- Ripple (XRP) surge, up 36.1 percent

- Börse Stuttgart lists Ripple and Litecoin ETNs

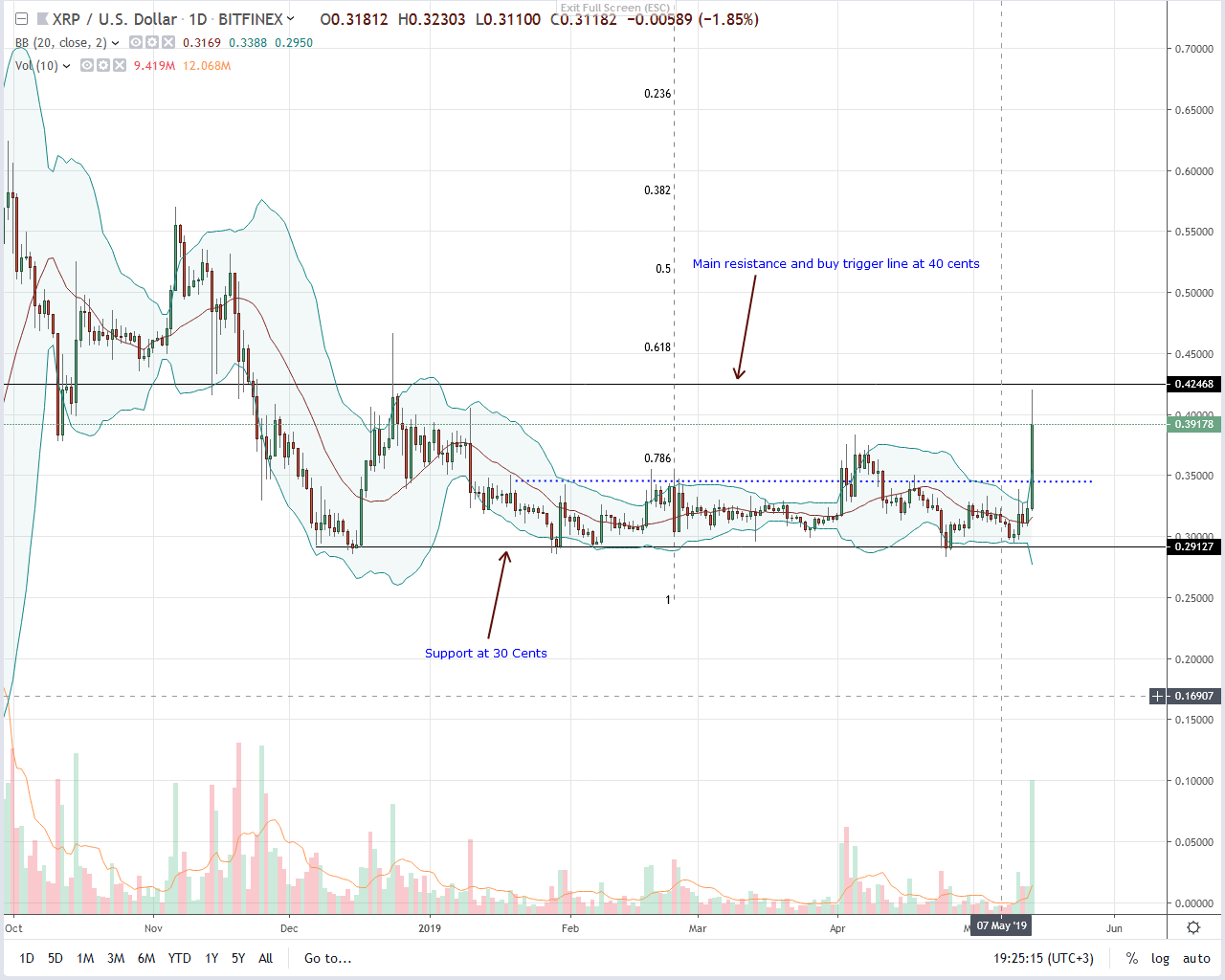

Volatility is back, and Ripple (XRP) bulls are in the driving seat. It may be because of Börse Stuttgart listing Ripple (XRP) and Litecoin (LTC) ETNs. However, what is evident is that behind today’s rally is interest thanks to a spike in participation levels. At this rate, it is likely that Ripple (XRP) will close above 40 cents as bulls aim at 80 cents.

Ripple Price Analysis

Fundamentals

After five months of consolidation, Ripple (XRP) bulls are back—and with force. Trailing Bitcoin (BTC), XRP is the second top performing asset in the top-10, adding a massive 36.1 percent in the last week. However, the increasing volatility is timely for traders because it appears that Bitcoin—and most assets, are slowing down after six weeks of enormous gains. Behind today’s price spike is first, XRP changing hands cheaply. While Bitcoin and ETH are up upwards of 70 percent, XRP has been stable, tepid and ranging within 4 cents.

Additionally, the listing of Ripple (XRP) ETNs at , the second largest regulated exchange in Germany and the ninth largest in Europe is noteworthy. Here’s what Jürgen Dietrich, Head of Trading at the exchange said:

“Interest in cryptocurrencies is still high. With the ETNs, investors in Germany can now for the first time through exchange-traded securities share in the performance of the major cryptocurrencies Litecoin and Ripple (XRP).”

However, there is more. There is a likelihood that the increasing tension between the US and China could see Wall Street sink channel funds to Ripple (XRP). The IMF has lauded the platform. Besides, Ripple Inc says they have a direct connection with the Trump administration, and they keep striking deals with banks.

Candlestick Arrangements

Price wise, Ripple (XRP) is up 25.7 percent in 24 hours, and because of that, bulls are back.

Not only is there is wide-ranging bull bar confirming buyers of Apr-26, but prices are trading above 34 cents complete with above average volumes meaning our XRP/USD trade plans are valid.

In that case, every dip, or retest of 34 cents, is but another buying opportunity with ideal targets at 40 cents, 60 cents and 80 cents as per our iterations.

Technical Indicators

From the chart, all our trade conditions are now correct. With today’s bar driving prices above 34 cents, triggering the first lot of XRP bulls complete with high volumes exceeding averages, bulls are in control and should load up on dips with targets as above.

courtesy of Trading View