With Bitcoin consolidating for nearly six weeks and the cryptocurrency community expecting a major move as a result, open interest in BTC options has been surging across the market.

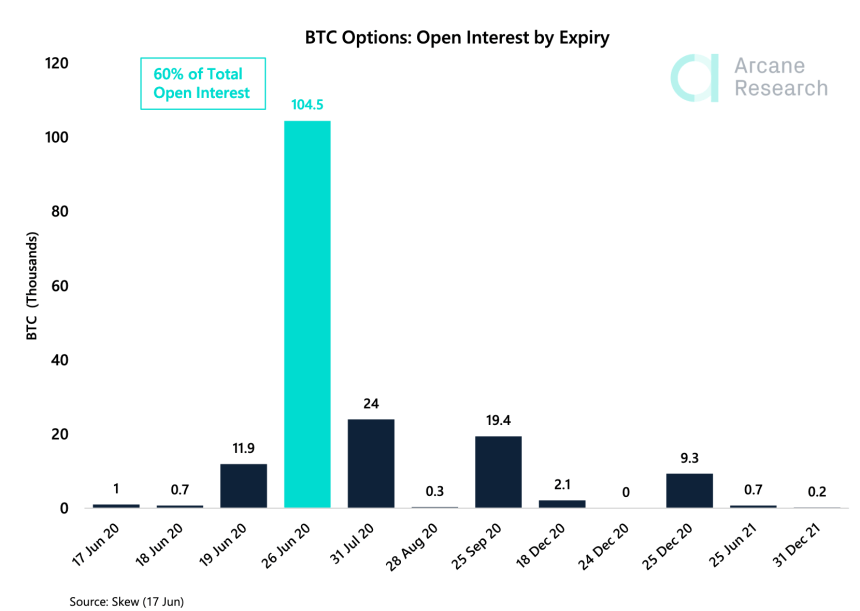

This coming Friday, June 26, nearly $1 billion in value worth of open interest in options, representing 60% of all options open interest, is set to expire. And when it does it could bring about a much need break in the sideways price action and a steep surge in the asset’s trademark volatility.Bitcoin Trades Sideways For Weeks, Preparing For Move To $11K or $7K

Bitcoin price has been stuck in a tight trading range for a month and a half. Several attempts to breach above $10,000 have been made, but none thus far has managed to hold.

Related Reading | This Volatility Measuring Tool Is Signaling One of Bitcoin’s Biggest Moves Yet

The lack of direction and clear trend has brought volatility to record lows, but a break is soon expected.

Data shows that when Bitcoin finally break out from consolation, expansion follows pushing the price by at least 20% or more.

20% to the upside would be a clear breakout of the bear market triangle at $11,250. Downside breakouts could target $7,500 or lower. But first, a break is necessary.60% of BTC Options Expiring Could Light Crypto’s Short Fuse

Before the end of this week, the break in volatility may finally be here.

Related Reading | Data Shows Bitcoin More Likely To Pump Following Consolidation, 20% Move Anticipated

It’s also the name for when four types of stock options expire all at once, which can also cause a ruckus across the stock market. The same could happen in for Bitcoin, with such a large sum of similar options contacts expiring all at once. Any price movements may occur going into expiration, so this entire week could be a nail biter. The day, in particular, to watch for, however, is Friday, June 26, when contracts expire.