- Ripple (XRP) slide 7.3 percent, retesting primary support

- Start-up innovating and funding firms building XRP use cases

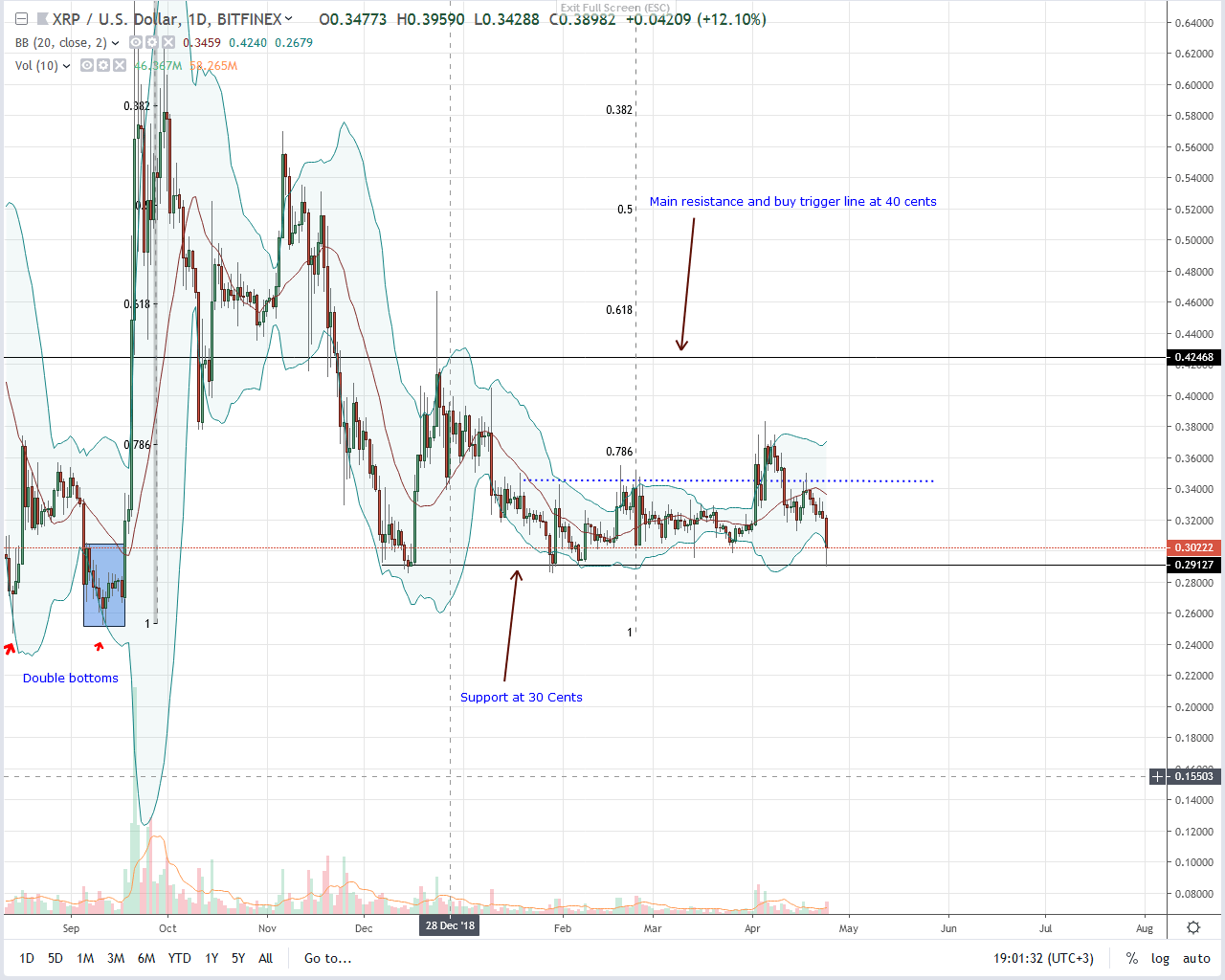

Prices and accompanying fundamentals are not in sync as Ripple (XRP) accumulate within a 4 cents range with support at 30 cents. All the same, we are bullish, and any trigger lifting prices above 34 cents or forcing liquidation below Jan 30 lows must be with high transaction volumes.

Ripple Price Analysis

Fundamentals

There is a clear divergence. From a fundamental point of view, Ripple (XRP) should be rallying and even back to $1. However, that is not the case and to put it quite literally, XRP, the third most valuable coin with a market cap of $12,616 million, is struggling.

Worse, it may drop below a critical support level, and that will precipitate losses as the coin drop to valuation last seen in Q4 2017. That’s some few days before the supper rally when XRP peaked at $3.3. Even if it may seem to be an uphill task, we cannot discount anything, especially now that fundamentals continue to flow as prices accumulate within a tight trade range.

While IBM, with a firm foothold in banking and collaborating with a competitor in Jed McCaleb’s Stellar and launching World Wire with six banks willing to issue their coins on the platform, Ripple is steps ahead.

First, they have a presence in SE Asia and the Middle East and are actively investing in projects, diversifying their portfolio and building infrastructure that makes us of XRP use cases. With , they plan to dominate the multi-billion gaming scene and with a vibrant community pushing for integration, it’s only a matter of time before prices respond—hopefully in the right direction.

Candlestick Arrangements

At press time, Ripple (XRP) is deep in accumulation and trading above Jan 2019 lows within a four-month, 4 cents range capped by 30 cents on the lower side and 34 cents on the upper side.

To reiterate our stand, we are net bullish on Ripple (XRP) with guidance from Sep 2018 bull bar. Therefore, as long as Jan 30 lows at 30 cents hold and bears find floors at this level, then there is always a slim chance that bulls will flow back and close above 34 cents in a trend resumption phase.

As it is, we shall take a neutral stand until after our trade conditions are right, that is, until XRP prices edge past 34 cents or drop below 29 cents invalidating our overall stance.

Technical Indicators

Despite our positive outlook, today’s meltdown did reverse gains of Apr-2 albeit with low transaction volumes. Average volumes stand at 16 million meaning for trend confirmation or bull-trend cancellation, confirming bar must be wide-ranging, closing above 34 cents or below 29 cents with high volumes exceeding mean of 16 million and 79 million of Apr-2.

Chart courtesy of Trading View