- Bitcoin popped towards its two-month high early on Thursday, breaking above $9,400 amidst halving hype.

- But the cryptocurrency failed to secure its intraday gains as it corrected lower by about $937 from the local top.

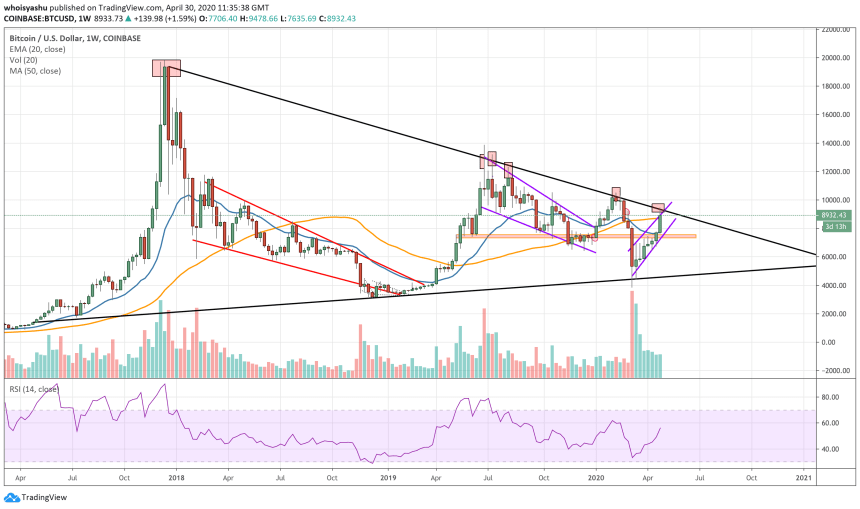

- The pullback started at the same level that has been capping bitcoin’s upside attempts since the 2017 bull run.

It was a glorious morning for bitcoin as its price rocketed past $9,400 for the first time in two months.

The top cryptocurrency was itching to make a comeback ever since it crashed by more than 50 percent in mid-March. A price rebound that ensued in the latter half of March, followed by an extended upside move throughout April, helped bitcoin recover fully – from $3,880-low to $9,478-high established April 30.

Nevertheless, the cryptocurrency’s uptrend is hinting to run out of fuel as it flirts with its long-term technical resistance.

Descending Trendline

The thick descending trendline stopped bitcoin from closing above $20,000, its all-time high, in December 2017. It again spoiled the cryptocurrency’s bullish attempt above $14,000 in August 2019. And the same level served as a no-entry zone to bitcoin’s advances above $10,500 in February 2020.

Even today, the bitcoin price reversed wildly after testing the same descending trendline, falling back to as low as $8,541 on Coinbase crypto exchange.

What It Means for Bitcoin

Technical levels are psychological – places where a majority of traders tend to express a unified market bias. So far, traders have treated the Descending Trendline as their cue to exit their long positions. They have been unable to breach above the level since 2017.

Bitcoin could either break above the trendline to begin a new bull run or extend its downside pullback to start a deeper correction towards a similarly strong, blacked Ascending Trendline. Given the prevailing fundamentals, traders are more likely to hold their positions near the Descending Trendline.

It is due to bitcoin halving, an event that will slash the cryptocurrency’s daily mining reward rate from 1,800 BTC to 900 BTC on March 12, 2020. Most analysts see it as a long-term bullish sign, given how the last two halvings followed more substantial price rallies in the bitcoin market.

At the same time, the fast-spreading Coronavirus pandemic could prompt investors to exit their risk-on positions to seek safety in cash, as had happened in March 2020. That would decrease the short-term demand for the cryptocurrency, drawing it away from the Descending Trendline.

A drawback could crash bitcoin to as low as $5,000 before it bounces again to retest the Descending Trendline.

Photo by on

Since you’re here…

Risk disclaimer: 76.4% of retail CFD accounts lose money.