Nansen on March 30 shows that over $18 billion of USDT is held on Binance, the world’s largest cryptocurrency exchange by user count and trading volumes.

Binance Holding Over $18 Billion Of USDT

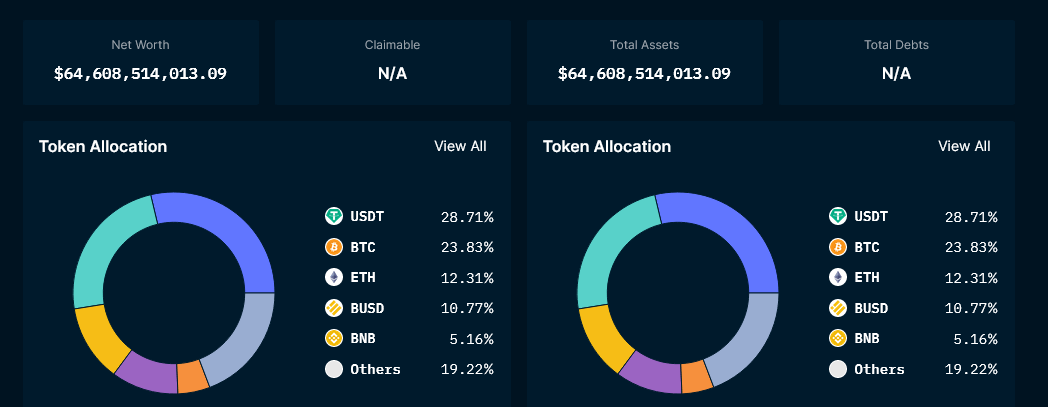

At this pace, USDT constitutes the biggest share of assets held in the exchange, even exceeding other popular cryptocurrencies like Bitcoin and Ethereum.

As of the time of writing on March 30, Bitcoin and Ethereum shares at the exchange stood at 23% and 12%, respectively, while USDT commanded 28.71% of the total allocation. In all, Binance held over $64.6 billion of user crypto assets, making it the largest cryptocurrency exchange by assets.

USDT is a popular stablecoin that tracks the value of USD. Available in several blockchains, mainly on Ethereum and Tron, USDT is the most liquid, with a market capitalization of $79.4 billion, according to trackers.

For context, at this figure, USDT is technically the cryptocurrency asset only after Bitcoin and Ethereum, whose market caps stood at $554.8 billion and $221 billion on March 30.

The stablecoin is the most liquid and exceeds USDC, issued by Circle, whose market cap stood at $33.2 billion on March 30, and BUSD, by Paxos, whose circulating supply was at $7.6 billion when writing.

Stablecoins play various roles in cryptocurrency. Since the most popular ones are backed by cash and cash equivalents, tracking the value of USD, they are used as conduits between traditional finance and the fast-growing cryptocurrency scene.

Over the years, in times of a crisis, especially tanking asset prices, the cumulative market cap of stablecoins also tends to increase. This is because stablecoins are, as the name suggests, “stable,” meaning crypto holders with Bitcoin or other volatile assets can revert to stablecoins as a refuge.

Crypto Bull Run Or Flocking To Safety?

The inflow of stablecoins into exchanges also indicates optimism among retail and institutional traders. With an increasing share of USDT in Binance, a leading cryptocurrency exchange, it might suggest that traders are positioning themselves for a bull run.

Earlier today, on March 30, Bitcoin prices rose above $29,000 for the first time in Q1 2023. Although prices have recoiled, traders appear upbeat as bulls build on gains of March 29. Since mid-March, Bitcoin prices have increased by around 46% amid a banking crisis in the United States.

Besides the price aspect, the increase in USDT holdings stems from the New York Department of Financial Services (NYDFS) order for Paxos, the issuer of BUSD, to stop minting new tokens.

Also, earlier, USDC, the second most popular stablecoin, briefly de-pegged. In light of these events, most users converted stablecoin holdings to USDT.