Bitcoin is trending downside on lower timeframes and seems to hint at future losses. The number one crypto by market cap records a 3% loss in the past week, but there is a potential sign of hope for the bulls.

Related Reading | Why Ethereum Could Trade At $500 If These Conditions Are Met

At the time of writing, Bitcoin (BTC) trades at $20,000 with a 1% loss in the last 24 hours.

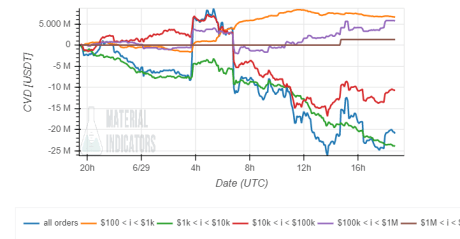

As a pseudonym trader pointed out, Bitcoin whales are currently buying into BTC’s price action and could be hinting at a future relief bounce. The trader used data provided by Material Indicators to show what the different investors’ classes are doing while BTC records losses.

As seen below, investors with bid orders of about $100,000 (purple in the chart below) have increased their buying pressure as almost every other and smaller investor class sells into this price action. This divergence could hint at a bounce as these BTC whales often anticipate or create price trends. The pseudonym trader :

Whales (purple) are market buying while #bitcoin price is flat. Historically, purple is the most important class for future price action. Clear divergence, hopefully it will play out this time.

Bitcoin whales (brown in the chart) also saw a small uptick in buying orders as BTC returns to the area of around $20,000. This investor class has been mostly dormant in the current market environment, but their recent involvement highlights the importance of BTC’s current levels.

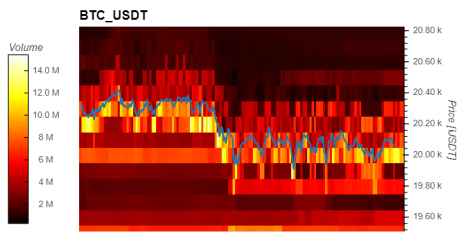

In that sense, Material Indicators records massive bid orders for BTC’s price around this area from $19,900 to $20,000. There are over $20 million in bid order on these levels alone with an additional $6 million at around $19,500, and over $10 from $19,000 to $19,000.

In other words, there seems to be enough liquidity for Bitcoin to hold at its current levels for the time being.

Can Bitcoin The Bitcoin Bulls Score A Green Monthly Candle

At higher timeframes, additional data provided by Material Indicators records an important liquidity zone between $17,000 and $20,000. Large market participants could attempt to push down the price to fill these orders which could hinder the bulls’ attempts to save the monthly candle.

Analysts from Material Indicators wrote:

Bulls are defending the 2017 Top, but with one day to go it’s going to be almost impossible to print a green Monthly candle. Still a chance for green on the Weekly. Expecting volatility. One way or another, Bitcoin is going to breakout or breakdown very soon.

Related Reading | Extreme Fear Remains: Recapping What’s Behind The Crypto Market Panic

The analysts expect a potential relief in the coming days after a potential retest of the yearly lows. Any bullish thesis would be invalidated if BTC loses $17,500.

Trend Precognition is flashing a pretty strong Long signal on the Weekly chart. Signal won't print until the W candle closes, but indicates that we could see a run at the 200 WMA this week. Happy to test the lows first. For me, sub $17.5k invalidates.

— Material Indicators (@MI_Algos)