Microstrategy’s CEO Makes Bitcoin Acquisition Second Business

Microstrategy’s primary business is software development. Michael Saylor, the CEO of the company, has added Bitcoin acquisition as a second mandate.Microstrategy had to take debt offerings so that the firm could pick up more coins, and they seem to have doubled down even more on their Bitcoin pursuits after the $489 million buy today.

We rotated our shareholder base and transformed ourselves into a company that’s able to sell enterprise software and to acquire and hold bitcoin, and we’ve done it successfully with leverage.

The software developer has also decided to sell more stock worth $1 billion so that they can fund more Bitcoin purchases

All these purchases have been a big benefit for the company as the year-on-year revenue jumped to 10%. Saylor says:That has increased the power of the brand by a factor of 100. We just had our best software quarter … in the last 10 years last quarter

Related Reading | MicroStrategy Receives Over $1.5B In Orders For $500M Notes To Fund Bitcoin Purchases

Microstrategy has also seen the benefit in terms of stock value. In August last year, when they first started buying BTC, their stock price was around $120. Today, it is $580, a sharp increase of over 400%.The bitcoin business is driving shareholder returns. I think the employees are happy. The shareholders are happy.

Bitcoin Price

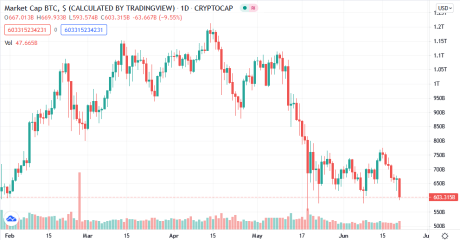

BTC is down to $32,195 today. This value is 19% down compared to last week. While over the entire month, its down slightly less, around 15%.

Here is a chart that showcases the current trend:

BTC shows a downward trend, again | Source: BTCUSD onIt looks like the market is bearish right now, and it’s unclear when it would change for the better. China’s crackdowns on crypto seem to be having a major effect on the price of BTC so the future of the market probably depends on that as well. Right now, China doesn’t seem to be slowing down.

Related Reading | Bitcoin Mining In China To Usher Historic Moment, Will BTC Be Affected?

Some experts believe the market could correct itself to 1/2 of the value at $17k, and only after that a bullish pattern will make a return.