Bitcoin continues to trade to the downside after it was rejected at around $45,000 last week. The crypto market, in general, has been following a downtrend with Ethereum (ETH), Binance Coin (BNB), XRP, Cardano (ADA), and others recoding over 10% losses in the past 7-days.

Related Reading | Bitcoin Prices Bear The Brunt Of Long Liquidations And Geopolitical Tensions

At the time of writing, Bitcoin trades at $37,638 with a 12% loss over that period.

The benchmark crypto seems to be negatively reacting to the latest developments between Russia and Ukraine. Yesterday, the president of the Russian Federation Vladimir Putin acknowledged the independence of two Ukrainian regions ruled by leaders with separatist tendencies.

This has heated up the situation with Russian sending in troops to “guarantee the security” of those territories. According to Yuya Hasegawa from crypto exchange BitBank, BTC’s price trends lower alongside the wider financial market.

Investors seem to be entering a period of risk-aversion which directly affects cryptocurrencies, considering some of the riskier assets. The situation might see some relief during the week as representatives from Russia and the U.S. could reach a diplomatic agreement, but that possibility seems to be fading. Hasegawa said:

(…) with the gas pipeline explosion in eastern Ukraine last Friday, increased Russian military presence at the border, heavier financial sanction on Russia, and the U.S. PCE announcement coming up this Friday, there seems to be only little reason to take on any risks right now.

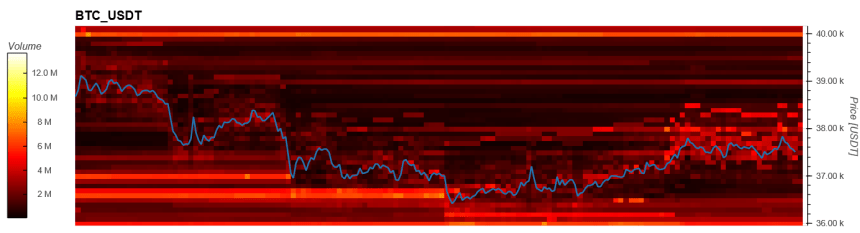

The analyst has set a Bitcoin price between $32,000 to $43,000 in the coming days. Data from Material Indicators show a lot of resistance for BTC’s price around $40,000.

As seen below there is as much as $20 million in asks orders which could prevent the bulls from retaking these levels in the short term. On the downside, $36,000 could operate as good support with $5 million in bids orders sitting around that price mark.

Will The Price Of Bitcoin Hold Off The Bears?

QCP Capital has been “aggressive volume-selling” any time Bitcoin attempts to make a run to the upside. The firm coincides with the relevance of the Ukraine-Russia situation for global markets and the apparent imminent hike in interest rates from the U.S. FED.

However, QCP Capital remains optimistic based on the drop in leverage long positions with BTC’s price current price action. These positions have been cleansed out of the market without impacting funding rates on BTC futures.

Related Reading | Tether & The Swiss City Of Lugano Promise “Europe’s BTC Capital.” Is It, Though?

In addition, the firm believes any future interest rate hike by the U.S. FED has already been priced in by market participants. QCP Capital said the following on BTC’s price potential fate for the short-term:

We think it will be more of a grind lower with the possibility of short-squeezes on positive headlines. These spikes in spot price would probably be met with aggressive spot selling, capping the topside.