New rumors circulating the web suggest that payments processing giant PayPal and subsidiary Venmo are making a major play in crypto.

What are the two powerhouses planning and how might it impact the crypto market in the future?PayPal and Venmo To Begin Selling Bitcoin, Launch Crypto Wallet

If you can’t beat ’em, join ’em, goes the saying. That’s exactly what Venmo and parent company PayPal may be doing, according to sources familiar with the matter.

The company’s stance has long been in opposition to the emerging technology that directly threatens its business model.

PayPal users report that the company routinely blocks transactions from being made using the service. It does, however, allow users to transfer funds to the platform from some exchanges to cash out.Related Reading | Coinbase, Cash App, Remain Top Rated Places To Easily Buy Bitcoin

Coinbase offers PayPal as a withdrawal option for many customers. Meanwhile, PayPal’s debit MasterCard isn’t allowed to transact on Coinbase.

Soon, PayPal and Venmo could act as a fiat payment gateway, much like the Cash App does for Bitcoin.

Payments Processing Giant Could Facilitate Critical Adoption Quickly

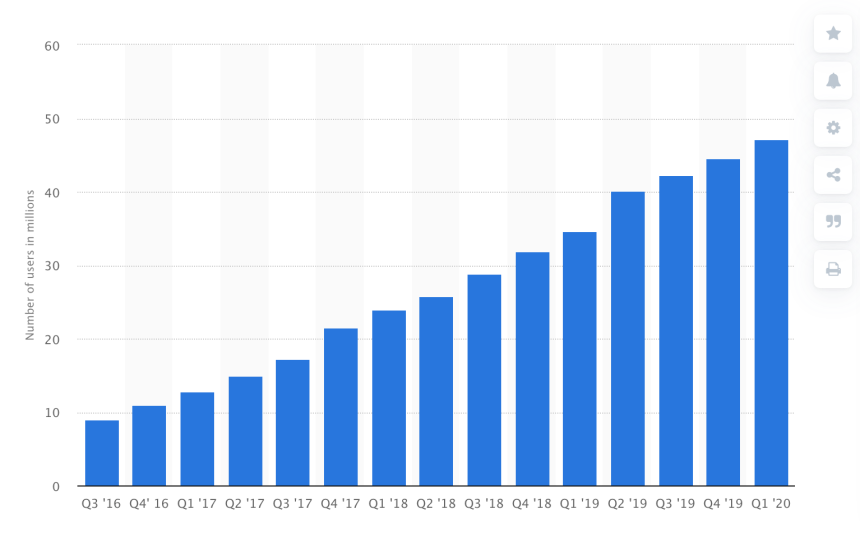

PayPal and Venmo would immediately face off against Jack Dorsey’s Cash App, which launched Bitcoin buying in 2018.Cash App was recently named alongside exchange Coinbase as the most popular places to buy Bitcoin.

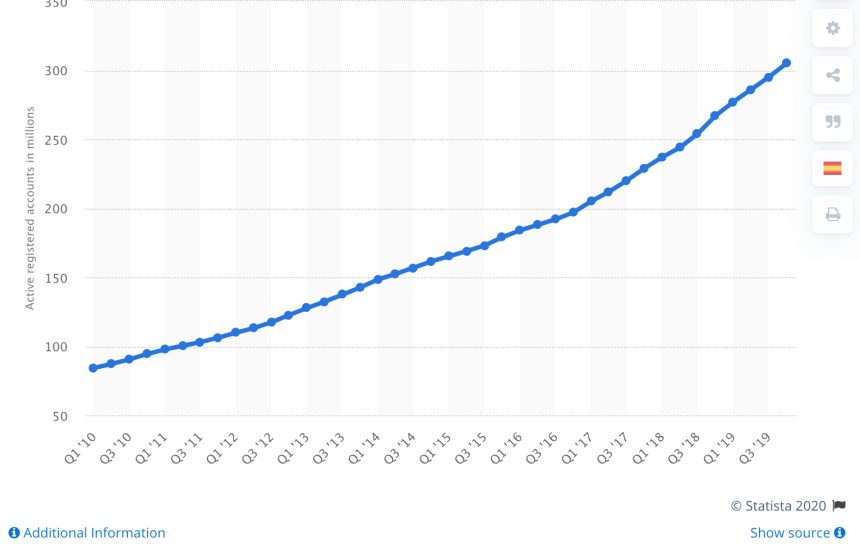

according to data. The company CEO plans to aggressively grow Venmo to over 52 million accounts this year.

Related Reading | 50% of Population To Use Bitcoin By 2043 If Cryptocurrency Follows Internet Adoption

There are said to be over 40 million individual blockchain wallets in the world. Even if just 10% of PayPal and Venmo users eventually use cryptocurrency wallets, the current number would double.