Related Reading | TA: Ethereum Eyes Key Upside Break, $3K Holds The Key

As of press time, BTC’s price trades at $43,691 with a 1.1% loss in the last 24 hours.

One month from now, on March 17th, the U.S. Federal Reserve is expected to possible announced a shift in its monetary policy and to begin its tapering process on their asset purchasing program. In addition, the financial institution could announce a hike in interest rates.

The possible shift in monetary policy has been contributing with the global markets current trend to the downside as investors attempt to price-in the FED’s future action. Bitcoin has been impacted by this risk-off environment, but a lot of uncertainty surrounds the crypto market. Director of Global Macro for investment firm Fidelity, Jurrien Timmer, recently two scenarios that the markets could follow as the FED prepares to increase interest rates.The ongoing inflation news will force the Fed to tighten so many times that it eventually “breaks” something, which will in turn force it to pivot much like it did in 2018 after a 20% sell-off in equities.

The Best Moment To Buy The Bitcoin Dip?

Fidelity’s Director of Macro seems optimistic, at least at the moment. Timmer believes the inflation narrative hasn’t force the FED to take extreme measures, so interest rates could top at around 2% which could be the less painful path for Bitcoin and the global financial sector.Related Reading | TA: Bitcoin Fails to Test $45K, Why Dips Could Be Attractive

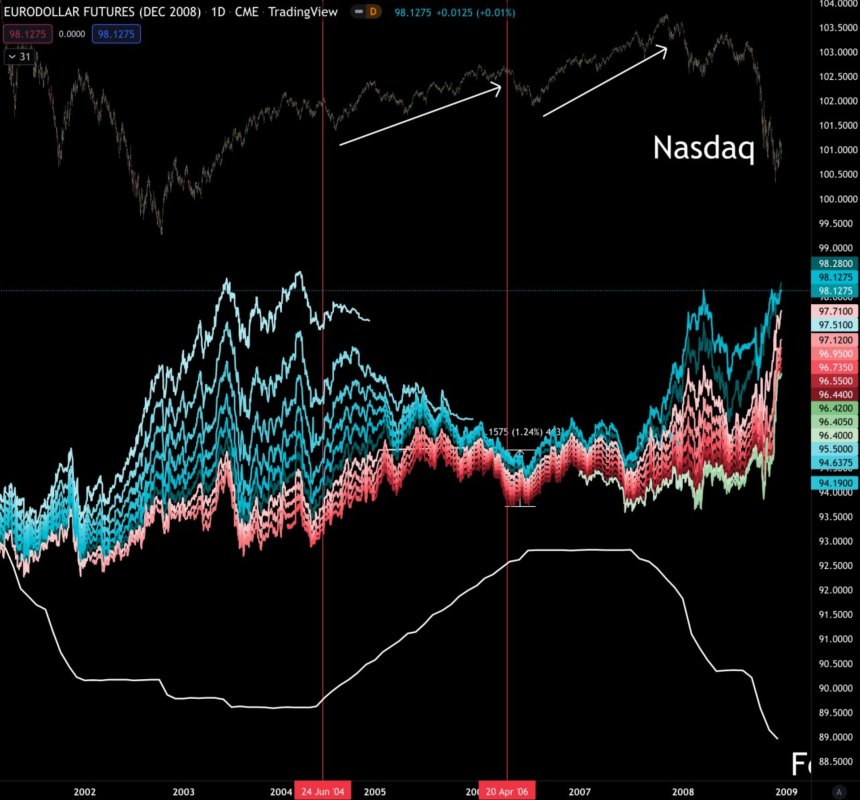

As seen below, in 2004, the Nasdaq index trended higher before a sell-off which, as Lilly said, was a good opportunity to buy the dip. Bitcoin and other cryptocurrencies could follow the same pattern as the market enter a “soft period” on higher rates expectation. Lilly said:Market went soft in anticipation of higher rates. Do we go bullish until the actual hike takes place in mid-March? Then once the hike happens, and market sells off, will it be the best BTD (Buy the Dip) opportuniry for next couple years?