Related Reading | Did Bitcoin Really Experience A Flash Crash Down To $5,400?

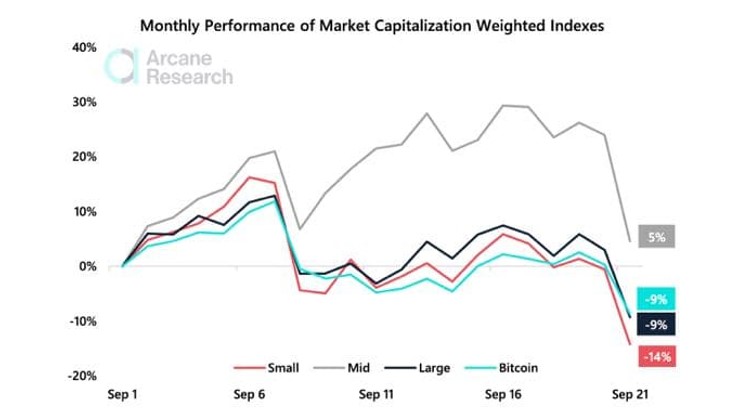

As often happens during market turmoil, the Bitcoin dominance increases, as altcoins often act as high beta play on the crypto sector. The last week, bitcoin’s market share increased by 1.14% grabbing market share from the other big coins like ETH, ADA, and SOL.

Bitcoin Reacts To Macro Factors, What’s Next?

In a separate report, investment firm QCP Capital analyzed the bigger picture for Bitcoin and the crypto market. Although mid-caps preserved part of their gains in higher timeframes, they will most likely follow BTC’s price trajectory in the short term despite their fundamentals.Related Reading | Bitcoin Holders Take Profits As Price Falls, Indicators Remain Bullish?

The first cryptocurrency by market cap faces September, a month that has historically been bearish for the asset, and potential complications from regulators in the U.S. and the performance on the Asia markets due to Evergrande.Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

The firm expect some government intervention to rescue the real estate company. This could result in the best-case scenario for Bitcoin and the crypto market, but there is a lot of fear and uncertainty about China’s approach. QCP Capital said:(…) the lack of guidance so far from Chinese regulators is scaring the market. The fear here is that President Xi could allow. Evergrande to fail as an example to the other real estate players ahead of the 100th anniversary of Chinese Communist Party (CCP) in 2022. He has already taken draconian steps with Big Tech and Education. At this point, the market has already priced in Evergrande’s equity as worthless (…).

At the time of writing, Bitcoin trades at $42,814 with a 2.6% loss in the daily chart.