- Ethereum price is currently declining and it is trading below the $188 level against the US Dollar.

- It is holding the $185 support area, but there is a risk of more downsides in the near term.

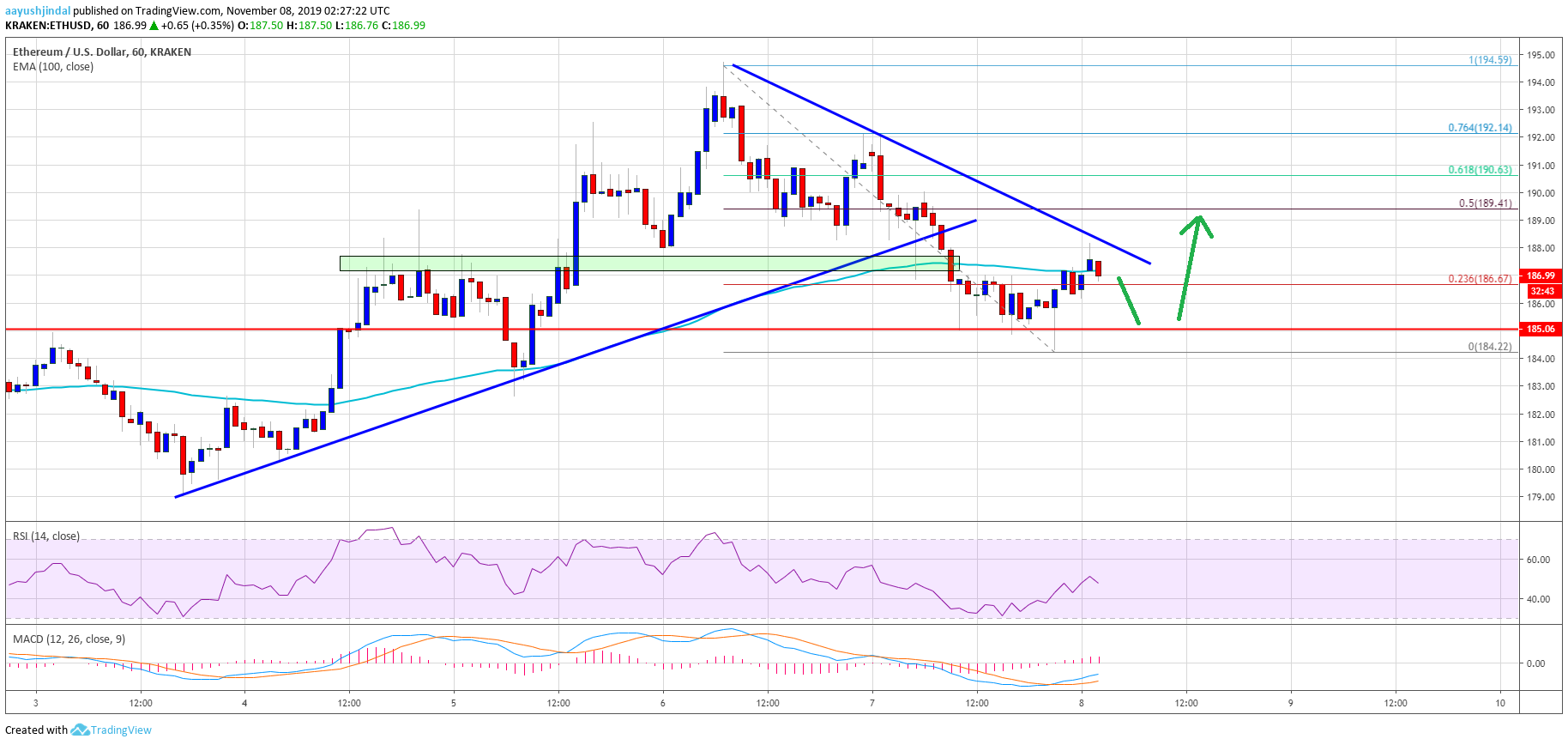

- This week’s major bullish trend line was breached with support near $189 on the hourly chart of ETH/USD (data feed via Kraken).

- Bitcoin is struggling to hold the $9,200 support and it might continue to decline.

Ethereum price is facing an increase in selling pressure versus the US Dollar, similar to bitcoin. ETH price remains at a risk of a break below $185 and $184.

Ethereum Price Analysis

After a decent upward move above $190, Ethereum struggled to continue higher against the US Dollar. As a result, ETH started a downward move and broke the $190 support area.

Furthermore, there was a break below the $188 support area and the 100 hourly simple moving average. More importantly, this week’s major bullish trend line was breached with support near $189 on the hourly chart of ETH/USD.

The price is now trading near the $185 support area, with a few bearish signs. Additionally, it is trading above the 23.6% Fib retracement level of the recent decline from the $195 high to $185 swing low.

An immediate resistance is near the $188 level. Moreover, there is a connecting bearish trend line forming with resistance near $188 on the same chart. If there is an upside break above the trend line, Ethereum could test the $190 resistance area.

Besides, the 50% Fib retracement level of the recent decline from the $195 high to $185 swing low is also near the $190 level. Therefore, a successful break above the $188 and $190 resistance levels is must for a fresh increase in the near term.

On the downside, an immediate support is near the $185 level. If there is a bearish break and close below the $185 support area, the price may perhaps accelerate its decline below $184 and $182. The next key support is near the $180 level. Any further losses could lead the price towards the $175 level.

Looking at the , Ethereum price is struggling to hold the main $185 support area. Thus, there is a risk of more downsides below $185 and $184 in the coming sessions. Conversely, the price needs to climb back above $188 and $190 to move back into a bullish zone.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving in the bullish zone.

Hourly RSI – The RSI for ETH/USD is currently recovering and it is now close to the 50 level.

Major Support Level – $185

Major Resistance Level – $190