In '21 bitcoin topped at $69k. I'm targeting $200-$600k by 2026. Fueled by $ trillions in global bailouts/stimulus. — Tuur Demeester (@TuurDemeester)

Why The Bitcoin Rally Is Far From Over

Adding depth to his latest prediction, Demeester pointed to Google trends data, which often serves as a barometer for retail investor interest in Bitcoin. Despite Bitcoin hitting $50,000 yesterday, Yassine Elmandjra, a researcher at Ark Invest, highlighted that Google search volumes relative to Bitcoin’s price are at all-time lows, suggesting a lack of widespread retail frenzy at this stage.

Bitcoin hit $50k. Meanwhile, Google search volumes relative to price are at all time lows. This is a new era. — Yassine Elmandjra (@yassineARK)This observation led Demeester to suggest, “I expect for retail to start waking up soon. Remember, there is no fever like Bitcoin fever,” indicating his anticipation of a surge in retail engagement once Bitcoin’s price momentum gathers pace.

Demeester also shared sage advice for investors, cautioning against the perils of debt and overexposure given Bitcoin’s notorious volatility. He emphasized the psychological resilience required to ‘HODL’ through market turbulence, stating, “The HODL attitude requires psychological & emotional work. The unprepared investor cannot sit tight, only the one who has worked to imagine the market relentlessly punching him in the face.”

Money Printing = Numbers Go Up

To understand Demeester’s claims, it’s essential to understand the broader economic dynamics at play. Economic stimulus packages and bailouts, particularly in response to crises, inject liquidity into financial markets, potentially devaluing fiat currencies through inflation.

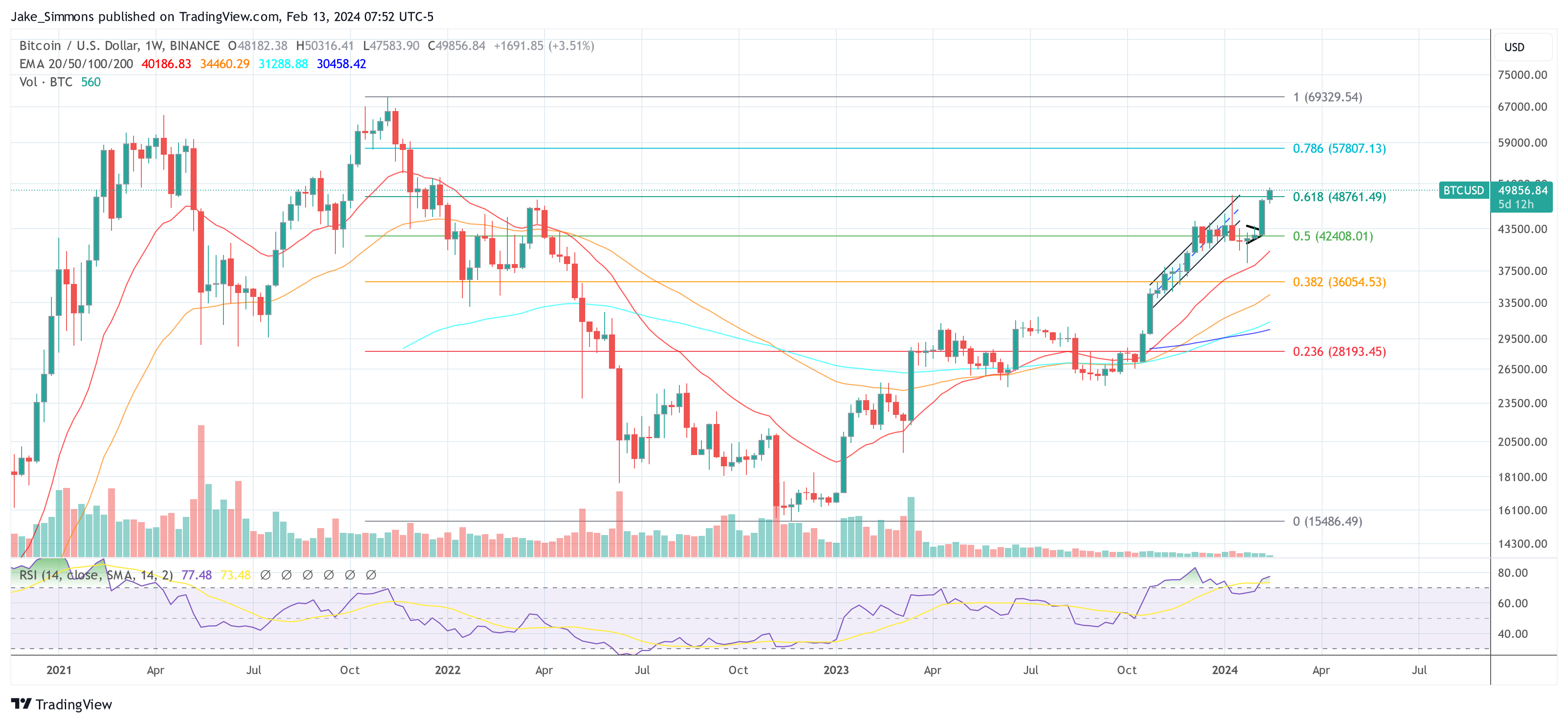

Hard assets like Bitcoin, with their capped supply, stand in contrast to potential inflationary pressures, offering a hedge against currency devaluation. This dynamic, coupled with increasing institutional adoption by spot ETFs and the growing recognition of Bitcoin as a ‘digital gold,’ could send BTC’s value to unprecedented heights, aligning with Demeester’s projections. At press time, BTC traded at $49,856.