Although this regulatory rule is the minimum regulatory rule, there are still regulatory rules. And it is necessary to ensure that speculation in such assets will not cause serious financial risks. In other words, before we figure out what regulatory rules are needed, we will continue to maintain the current measures and practices.In the event, Bo was accompanied by the Former Governor of the Central Bank of China Zhou Xiaochuan highlighted “finance”, cryptocurrencies, and digital assets should serve the “real economy”. Later, Xiaochuan said he has a “question” about whether Bitcoin and digital currencies have “benefits” for the real economy.

China’s digital yuan, attack on Bitcoin and the dollar?

The Central Bank of China is developing its digital RMB or digital yuan. Currently, the institution is testing and developing for their central bank digital currency (CBDC) user interface, wallet, and other features. The People’s Bank of China Deputy Governor said the government is not aiming to “replace the U.S. dollar” or any other currency. Bo claimed the CBDC has been designed to “facilitate trade and investment” and expect the market to “choose” the best way to do so. As reported by Dovey Wan, founder partner at Primitive Crypto, the digital currency and electronic payment (DCEP) is being tested in the province of Shenzhen. Its first integration could come from government installments, Wan :(…) some municipal payment and public economic activity will be first adopted, then merchant adoption. China is really good at deploying new tech infra–at large scale, this won’t be exception.

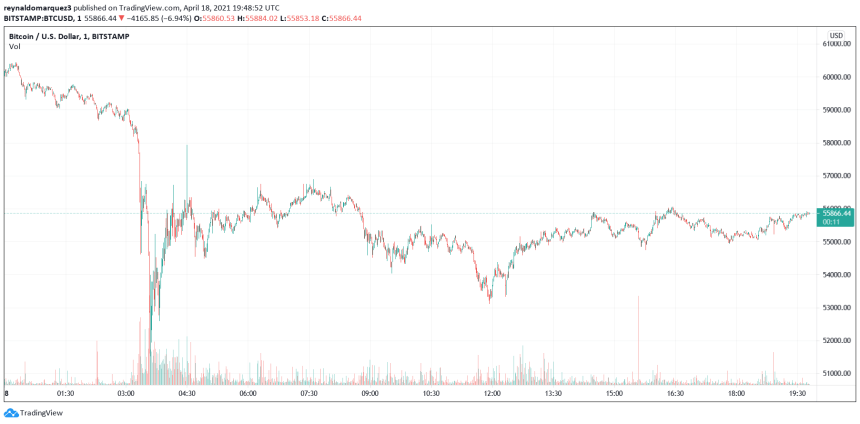

Bitcoin (BTC) is trading at $55.776 with 8.1% losses in the daily chart. In the weekly chart and monthly chart, BTC has 7% and 3.7% losses, respectively.

, breaking it down, post mortem. We just saw the single largest 1-day drop in mining hash rate since Nov 2017. The hash rate on the network essentially halved, causing mayhem in BTC price as it crashed. — Willy Woo (@woonomic)

Also, the increase in sell pressure during the weekend was enough to trigger a lot of liquidations of “short-term speculators”. Therefore, BTC’s volatility has been rising. Woo said he still is long-term bullish.