Just 12% Of Bitcoin Supply Is Now Held By Exchanges

As pointed out by an analyst in a CryptoQuant , the percentage of BTC supply stored on exchanges has now dropped down to just 12%.The all exchanges reserve is an on-chain indictor that measures the total amount of Bitcoin currently held by wallets of all exchanges.

Related Reading | Bitcoin Miners Show Strong Accumulation As Their Inventories Spike Up

Now, here is a chart that shows the trend in the value of this metric over the past few years:

Looks like the supply on exchanges has been heading down since a while now | Source:As you can see in the above graph, the percentage of the Bitcoin supply on exchanges has shrunk down to just 12% now. The indicator’s last all-time high (ATH) was made at around 16%. Since then, the metric has been steadily making its way down, and has now dropped 4% in value.

Related Reading | Jack Dorsey’s Block To Democratize Bitcoin Mining With Open Source Mining System

Some traders believe that this decrease in the supply on exchanges may be creating a supply shock in the market. Such a scenario would be bullish for the price of Bitcoin in the long term.However, some recent data goes against the narrative, arguing that the supply has merely redistributed itself in the form of investment vehicles like ETFs.

BTC Price

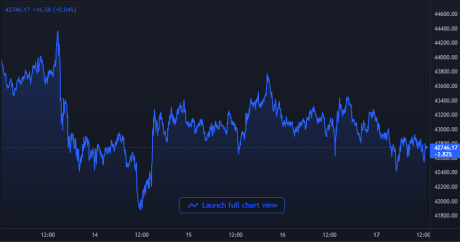

At the time of writing, Bitcoin’s price floats around $42.7k, up 3% in the last seven days. Over the past month, the crypto has lost 11% in value.

The below chart shows the trend in the price of the coin over the last five days.

BTC's price has once again started to move sideways in the $40k to $45k range over the last few days | Source:

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com