Head and Shoulders

Head and shoulders are top and bottom formations, that represent a winning and losing battle of tug of war between buyers and sellers.

After a game of push and pull, one side breaks and the pattern is confirmed. A large move results that often kicks off a longer term trend.

Inverse Head and Shoulders

Inverse head and shoulders are the same as head and shoulders, just flipped upside down. The push and pull price action still develops a left and right shoulder, along with a low point or head.

When the resistance line is reached once again, a breakout follows. In this case, a throwback confirmed former resistance as support before the target was reached.

Double Top

When the price peaks out at two similar price levels, it is called a double top. Double tops are a common occurrence in trading. Assets may need several retests of support or resistance before a trend fizzles out. This results in two or more peaks.ű

Double Bottom

Double bottoms act the same way, requiring two strong pushes to support before a reversal takes place.

In the below example, a Adam and Eve double bottom is depicted. It differs from a traditional double bottom by having a second, rounded bottom instead of two sharp points such as the top example above.

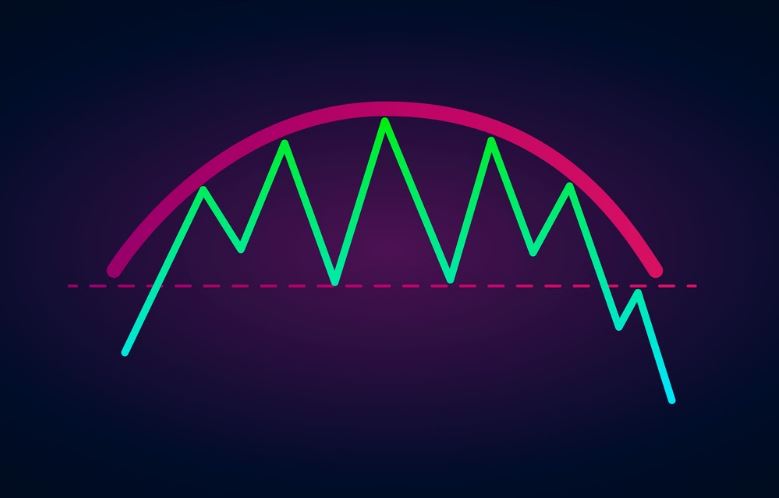

Triple Tops and Bottoms

Much like a double top or bottom, a triple top or bottom features a third and final test of support or resistance before a reversal takes place.

By the third test of the support or resistance holding, it is a signal that it likely isn’t going to break and needs to gain momentum once again before another attempt is made.