- Litecoin prices up 26.3 percent

- Adoption levels on the rise

- Transaction volumes low but up from Dec 2018

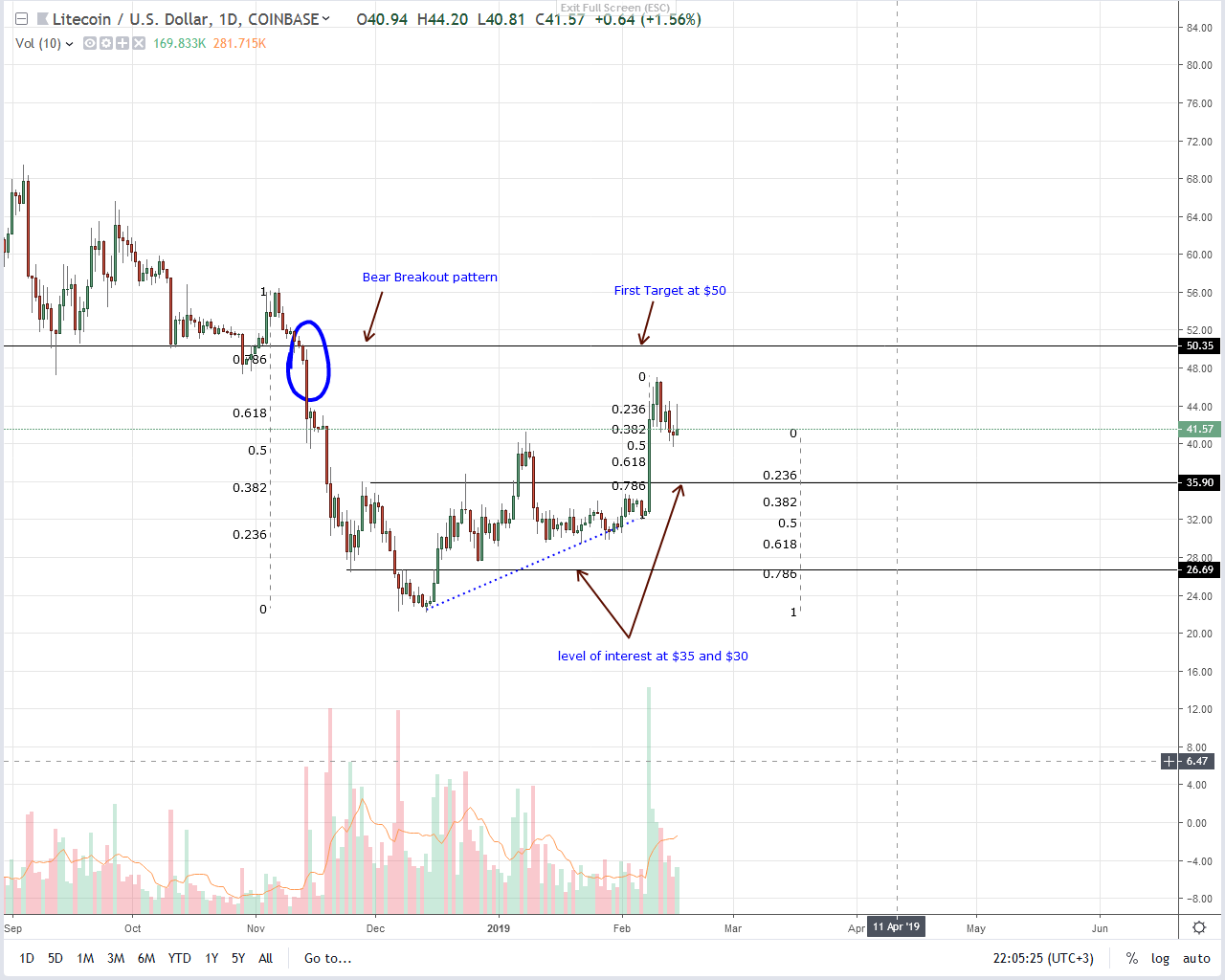

Despite short-term sell pressure, Litecoin (LTC) is on the rise and adoption levels picking up. We can only conclude this as bullish and a pre-requisite for higher highs above $50.

Litecoin Price Analysis

Fundamentals

The price of a digital asset, a product of supply-demand dynamics, is one of the many metrics of gauging performance. Fashioned as silver to Bitcoin gold, Litecoin is perhaps one of the few coins to gain widespread adoption. Leading the park is Bitcoin and similar to Bitcoin, LTC is one of the most supported assets, available in leading cryptocurrency exchanges across the world. As impressive as it may be, it is adoption that excites investors and blockchain maximalists. Designed to complement Bitcoin, is one of the leading investors of Elizabeth Stark’s . Although Litecoin’s LN is not as popular as that of Bitcoin, the coin stands to benefit thanks not only to the positive correlation of price but mainly because of sub-atomic and atomic swaps capability.Candlestick Arrangements

Determining our short-term trajectory is the ability of Litecoin (LTC) bulls to sustain prices above $35. The level is our immediate support, and in a classic bull breakout pattern, traders should consider every low a buying opportunity.

For better entries, a Fibonacci retracement tool comes in handy. When we paste it on recent high low, not only does it complement our general outlook backing bulls but it hints of sellers driving prices back to $35-$40 supports. That’s the 61.8 and 78.6 percent Fibonacci retracement level, a typical area where asset prices tend to recover. Already, there are hints of sellers. Note that today’s bar has a long upper wick meaning there is sell pressure in lower time frames. If prices close below $35, it is likely that sellers will take charge invalidating our outlook.