Bitcoin and other cryptocurrencies have exploded in popularity over the last few years. With more people getting interested in trading digital assets, the need for cryptocurrency brokers has grown. Investors are able to buy, sell and hold Bitcoin and crypto on FX brokers that offer Bitcoin and crypto trading.

However, the crypto space is not all rosy. Trading in crypto is risky because it has regulations, security risks, market volatility and more. If you are a Bitcoin investor who wants to trade it, then you need to know the FX broker landscape and the benefits and pitfalls to avoid.

The Rise of Crypto Trading

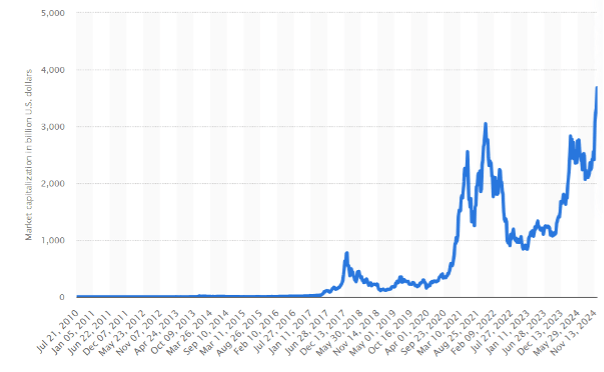

In the past decade, cryptocurrencies that were once considered a fringe asset have become more mainstream. The total market cap of cryptocurrencies has gone from just $7 in 2016 to more than tripled to over . The largest and most well-known coin is represented by Bitcoin, which makes up over .

Several factors have fueled the popularity of crypto:

- Major companies like Tesla, Square and MicroStrategy are upping institutional investment

- DeFi and crypto lending platforms rise

- More clarity on crypto rules and taxes

- Improved access through crypto brokers and exchanges

- Mainstream media attention and (fear of missing out)

As crypto has gone more mainstream, FX brokers for Bitcoin trading have raced to meet surging demand from traders who want exposure to digital currency price movements. Today, most of the best forex brokers offer the possibility to trade the main cryptocurrencies, such as Bitcoin, against USD, EUR and other national currencies. Not only that, some even provide CFDs or derivatives, which means you can trade on crypto price movement without owning the coins.

Benefits of Trading Crypto with an FX Broker

Here are some of the major advantages of trading Bitcoin and other digital currencies via an FX broker platform:

- Easy market access: FX brokers make starting crypto trading simple. Users do not need to engage directly with decentralized exchanges. Instead, they can quickly fund accounts with fiat currencies like USD and EUR to trade top cryptos.

- Advanced trading platforms: Crypto traders often find that Forex broker platforms provide various charting tools, indicators, educational resources or others to support them. It enables in-depth technical and fundamental analysis of digital asset price movements.

- Leverage trading options: Leverage of 2:1, 5:1 or more is available for crypto positions with some FX brokers. It allows traders to take larger positions with less upfront capital and make more profit and greater risk.

- Industry security standards: FX brokers that are regulated must protect client accounts and funds and have strict capital requirements. Traders have more protection on this than on decentralized exchanges.

- Diverse asset offerings: The best crypto brokers allow users to trade many digital coins beyond Bitcoin, including altcoins like Ethereum, Litecoin, Ripple and more against fiat or stablecoin pairs.

By harnessing FX broker trading infrastructure, cryptocurrency investors gain easier access to more tools at their disposal. However, there are also unique challenges to evaluate with crypto trading within the traditional brokerage ecosystem.

Key Challenges and Risks of Crypto Trading via FX Brokers

While the benefits are substantial, prospective crypto traders should also carefully consider these common issues:

Crypto Regulation Uncertainty

Cryptocurrencies still have a very undefined regulatory environment that is changing on a country and jurisdictional basis. Digital assets are often ambiguous when it comes to existing regulations, and new rules can completely change the landscape. When buying from an international FX-based broker, traders have to look into their country’s laws and tax rules regarding crypto. These can be violated, and lead to heavy fines or account freezes.

Security Vulnerabilities

FX brokers can provide account protection against basic hacking attempts. However, crypto itself still presents cybersecurity issues for traders. Key storage with private keys remains a prime target. Decentralized exchanges have proven vulnerable to exploits, hackers and fraud at times due to the irreversible nature of blockchain transactions. Traders must implement the best security practices for any crypto storage and trading.

