclining even more “aggressively” than the 200-day simple moving average (SMA).

This provides a new reference point at $22,800, higher than the 200 simple moving average (SMA) support at $20,500. Both levels can serve as “dynamic” support areas as Bitcoin’s price fluctuates. Furthermore, this indicates a positive signal for Bitcoin, indicating that the bullish trend may continue in the long term.

Moreover, Bitcoin’s midday chart indicates a continued sideways movement. This means that Bitcoin’s price may remain relatively stable in the short term. However, the HTF trailer of BirbicatorPRO, a technical indicator used to analyze Bitcoin’s price by the trading group, retains its bullish character.

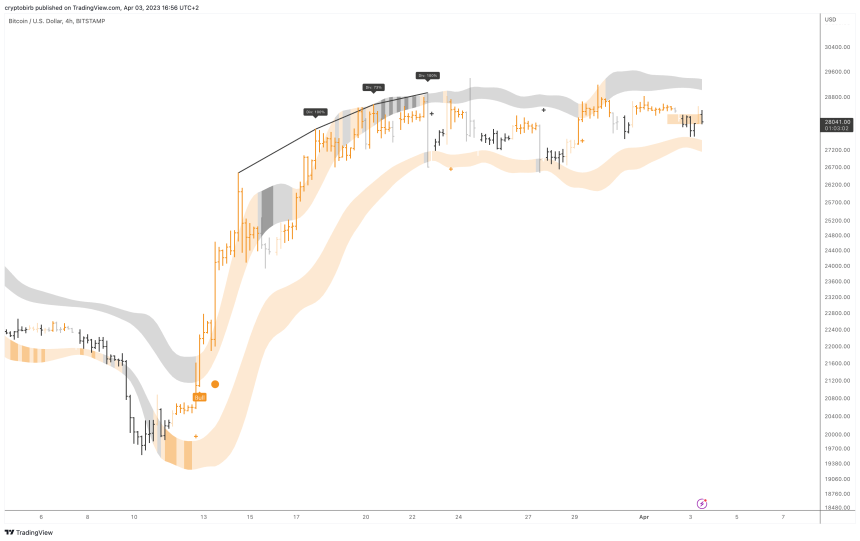

Additionally, the High Band resistance for Bitcoin is located in the $29,000 and $29,300 region, while the low band describes the support zone at $27,200. These bands are important technical indicators to predict potential price movements for BTC in the long term.

Furthermore, a potential breakout outside Bitcoin’s resistance and support bands, as seen in the chart below, may signal a more powerful market shift, potentially leading to a new short-term trend for the cryptocurrency.

Featured image from Unsplash, chart from TradingView.com