The liquidators of Three Arrow Capital (3AC), a prominent digital asset management firm, have announced plans to sell the company’s non-fungible tokens (NFTs) to realize value amid bankruptcy proceedings.

3AC is a incorporated in the British Virgin Islands. It invested assets worth more than $10 billion in some major projects, such as Terra and Solana.

The company crashed in 2022 after the fall of LUNA and its stablecoin, UST. During bankruptcy proceedings, it was revealed that 3AC held about $560 million worth of LUNA and UST.

Liquidators To Sell Company’s NFTs

Liquidators are now planning to sell 3AC NFT holdings to realize liquidation value, Joint Liquidator Christopher Farmer recently. The announcement revealed that the sales will commence 28 days after the notice date.

According to the liquidator’s statement, the decision to sell the NFTs came after considering all available options to maximize the value of 3AC’s assets. The NFTs, which include unique digital assets such as artwork and collectibles, are expected to fetch a significant sum at auction.

However, the liquidators cited that the NFTs for sale will not include those dubbed informally as the Starry Night Portfolio. Before now, the company from its subsidiary Starry Night Capital, which it considered a part of the bankruptcy proceedings.

Although the notice failed to mention the NFTs the liquidators plan to sell, Tom Wan, an analyst, which items the team will likely sell. In his speech, Wan mentioned that some of the NFTs to be sold are high-profile pieces, including PEGZ, Otherdeeds, MAYC, Punks, Autoglphys, and more.

Notably, 3AC liquidators amassed a significant collection of NFTs over the years. Liquidators believe that selling these assets would help offset some outstanding debts.

While the amount of money liquidators can get from the sale remains uncertain, they hope the proceeds will alleviate some of its financial woes.

Community Members React Against 3AC

Even with the bankruptcy proceedings, the 3AC community members have continued to express anger against 3AC. In a , Su Zhu, the founder of 3AC, accused the Digital Currency Group (DCG) of collaborating with FTX to end the operation of LUNA. However, his efforts to blame the organizations failed when community members urged him to focus on his own mistakes.

Also, members of the crypto community are displeasure at a new exchange, which 3AC and Coinflex support. Some members even swore never to use the platform and bully anyone who does.

As the market for NFTs continues to grow, more companies will likely begin to explore the potential of these digital assets. For 3AC liquidators, selling these NFTs represents a unique opportunity to realize value for the creditors.

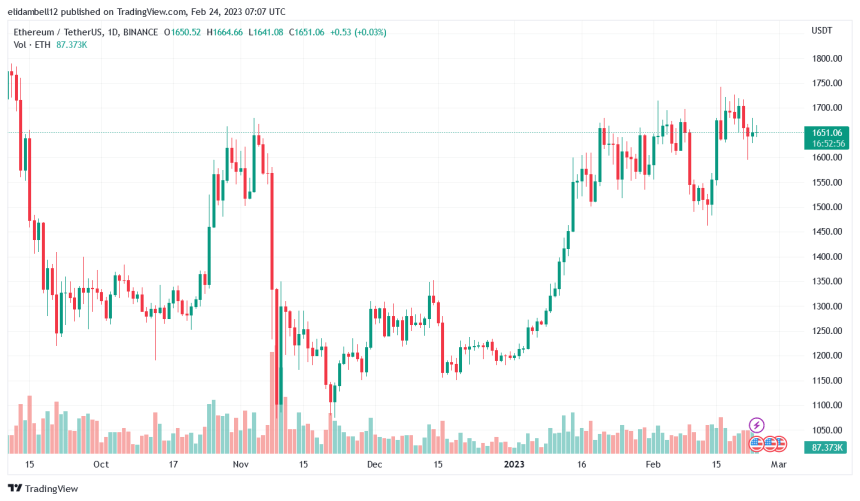

Featured image from Pixabay and chart from Tradingview.com