In coming weeks it is very likely USDT’s share of the stablecoin supply on Ethereum will fall below 50% for the first time. USDC is quickly emerging as the dominant stablecoin on Ethereum in large part due to its growing role in DeFi. 1/ — Ryan Watkins (@RyanWatkins_)According to the analytics research, there is now an increase in the demand for USDC due to abrupt popularity in the DeFi ecosystem. Such demand has positioned USD Coin to bag more market shares in the crypto space.

Related Reading | VeChain Announces The World’s First National eNFT Adoption, Why It Could Be Huge for VET

More so, Watkins further acknowledges:“Although this percentage is not as high as DAI, USDC leads by a wide margin in dollar terms and has become the preferred stablecoin in DeFi for now.”This makes it the most preferred digital asset for staking in DeFi protocols’ smart contracts. He said that even though USDC’s percentage is still low compared to DAI, it’s ahead with a wide margin in terms of the dollar. This pushes USDC to emerge in the DeFi sector as the preferred stablecoin. From its 1.3 billion circulating supply, USD Coin made an upward growth of over 1,820% since the beginning of 2021. According to Circle, the coin’s stablecoin supply is currently at 25 billion. Moreover, a recent report suggests USD Coin will get more exposure once it’s issued on other networks in the near term. A few hours ago, one of the biggest media outlets in the cryptocurrency industry reported that the USD Coin will gain huge attention once it goes live on other networks. The report reads:

“We anticipate that in the coming months USDC will become available on Avalanche, Celo, Flow, Hedera, Kava, Nervos, Polkadot, Stacks, Tezos, and Tron.”

What’s Ahead For Tether (USDT) As USDC Gains Significant Traction

Tether’s transparency report reveals that there are 62.7 billion circulating USDT. This portrays an increase of about 200% since the beginning of 2021. Currently, only 30.9 billion from the total supply are on the Ethereum network. This value has been experiencing consecutive dipping through the year caused by high network transaction fees.Related Reading | TA: Ethereum Remains Strong, Why ETH Could Rally Above $2.3K

According to a researcher, the largest USDC consumers are DeFi lending protocols such as MakerDAO, Aave, and Compound. Their holding is about 23% of the total USD Coin supply. The researcher explained that while the launching of Compound Treasury still pends, there’s likely to be a continuation in the trend. Treasury is a new product that will offer institutions 4% interest on USD Coin. This new product will also give initiatives that will revolve around the DeFi API of . The Circle protocol is a new platform that promotes decentralized finance operations for businesses. Recall that Clinbase, a U.S. crypto exchange, promised 4% interest on USDC holdings earlier this week. Their action was a spark to the stablecoin.

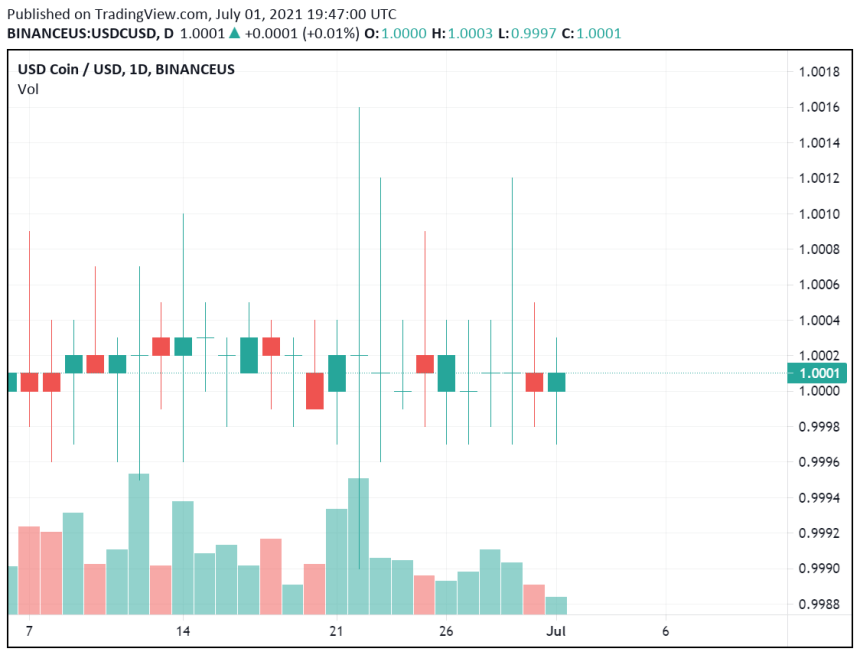

As the USDC stablecoin's significance grows, the bulls are keeping its price intact |While the bears keep the entire DeFi market in the red zone, the USD Coin is thriving and it has claimed the most dominant stablecoin spot.

Featured image from Pixabay, Charts from TradingView.com