September Proves To Be Deadly

The month of September has not been kind to the digital assets that currently play in the crypto market. From the beginning of the month to the present day, the crypto market has been wracked by dips and crashes, which has left most assets barely holding their heads above others. For Bitcoin, the effects of the September trend have been quite pronounced. Data shows that for the entirety of the month, the digital asset has only seen low single-digit gains. At this point, the gains of the cryptocurrency sit at 1%, but with the price continuing to succumb to the bear trend, it is possible that bitcoin may dip below this level.

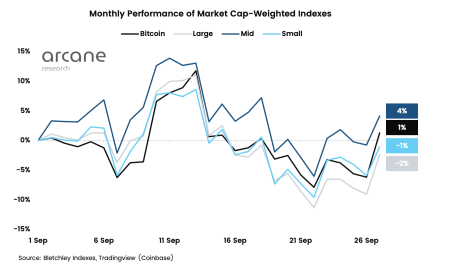

BTC suffers in September | Source:Bitcoin is also not the only cryptocurrency to suffer such dreary fates. Other indexes, such as the Large and Small Cap Indexes, have all come out even worse. The Small Cap index was slightly below bitcoin in the fact that it was down -1% for the month of September, while the Large Cap Index had seen losses of -2%. The Mid Cap Index was the only one to see some form of encouraging return. It did about 300% better than bitcoin, with gains of 4% this month, making it the best performer so far.

Bitcoin Doesn’t Get Better

September has been historically bearish, and the events that took place this month did nothing but drive that point further home. With the CPI data release and the FOMC meeting ending with another hike in interest rates, the short-term future does not look too bright for bitcoin.BTC remains volatile | Source:The present single-digit gains that the digital asset is seeing have been much more than anticipated. Even with this, the likelihood that the price of the digital asset would close in the red remains quite high, especially given the sell-offs that have been rocking the market.

Featured image from Analytics Insight, charts from Arcane Research and TradingView.com

Follow for market insights, updates, and the occasional funny tweet…