Glassnode looks at these bearish risks but also bullish opportunities in its new . Periods of extremely low volatility have been very rare in Bitcoin’s history. Ultimately, there has either been an extremely strong move up or down.

The Bear Case For The Bitcoin Price

On the bear side, historically low on-chain usage reveals some parallels to 2018’s bear market.As NewsBTC reported yesterday, miner capitulation is currently the biggest intra-market risk. According to Glassnode, the hash price has fallen to an all-time low of $66.5k/day per exahash deployed.

In addition, Glassnode estimates that miners’ balances have increased 10-fold since 2019 and now total 78.2k BTC, which equates to $1.509 billion at a price of $19.3k.With Hash Price now falling below the post 2020 halving lows, despite coin prices being ~2x, this demonstrates just how extreme the recent increase in hashrate competition has become.

The Bull Case

However, there are also good arguments for a bull case. First and foremost, HODLers continue to show very strong conviction and have reached an all-time high in coin ownership while “steadfastly” refusing to put coins on the market.Reserves held on crypto exchanges are also shrinking relentlessly and are currently at January 2018 levels, while more than $3 billion per month in stablecoin buying power is flowing in.

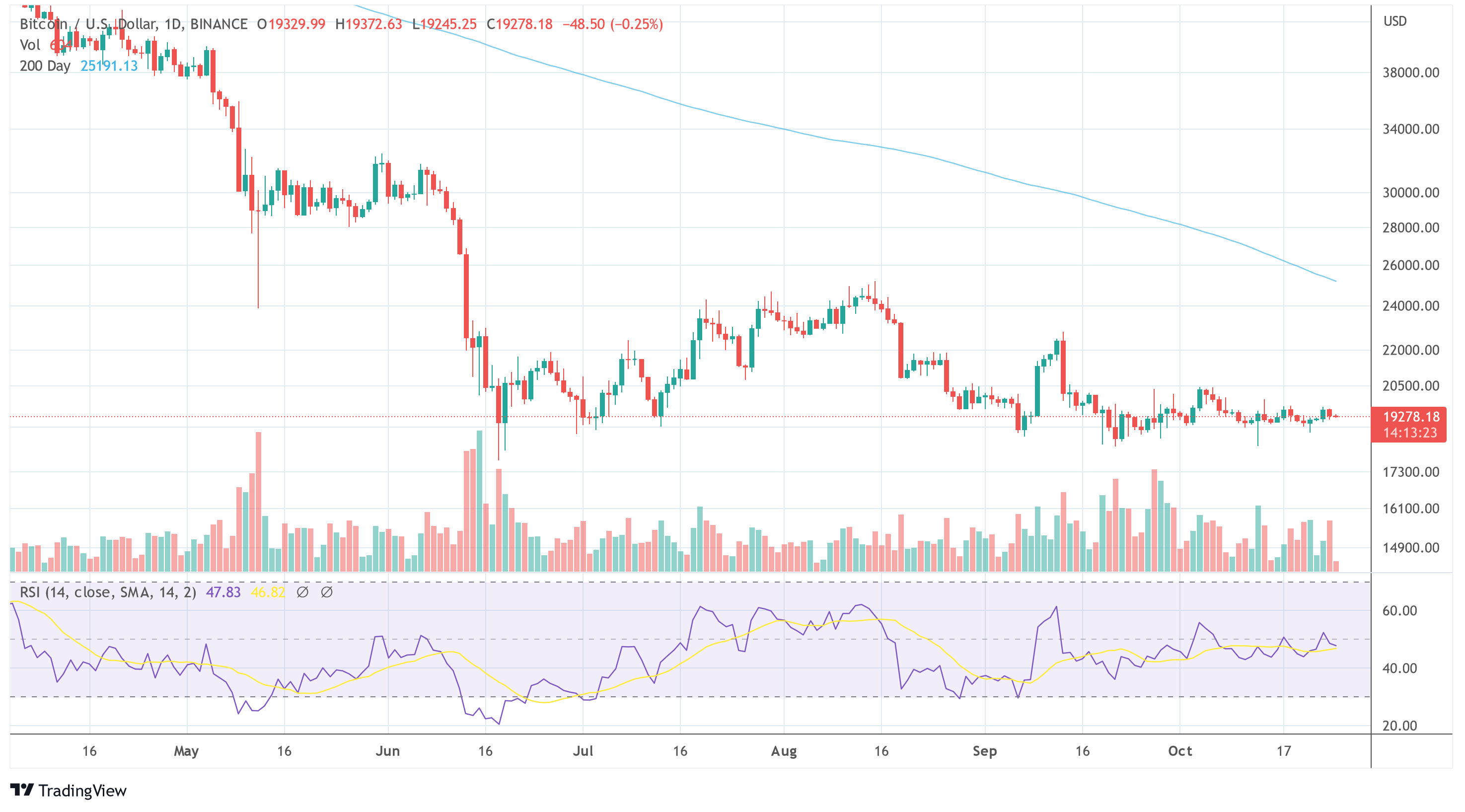

At presstime, BTC continued to trade in its incredibly narrow range.The bullish case for Bitcoin at present is one of unwavering conviction, and persistent balance growth by the HODLer cohort. Liquid coins continue to flow out of exchanges, relative stablecoin buying power is increasing, and extreme volatility and severe downside has thus far failed to shake out Bitcoins most die-hard believers.