Crypto is still holding up to all of the onslaughts. It, like other financial markets, has been subject to a lot of stress following the political tensions that continue to rage on. However, investors have found solace in the digital assets that have continued to hold up. Although returns have not been great, there has not been too high a slip in prices. But it hasn’t helped market sentiment much.

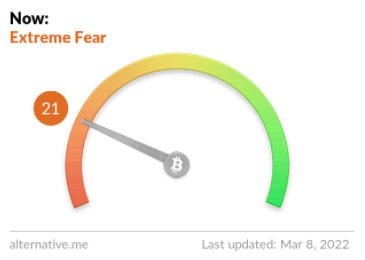

The crypto market is propelled a lot by investor sentiment. Depending on where sentiment skews, it can be an indicator of where the market is headed. Currently, market sentiment is very much in the negative territory as evidenced by the Fear & Greed Index.

Market Falls To Extreme Fear

The Fear & Greed Index is an index that measures market sentiment across a number of factors. Using this, it puts out a number on a scale that shows how investors are feeling about the market. This week has not been a good one for the crypto market in terms of sentiment as it has fallen deep into the fear territory. After spending the majority of last week in the neutral territory, the Fear & Greed Index has not pointed its finger at Extreme Fear.

Related Reading | Green Mining Company HIVE Secures Deal To Buy A Number Of Intel’s New ASICs

The fall into this territory comes as a result of declining prices. Coming out of the weekend, bitcoin which had managed to recover to the $40K-$44K level last week had begun to slip up. By the time the new week rolled around, the digital asset had once again fallen back below $40,000, taking the rest of the market with it. Sentiment quickly turned negative, putting the index in the extreme fear territory.

Market goes into extreme fear | Source:

It seems the month of March will follow in the footsteps of February which had closed out the month in Fear. Currently, the crypto market is at a score of 21 on the Fear & Greed Index. This may not be the lowest that the index has gotten in recent times, but it is still a low number nonetheless.

Time To Fill Up On Crypto?

Trying to time the market can often be a futile endeavor given how highly volatile cryptocurrencies can be. But that does not mean that investors cannot look to indicators to try to pinpoint the best time to enter the market. One of those indicators that investors often use to determine if they should enter the market is the Fear & Greed Index.

Related Reading | Crypto Markets Slightly Recover After Weekend Decline

There is a saying in the investing world, “buy when there is blood on the streets”. This suggests that investors should buy assets when the market is down. One indicator that can point to a good buying time is when others are fearful and wary of getting into the market. It is the belief that this is a time when people begin loading up their bags and as such, the value of assets will begin to go up.

Crypto total market cap below $1.7 trillion | Source:

However, this cannot always go as planned as sometimes even purchasing digital assets when the market is down does not guarantee that there is a reversal coming up. The crypto market is unpredictable with a mind of its own and sometimes when investors believe the prices cannot go further down, they do. So the best time to buy is subjective and based on the experience of each investor.

Featured image from TED, chart from TradingView.com