THORChain (RUNE) has seen an important rally in the past month. The native token of this decentralized cross-chain bridge rose from its 2022 low at around $3 with 30% intra-day rallies to its current levels.

Related Reading | THORChain Activates Feature, 30% Spike Follows, Can Bulls Sustain It?

At the time of writing, RUNE’s price trades at $9 with an 11% profit in the past 24-hours and a 17% profit in the past week.

to analyst Alerzio from research firm Santiment, RUNE’s current rally has traders wondering if the token will be able to sustain its gains. The cryptocurrency could revisit its lows if the bulls are unable to push past the $10 in the short term or if the crypto market takes another bearish turn.

The analyst believes that RUNE’s current rally has been “healthy”. As the price move upwards, the token’s trading volume followed standing at its highest since April 2021.

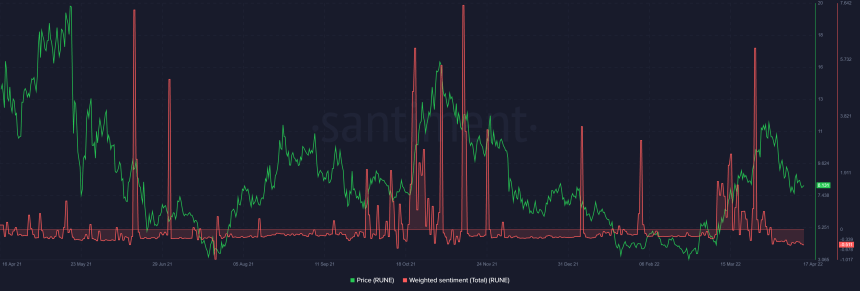

In addition, the Weighted Sentiment, a metric used to measure market sentiment across social media platforms, suggests more gains. This metric stands in the negative as the token claims into its current levels which is a bullish sign.

In the crypto markets, operators believe that prices tend to move opposite to the crowd’s expectations. Therefore, a negative sentiment suggests more gains for RUNE. The analyst said that “the greed is out” of the market, for the time being.

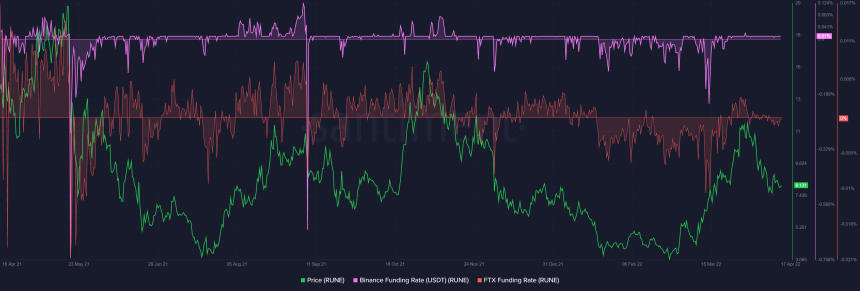

In addition, the futures market seems to support the bulls as funding rates on Binance and FTX were barely returning from negative territory into positive on the recent price action. The analyst added:

Binnance’s funding rate is positive (not too much) while FTX’s funding rate is about to get into the positive areas. this can be considered as a “not very good, but not too bad” signal.

THORChain (RUNE) Potential Headwind For Future Gains

The analyst believes that THORChain (RUNE) developer activity could be a long-term obstacle for RUNE’s price. He claims the project needs fresh ideas and proposals to sustain its momentum. The analyst concluded:

RUNE’s previous rally was a healthy one. there is still some price potential in short term, but the outlook for long term hodling is not good enough because there is not enough development activity.

However, THORChain introduced a major feature for its network recently called synthetics assets. This gives users the capacity to access tokens pegged to the price of BTC, ETH, and others.

Related Reading | Top DeFi Names SUSHI, ThorChain, Others Surge 10% Higher

Thus, users will be able to leverage new investment strategies and products. At the time, an official THORChain post stated:

As a benefit, you will have access to yield generating vaults, and be one of the first users who will vest their funds. Minting synths will be capped and access will depend on how much liquidity is in the THORChain pools.