It is important to note that while institutions and asset managers are net long on the CME’s Bitcoin futures contracts, leveraged funds, which use more aggressive investment techniques, are leaning in the opposite direction. Romano did not comment on that facet of the CME’s COT report.COT Report: Bitcoin CME

Futures Only Positions as of 2019-10-01

CFTC Code: #133741Asset managers/Institutional net long

(They were net short at the day of the bakkt launch. They have a good track record for the right directional trade) — Romano (@RNR_0)

69.31 % long and 30.69% short

Related Reading: More Downside in Bitcoin Before Conservative Buying Opportunity, Say Analysts

Bitcoin Bull Case Gains Traction

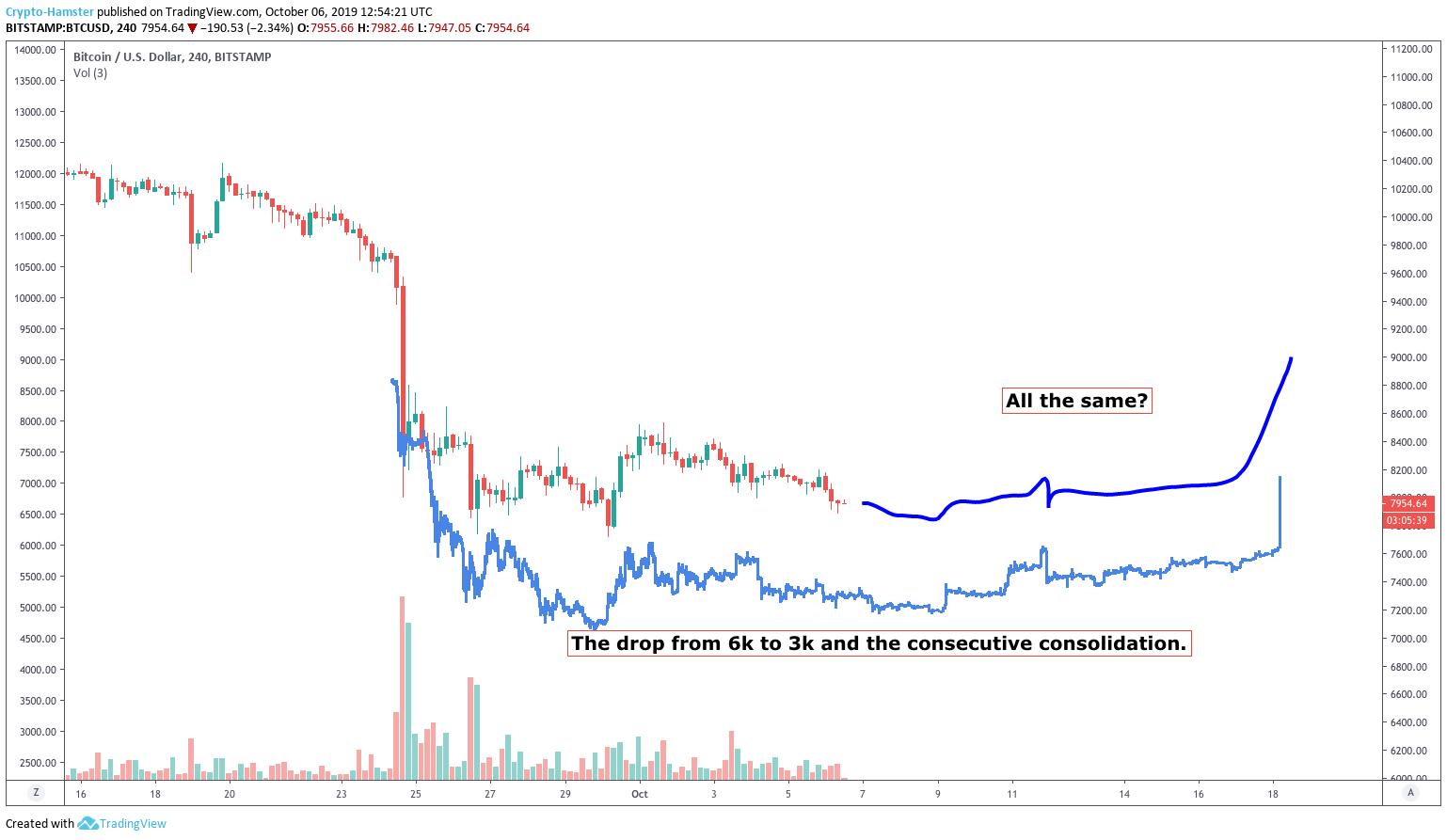

Although Romano reminded his followers that institutions being net long isn’t a conclusive sign that Bitcoin will head higher in the near future, there is evidence to suggest that cryptocurrencies may soon rebound.“It is too obvious to be true, but I have to admit that the drop from 6k to 3k and the following price action indeed looks very similar to what we have now.”

Related Reading: Too Obvious? Current Bitcoin Price Action Resembles $3,200 Bottom

Featured Image from Shutterstock