XRP Price Set For Final Dip?

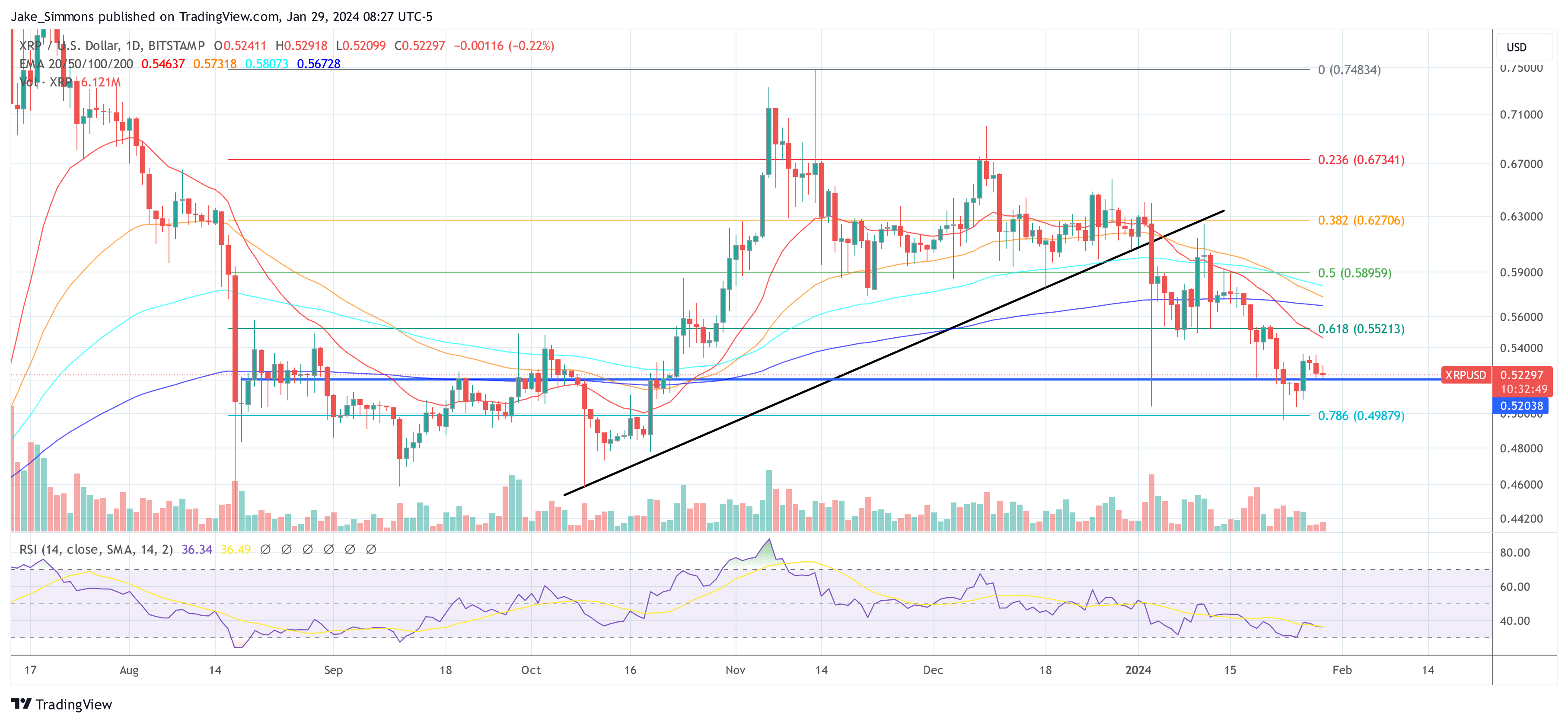

According to the provided daily XRP/USD chart, the price closed below the significant level of $0.5286. As a result, the RSI has been “forced to stay below the Resistance Trend Line,” implying that bears are currently in control, exerting downward pressure on the price.

However, this game plan was invalidated as XRP closed below $0.5286 and the RSI trend line. Now, the analyst identifies two key support levels, the trend support at $0.5085 and the Fibonacci support at $0.4623. These levels are now considered pivotal as XRP trades under the $0.53 threshold. Dark Defender emphasizes the importance of these supports: “So, $0.5085 & $0.4623 supports become more important now.”XRP moved towards $0.52-$0.53 as we expected. The target area was $0.5286 and XRP closed just above that level yesterday and had a break on the RSI. This is a great sign for XRP shortly to try the $0.60 Resistance […] But of course, will be more than happy to see XRP breaking $0.6649 first & proceed with the initial Fibonacci Target of Wave 3 at $1.88.

Looking forward, Dark Defender anticipates a potential “wick below these levels to complete this exasperating correction” and hints at an eventual recovery, with expectations set towards “Wave 3 in the end.” This reference to Elliott Wave Theory suggests that following the correction, a strong upward trend could emerge. The final price target would then be $1.88.

Despite the current market conditions, Dark Defender advises the community to maintain a positive outlook: “Be positive and be strong since this will be over.” The statement conveys a sense of resilience and long-term perspective amid short-term market fluctuations.