#1 Anticipation Of Spot Bitcoin ETF Approval

The recent uptick in the Bitcoin price can probably be attributed in part to developments around the potential approval of a spot Bitcoin ETF. Bloomberg ETF analyst James Seyffart on X, “Okay the window for potential spot Bitcoin ETF approval is looking like it’s gonna be between Jan 5 & Jan 10 2024.”

This observation follows the SEC’s announcement about publishing the Franklin/Hashdex delays today, December 1. Scott Johnsson, a lawyer at Davis Polk, agreed with Seyffart, “This puts the comment period ending at January 5. Ark/21 Shares deadline on January 10.”These developments suggest that a spot Bitcoin ETF is only a question of when, not if. They also show a growing consensus between ETF applicants and the SEC, which only wants to fine-tune all proposals before approving a batch or all 12 applicants (besides Pando Asset) at once.

#2 MicroStrategy Will Buy More BTC

Another driving force could be MicroStrategy’s unwavering commitment to Bitcoin. The company’s latest filing revealed an additional purchase of 16,130 BTC, amounting to roughly $608 million. This acquisition, at an average price of about $36,785 per Bitcoin, takes MicroStrategy’s total holdings to 174,530 BTC.

#3 Market Dynamics

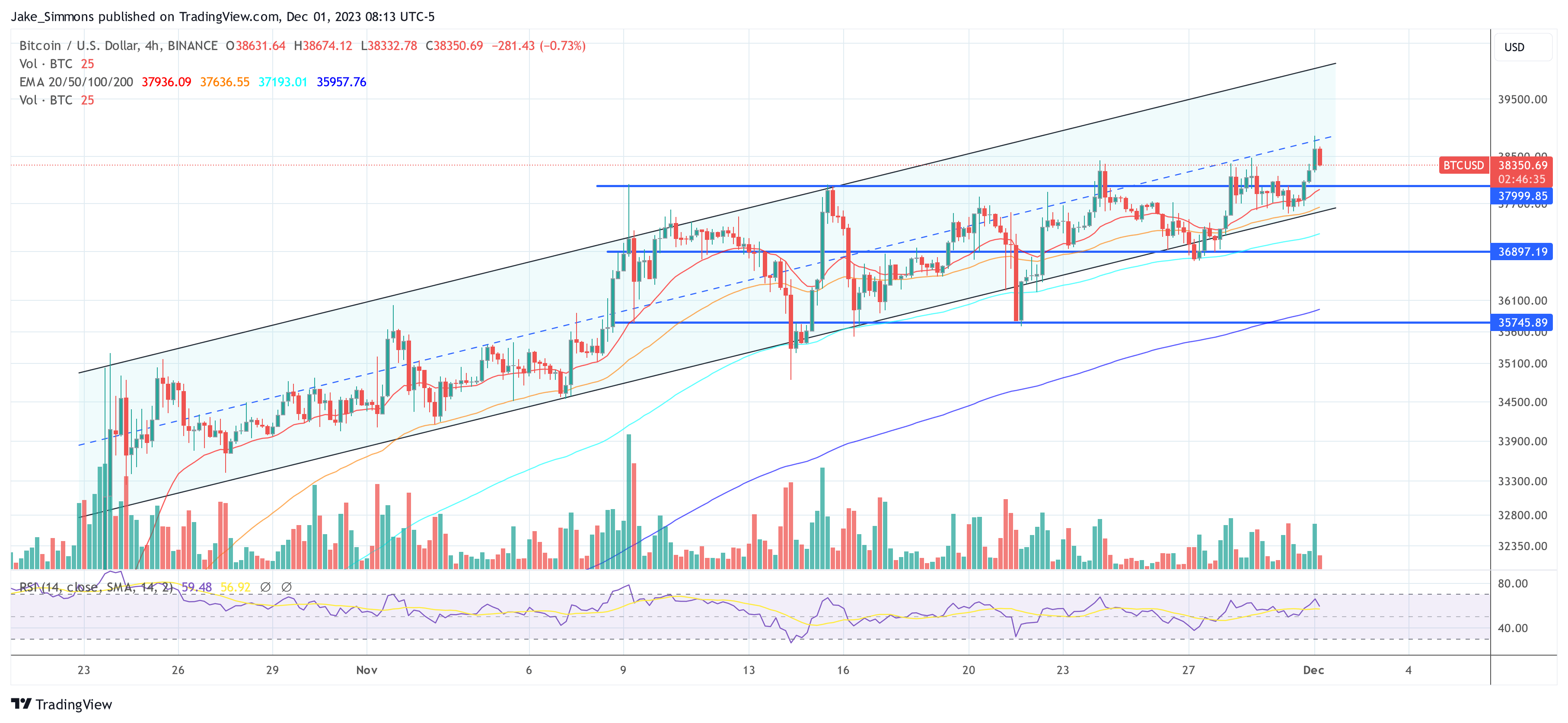

The current market dynamics surrounding Bitcoin’s price surge have been closely scrutinized by leading crypto analysts, revealing nuanced insights into the behavior of market participants. Crypto analyst Skew a specific pattern in the buying behavior, indicating a strategic approach by market players.#4 Breakout Move On Lower Time Frames

From a technical standpoint, crypto pundit Scott Melker a breakout move on the lower time frames. He noted, “Bitcoin breaking out on low time frame. “ In the 15-minute chart, Bitcoin has been trading within a descending channel, a pattern marked by sequential lower highs and lower lows. This typically reflects a bearish trend.However, a few hours ago, the Bitcoin price has managed to break above the upper boundary of this channel, a movement that is often interpreted as a potential reversal signal. The low time frame breakout is significant for traders because it indicates a shift in short-term sentiment, possibly setting the stage for a continued upward trajectory in the higher time frames.

At press time, BTC traded at $38,350.