Price Volatility

Cryptocurrencies are known to experience huge price swings in a short time. This enables quick profit opportunities, but at the same time, market volatility increases the risk of fast-paced losses and liquidation of leveraged positions. With an FX broker, even with crypto as volatile as this, traders must use careful risk management.

Scams and Fake Brokers

The hype around crypto trading attracts many fraudulent operations looking to separate traders from their money. From fake crypto exchanges to to phony mining operations, r, according to FBI estimates. Before depositing funds and reviewing registration, regulation status, account security, and fee transparency, traders need to vet any FX brokerage thoroughly.

Complex tax reporting

Crypto trading gains and losses properly reporting to your annual tax return can be quite complicated. Different countries have different crypto tax rules that change from year to year. Some FX brokers support tax reporting. Without such tools, traders must painstakingly track cost bases, capital gains and other pieces of information in thousands of crypto transactions to meet with tax officials.

The Future of Crypto Trading via FX Brokers

Young digital asset markets are plagued with challenges, but cryptocurrencies seem poised for continued expansion and adoption. Governments are also being called on to provide clearer legal guardrails to spur further growth. If so, FX brokers will remain a key gateway to crypto markets for everyday investors.

Besides, trading crypto via FX brokers can also become more robust with the advent of trading technology. Aggregation technology allows liquidity and pricing data from several exchanges to be aggregated and used to provide a better spread for brokers. Brokers’ crypto funding and withdrawing funds to and from crypto accounts become faster and smoother with the help of streamlined authentication software. Further security advances could make blockchain transactions less reversible.

Here are some other key developments that could shape the future of crypto trading with FX brokers:

- A wider variety of altcoins supported

- Evolution of crypto derivatives like options, swaps and futures

- Faster trade execution speeds

- Growth of social trading and copy trading

- More advanced charting, backtesting and analytics

As the technology progresses and standards emerge, FX brokers look to maintain a crucial role in making crypto trading more reliable and accessible to investors around the world.

Top Crypto Brokers to Consider

If ready to explore crypto trading, these regulated FX brokers provide a reputable starting point:

- eToro: A social trading platform with copy trading features for a variety of cryptocurrency CFDs.

- AvaTrade: They offer access to many crypto coins with leverage options on the crypto trade and also good educational resources for beginners.

- Plus500: Trades top crypto crosses with leverage and variable spreads.

- IG Markets: It is a trusted broker that has been operating since 1974, and it provides options to trade CFDs on the most important cryptocurrencies against other currencies.

- Capital.com: Offers a set of crypto CFDs with leverage and guaranteed stop options to limit risk.

- Swissquote: A leading European bank offering actual crypto assets alongside managed crypto portfolios.

- Turnkey Forex: Offers crypto trading alongside currency pairs, commodities, stocks, indices, and more.

- FP Markets: Provides leverage on crypto CFDs from top blockchain projects, such as Bitcoin, Ether, and Cardano.

- EarnForex: A primarily educational platform that provides in-depth guides and resources on forex and crypto trading. It doesn’t work as a broker, but it offers useful information and a big table of top crypto brokers to help traders understand the subtleties of the forex and cryptocurrency markets.

FP Markets offers leverage of up to 1:5 on crypto CFDs from top blockchain projects, such as Bitcoin, Ether and Cardano.

Account minimums, trading parameters and costs vary from broker to broker. Match your crypto trading strategy, risk tolerance, and country-specific regulations with those of a reputable FX broker by doing due diligence.

Conclusion

As cryptocurrency adoption speeds up, there is a growing demand for safe platforms, such as foreign exchange brokers, to gain access to digital asset markets. Traders can buy, sell and manage positions in assets such as Bitcoin while leveraging robust trading infrastructure when partnering with properly regulated FX brokers.

However, unlike before, the the emergence of the crypto ecosystem introduces other risks, such as cyber security threats, price volatility and changing government oversight. However, by picking established FX brokers, studying the crypto landscape and employing good risk management, traders can sidestep these challenges and reap the great profit potential that crypto’s ongoing mainstream breakthrough promises. Over time, as the technology matures and the regulatory environment evolves, working with vetted brokers will be a gateway to riding the next wave of revolutionary growth in cryptocurrency.