It’s safe to say that DeFi is booming lately – and Terra’s stablecoin UST has swiftly emerged as a powerhouse player in DeFi, swimming among of sea of centralized tokens such as Tether’s USDT and Circle’s USDC.

DeFi is wholeheartedly embracing UST, and new protocol integrations are popping up faster than most can keep up with, leading UST to surpass decentralized competitor DAI.

Let’s take a look at the recent growth for Terra and UST, and what we can expect from the stablecoin – and the broader Terra Luna ecosystem – looking forward.

Terra’s On A Tear Lately…

First and foremost, UST has been gaining substantial traction from more casual stablecoin holders who want to maximize their yield potential while balancing platform risk. Terra’s Anchor Protocol has served as a tool that many have turned to in recent months for exactly that; Anchor has offered a consistent ~19.5% continually compounding yield on UST while CeFi platforms like Celsius or BlockFi have been less aggressive in stablecoin rates (Celsius, for example, reduced it’s stablecoin yield rates in December from north of 10% to around 8.5%).

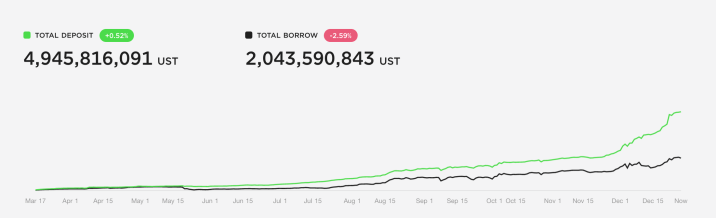

This has opened the door for moderate-risk stablecoin holders to give Anchor a try. Just take a look at the growth in recent months from both depositors and borrowers on the Anchor Protocol platform:

Related Reading | Billionaire Ricardo Salinas: Forget Fiat, Buy Bitcoin Instead

New Integrations

New platform and protocol integrations have been rolling out at a rapid pace. Our team at NewsBTC covered a deep-dive this week around the NEAR Protocol’s support of UST, and Binance rang in the holiday week last week with for BTC, USDT, and BUSD trading pairs.

Additionally, UST continues to find new protocol integration across the traditional DeFi landscape: chatter has been abundant around Abracadabra.Money’s new “degenbox,” a yield-generating strategy that allows user’s to leverage their stablecoin UST with Abracadabra’s now infamous Magic Internet Money (MIM).

Of course, we can’t leave out , a Terra-native Automated Market Maker (AMM) that is in early stages – but has already fielded over $1B worth of capital inflows. These developments have led to Terra’s native platform token, LUNA, to reach record highs. LUNA incurs $1 USD worth of burn with every UST minted, leading it to be an elastic (but lately, deflationary) token.

For more on Astroport and LUNA’s skyrocketing movement lately, check out NewsBTC’s report last week around exactly that. In all, if Q4 2021 is any indication, there’s plenty for LUNA holders, UST yield generators, and Terra Luna watchers alike to be excited about as we head into 2022.

Terra Luna's LUNA token has seen substantial growth in December, in part fueled by greater adoption and integration of the UST token throughout DeFi protocols. | Source:

Related Reading | UAE Authorities Announce New Stringent Measures Against Crypto Scammers

Featured image from Pexels, Charts from TradingView.com The writer of this content is not associated or affiliated with any of the parties mentioned in this article. This is not financial advice.