Crypto Fear And Greed Index Now Has An Extreme Fear Value of “7”

The “fear and greed index” is an indicator that tells us about the general market sentiment among crypto investors right now.

The metric uses a numeric scale that runs from zero to hundred for representing this sentiment. All values of the index below fifty imply that investors are fearful at the moment, while those above the threshold mean they are currently greedy.

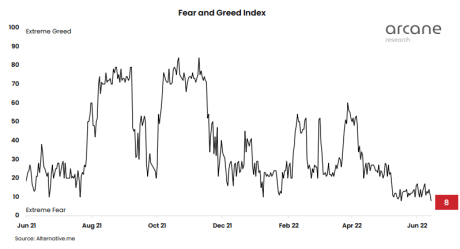

Looks like the value of the metric has plunged down in recent days | Source:As you can see in the above graph, the crypto fear and greed index has been in the “extreme fear” territory for a while now. In fact, this streak of extreme fear, which has been running for 57 straight days now, is the longest the indicator has ever observed.

Related Reading | Has Bitcoin Hit Bottom Yet? Here’s What On-Chain Data Says

This sentiment was actually worse than the Black Thursday event from back then (which occurred due to the COVID-19 pandemic).

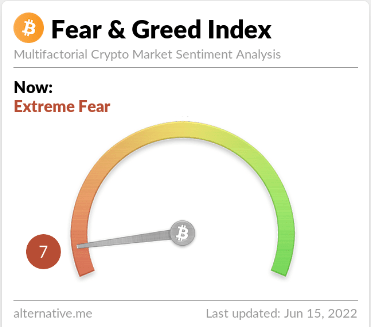

Today, the crypto fear and greed index has further dropped in value, now showing just 7.

The sentiment in the crypto market now seems to be the worst it has been since 2019 | Source:Historically, extreme fear periods have been when coins like Bitcoin have bottomed out, and extreme greed stretches has been when tops have tended to form. Because of this, some investors consider very low sentiment values to be ideal buying opportunities. As Warren Buffet’s famous quote says, “be fearful when others are greedy, and greedy when others are fearful.”

Related Reading | Here’s What Would Happen If Bitcoin Breaks Below $20K, Arthur Hayes Predicts

The report notes, however, that while buying has been profitable in such times before, catching a falling knife like now isn’t an easy task.BTC Price

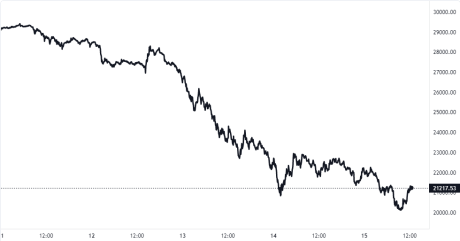

At the time of writing, Bitcoin’s price floats around $21.1k, down 30% in the last seven days. Over the past month, the crypto has lost 30% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of Bitcoin has crashed down over the last few days | Source:

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research