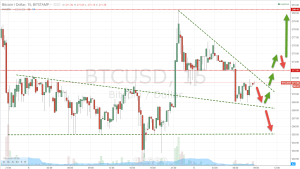

A little earlier on today we published this piece highlighting the action in the bitcoin price throughout the early European session, and our expectations for the day on Tuesday. We suggested that – having broken out of the downward sloping channel just before 8:30 AM GMT, we might see some further bullish momentum, albeit likely to be preceded by a short-term correction and a retest.

A look at the bitcoin price as we head into the late European afternoon shows that – in reality – while we did see this retest, it failed and we have since broken through in term support to take us out of the trade for a small loss (based on our predetermined stop loss entry position). So, with this said, what are we looking at as we head into the European close and the US afternoon? Let’s take a look.

Likely future action really depends on how we respond to the current range between 286.94 support and 288.49 resistance. If the former holds, look for a rebounding towards resistance, with a break above this level validating 290.93 to the upside medium-term. Conversely, if we see a break of 286.94 short-term, or a temporary rally towards resistance and a break back down towards support, it could signal a medium-term bearish bias as we head into Tuesday evening. A break below 286.94 would validate 283, initially, to the downside.

Action today has been volatile, and has highlighted the importance of well-placed risk management parameters. As a number of our readers have pointed out, bitcoin’s liquidity is far lower than that of many other financial assets, and this can translate to large, quick price movements and reversals as a result of individually large transactions in the market. With a long entry from resistance at 286.94, a stop loss around 286 flat would ensure a timely exit in the event of such a move. Similarly, looking short in the bitcoin price from 288 resistance, a stop loss at 289 with a downside target of 283 would be sensible.

Charts courtesy of

Thanks for your article.

Amazing I said it would go down and it did. Whale club for the win!

There have been many groups dedicated to trading, some focusing on pumping and dumping low-liquidity, low-volume altcoins, but others like the Whale Club that focus on profiting from the moves of Bitcoin or Litecoin, where there is sufficient liquidity to make money consistently. This is what people fail to understand…smart traders make money on the way down, using leverage, as well as on the way up. But they are all in it primarily to realize a fiat profit.

Until volume and liquidity get a whole heck of a lot higher than they are now, these kinds of groups can and do wield more influence over the markets than they probably should…but these are pretty much still 100% unregulated markets and so they are free to profit off of the less-informed. Sam your outmatched.

World Bitcoin Association Files for Bankruptcy Amid Landlord Legal Fight

A New York-based bitcoin company affiliated with Bitcoin Center NYC has filed for Chapter 11 bankruptcy protection after months of legal wrangling.

A non-profit industry advocate founded last year, the World Bitcoin Association (WBA) has been embroiled in a legal dispute with its landlord over site issues at 40 Broad Street, a building that also houses Bitcoin Center NYC.

The organization claimed between $100,000 and $500,000 in liabilities, and up to $50,000 in assets, according to court documents obtained by CoinDesk. The filing also states that the company expects to have enough funds to pay unsecured creditors, with a creditor meeting scheduled for 17th April.

This also will drive btc value down even further.