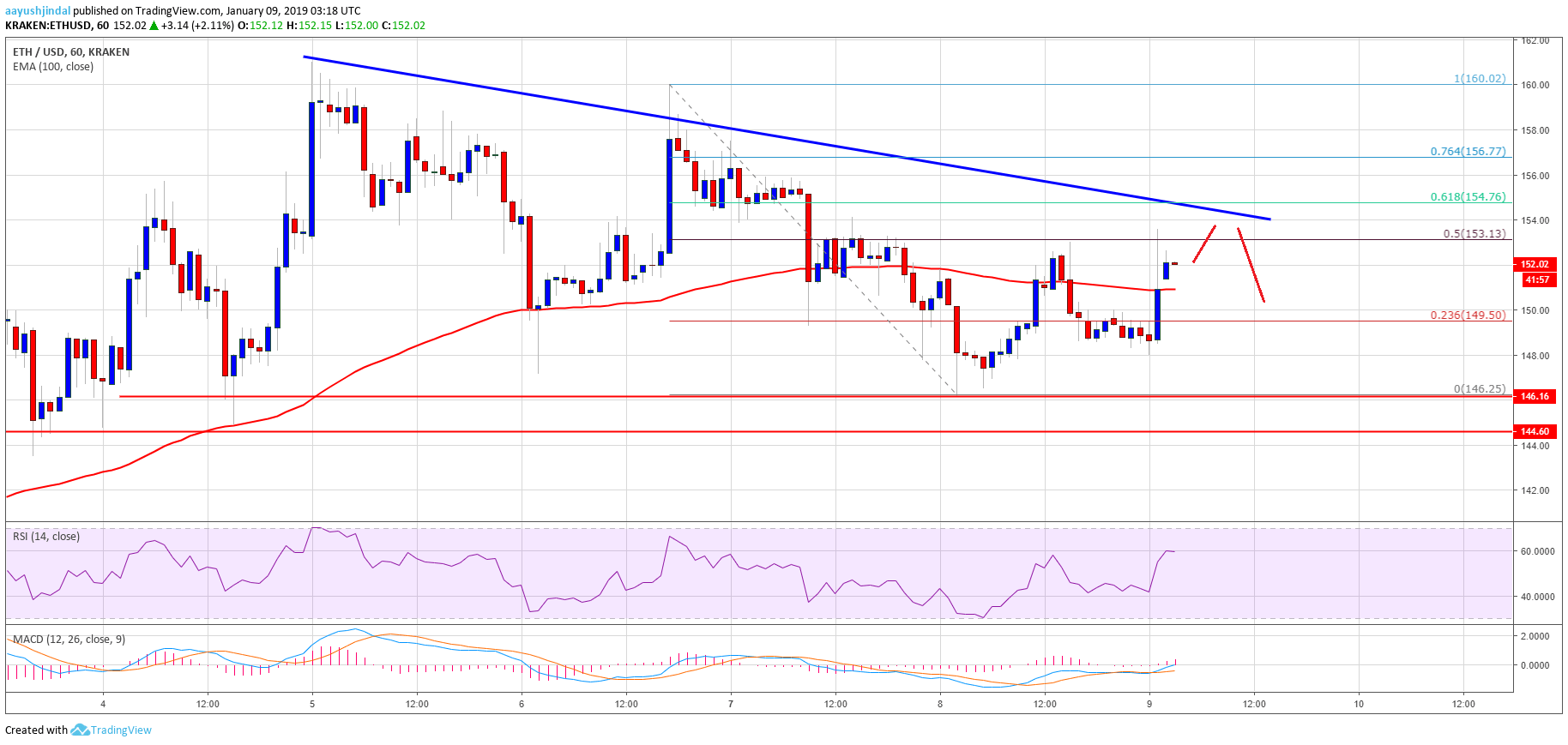

- ETH price stayed above the $146 support and later recovered against the US Dollar.

- There is a connecting bearish trend line formed with resistance at $154 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could climb quickly if buyers clear the $154 and $155 resistance levels in the near term.

Ethereum price is placed nicely above key supports against the US Dollar and bitcoin. ETH/USD is likely to slowly move higher as long as it is above $146.

Ethereum Price Analysis

After testing the $159-160 resistance, ETH price started a downside correction against the US Dollar. The ETH/USD pair declined below the $156, $155 and $150 support levels. There was a test of the $146 support area, where buyers emerged. Later, the price started a fresh upward move and traded above the $150 level. There was a break above the $152 level and the 100 hourly simple moving average. Moreover, the price cleared the 23.6% Fib retracement level of the recent decline from the $160 high to $146 low.

However, there is a strong resistance formed near $154-155. Besides, there is a connecting bearish trend line formed with resistance at $154 on the hourly chart of ETH/USD. An initial resistance is near the $153 zone. It represents the 50% Fib retracement level of the recent decline from the $160 high to $146 low. If there is a break above the $153 and $154 resistance levels, the price may climb towards the $157 level. It is close to the $156.50 pivot level and the 76.4% Fib retracement level of the recent decline.

Hourly MACD – The MACD for ETH/USD is back in the bullish zone, suggesting a nice upward move.

Hourly RSI – The RSI for ETH/USD is now well above the 50 level, with a flat bias.

Major Support Level – $146