- Ripple (XRP) down 6.4 percent

- Low correlation with Bitcoin prices means XRP is the best diversifier

Brad Garlinghouse must be happy, Ripple (XRP), a Binance research report reveals, has a low correlation with Bitcoin (BTC). Because of that, it is a good diversifier for investors willing to spread out their risks. Nonetheless, Ripple (XRP) prices are down, shedding 6.4 percent in the last week.

Ripple Price Analysis

Fundamentals

Based on historical cryptocurrency market performance, diversification may, after all, not be ideal for investors. That’s what the last shows. Nonetheless, diversification remains a market strategy for many. For investors planning to spread out their risk in light of fluctuating asset prices, Ripple (XRP), Binance confirms, is the best diversifier. The conclusion is after a detailed study revealed that indeed, Ripple (XRP), despite its position as the third most liquid asset commanding a multi-billion market cap, has a low correlation with the king, Bitcoin. That’s unlike Ethereum (ETH) which moves in tandem with Bitcoin (BTC) prices.Candlestick Arrangement

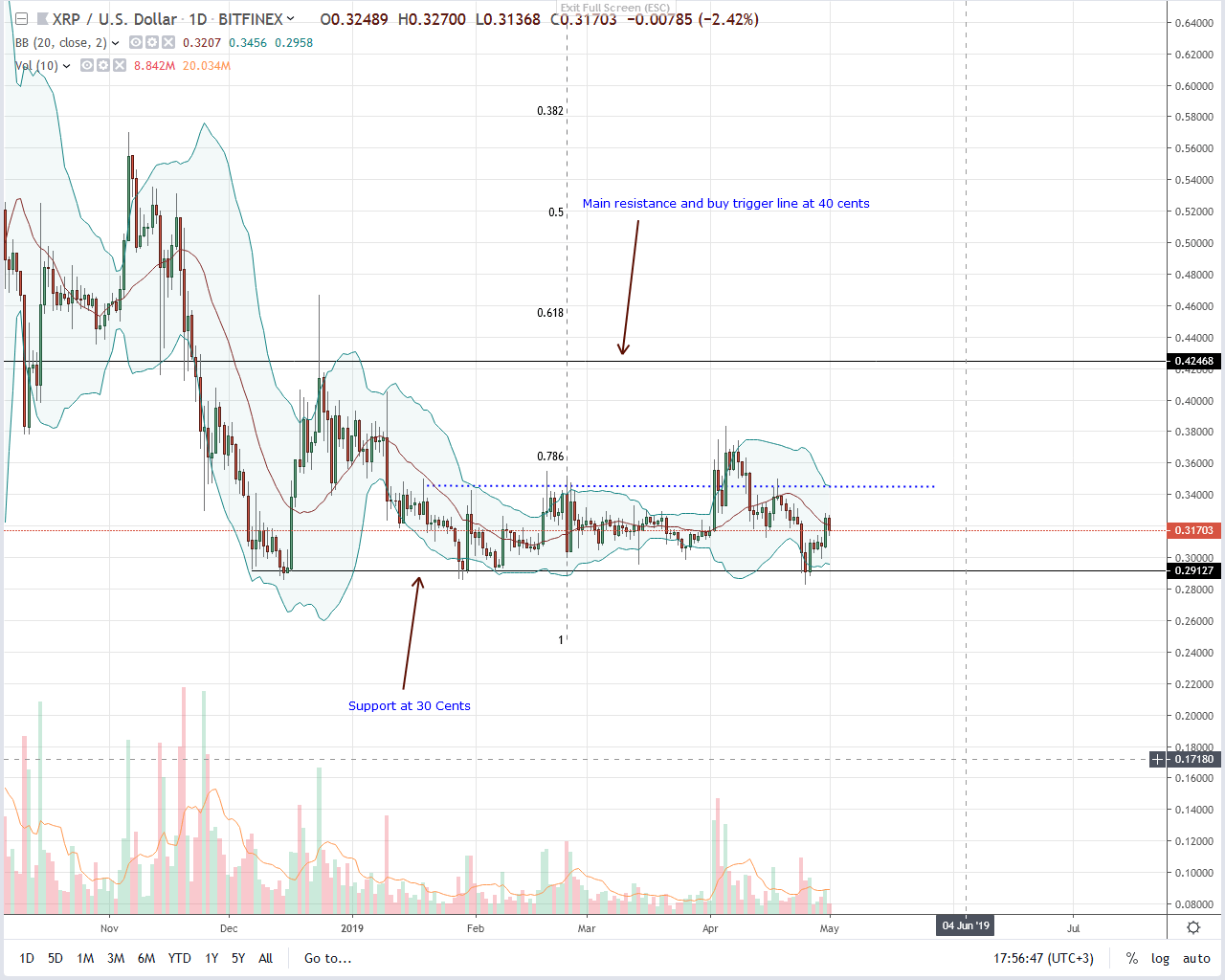

Like in previous XRP/USD trade plan, we shall adopt a neutral to bullish stance aware that any surge above 34 cents shall trigger the first wave of buyers targeting 40 cents. On the reverse side, liquidation forcing prices to slip below our floors could indicate weakness as prices slide to 25 cents.

Technical Indicators

In light of the above and from candlestick arrangement, Apr-24-25 bears stand out. They have high transaction volumes—averaging 36 million. As such, gains above 34 cents or below 30 cents, confirming or canceling our bullish stance must be with high participation exceeding 17 million.Chart courtesy of Trading View.