Data shows Bitcoin open interest has remained high despite the dramatic sell-off that occurred a few days back due to fud from the new COVID variant.

Bitcoin Open Interest Remains High Following The Sell-Off

As per the latest weekly report from , the BTC open interest hasn’t fallen much in the past few days. This is despite the recent sell-off triggered by fresh fud from the new Omicron COVID variant.

The “open interest” is an indicator that measures the amount of Bitcoin derivative contracts open at the end of a trading day.

High values of the metric can mean there is excessive leverage in the market. This could lead to higher volatility in the price of the cryptocurrency.

On the other hand, low values of the open interest may lead to lesser volatility as there isn’t much leverage in the market.

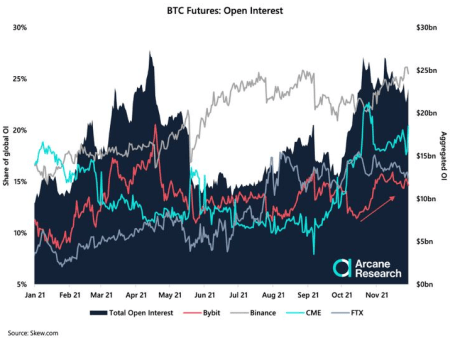

Now, here is a chart that shows the trend in the value of this Bitcoin indicator over the past year:

Looks like the open interest has been very high recently | Source:

As you can see in the above graph, the value of the Bitcoin open interest has remained quite high recently, despite the crash.

The metric has been trending down when measured in the USD, but it has remained above a certain level when denominated in BTC.

Related Reading | Bitcoin Aims Fresh Run To $60K, Why Bulls Could Face Hurdles

Currently, the Bitcoin open interest sits around $22 billion, or 380k BTC. This is a high value when compared historically.

Also, as the chart shows, the indicator’s value has remained above 365k BTC for more than a month now. It’s uncommon that these kind of high values are sustained for such a long time. As the report notes, this could mean the market currently has a lot of excess leverage.

Related Reading | Exchanges See Bitcoin Outflows For 7th Straight Day As BTC Price Begins Recovery

The graph also has curves showing the share of the major derivatives exchanges out of the total Bitcoin open interest.

Following the launch of the futures-based ETF, CME’s share in the market saw a sizeable drop. However, yesterday the exchange’s share saw a sharp increase, and now its open interest share sits at 20%.

Bybit’s open interest has seen significant growth recently. The report suggests that spikes in this exchange’s share have previously lead to sharp price fluctuations in Bitcoin so it might be worth paying attention to the upcoming trend of the exchange’s open interest.

BTC Price

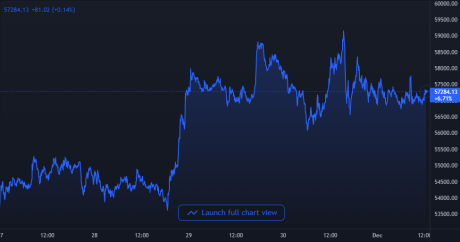

At the time of writing, Bitcoin’s price floats around $57.3k, up 1.3% in the last seven days. The below chart shows the trend in the price of BTC over the past five days.

BTC's price shows recovery from the crash | Source:

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research