Bitcoin Short-Term Holders Continue To Realize Losses

As pointed out by an analyst in a CryptoQuant , Bitcoin short-term holders have continued to realize profits recently, as suggested by the SOPR. This trend may be similar to the one seen in June.The “Spent Output Profit Ratio,” or SOPR in short, is an indicator that measures the profit ratio of the overall market by looking at the price each coin was sold at and comparing it with the price it was bought at.

A modification of this indicator is the short-term holder (STH) SOPR. This metric accounts for only those coins that were held for less than 155 days before being sold.

The indicator currently seems to be below one | Source:As you can see in the above graph, the Bitcoin STH SOPR has remained below one for a while now, showing that these holders have been selling at a loss.

Related Reading | Bitcoin Whales Contribute 90% Of Money Inflow of Exchanges, How Can We Follow and Make Profits?

Less than a couple of weeks back, the indicator retested the SOPR equal to one trendline. However, it was rejected back downwards. The reason for the rejection is possibly that since the SOPR = 1 line represents the “break-even” point, holders would be keen to sell as soon as the price reaches that point as they would feel they got their money “back.”Related Reading | Altcoin Underdogs Outperform Bitcoin To Kick Off 2022

A similar kind of retest of the metric was also seen back in June, when a mini-bear market period was going on for Bitcoin. As the indicator was also rejected downwards then just like now, it’s possible the market may observe a similar bear market situation.BTC Price

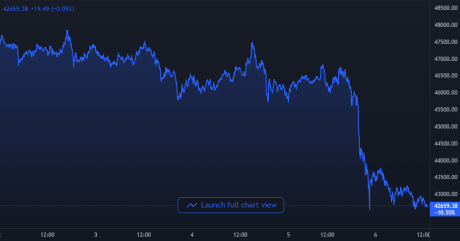

At the time of writing, Bitcoin’s price floats around $42.7k down 10% in the last seven days. Over the past month, the crypto has lost 12% in value.

The below chart shows the trend in the price of the crypto over the last five days.

BTC's price has crashed down in the past day | Source:

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com