Ethereum Outflow Hits $1.2 Billion

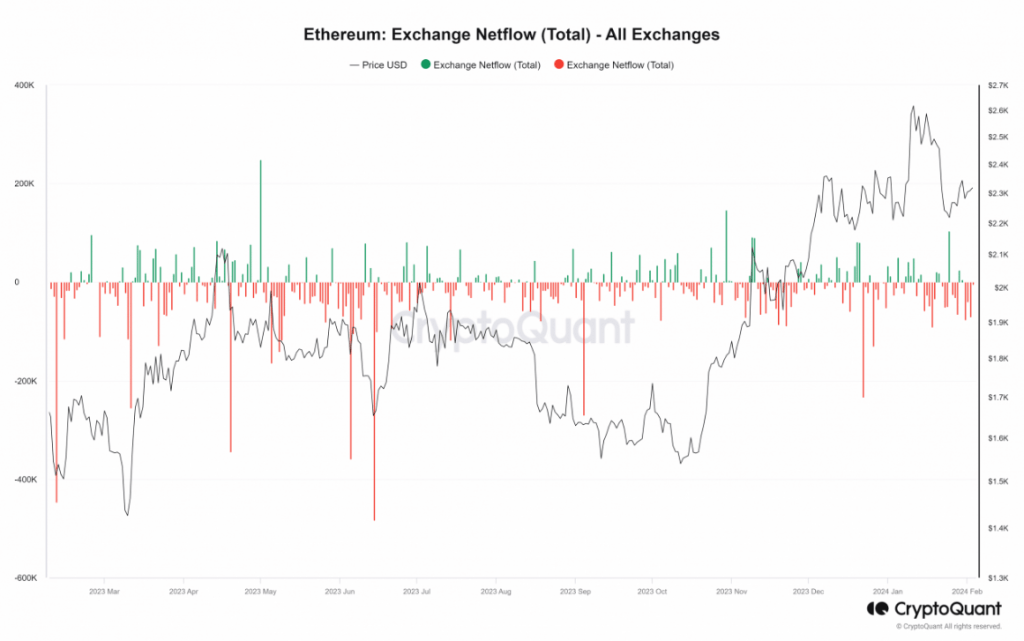

According to blockchain analytics firm IntoTheBlock, a staggering $500 million worth of ETH exited exchanges last week, contributing to a total outflow of $1.2 billion for the entire month of January. This represents a major shift compared to previous months, raising questions about the motivations behind this trend.$500M in was withdrawn from CEXs this week, adding to a total of over $1.2B in outflows in the last month — IntoTheBlock (@intotheblock)CryptoQuant data paints an even starker picture, showcasing a dominant pattern of outflows since the beginning of January. The chart reveals a persistent decline in exchange holdings, with the last inflow recorded on January 30th. At the time of writing, the outflow continues unabated, with over 3,000 ETH leaving exchanges every hour.

Binance ETH Exodus: Investors’ Strategic Moves

Interestingly, the historical balance of ETH on Binance, the world’s largest cryptocurrency exchange, tells a different story. Despite the overall uptick in exchange holdings, Binance has witnessed a consistent decline in its ETH balance throughout January. From a peak of over 3.9 million ETH on January 23rd, the balance has shrunk to around 3.7 million, indicating that users are actively withdrawing their Ethereum from the platform.While the exact reasons behind this trend remain unclear, several possible interpretations emerge:Ethereum currently trading at $2,288.5 on the daily chart:

- Increased Investor Confidence: Moving ETH off exchanges could signal a growing sentiment among investors to hold the asset for the long term, potentially driven by confidence in its future potential. Additionally, some investors might be transferring their ETH to DeFi platforms for staking or yield farming opportunities.

- Market Uncertainty: The recent outflows could also reflect broader concerns about market volatility or potential regulatory changes, prompting investors to seek safer storage for their holdings.

- Binance-Specific Dynamics: The decline on Binance might be due to factors specific to the exchange, such as user preferences for alternative platforms or changes in its trading fees or policies.

Featured image from Adobe Stock, chart from TradingView