The short-term bullishness of this event is widely debated.

Some analysts believe that the lower profitability seen amongst miners will lead them to stop selling their newly minted BTC until the crypto’s price climbs higher.Bitcoin Sees Tremendous Network Growth in Time Since Last Halving

It has been four years since the benchmark cryptocurrency’s last halving event, and the growth it has seen in the time following has been quite significant.

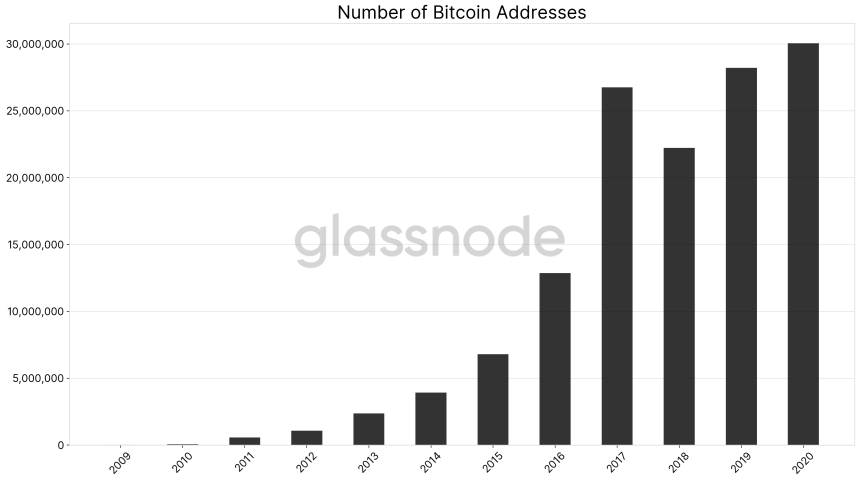

“The number of Bitcoin addresses is steadily increasing and currently at ATH. It recently crossed the milestone of 30 million addresses. That’s an increase of +234% since the last halving four years ago,” he noted while referencing data from Glassnode.

“Not only is the network increasing, but so is the pace it which it grows. The current growth rate (daily number of addresses added to the Bitcoin network) is over 68% higher than compared to last halving four years ago.”

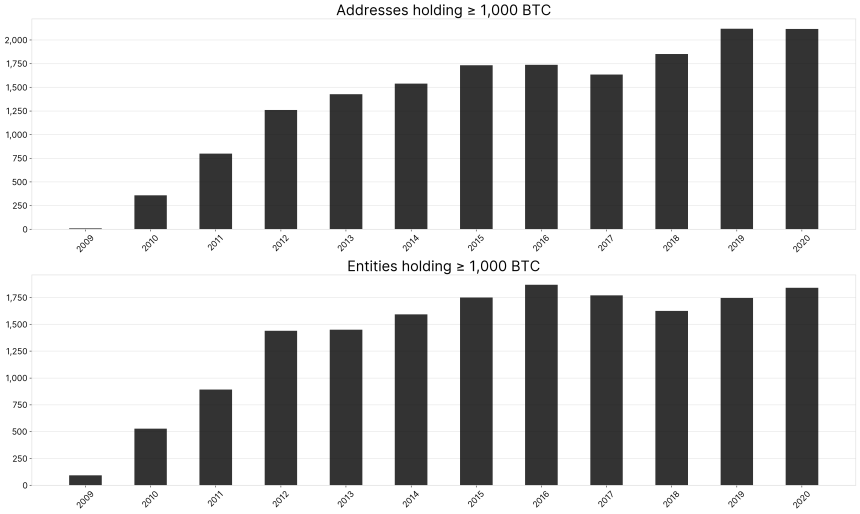

Whales Accumulate as Long-Term Outlook Grows Bright

Retail investors aren’t the only ones who have been flocking to Bitcoin in recent times. Data from Glassnode also shows that the number of so-called “whales” has also grown significantly in recent times. This is a sign that big money is being drawn into BTC as its mid and long-term outlook brightens.“Both the number of Bitcoin addresses and entities holding ≥ 1,000 BTC are well on their way to reach new ATHs in 2020. Even though the increase since the last halving is not significant, it’s important to note that the USD value they hold is more than 10x higher,” Schultze-Kraft noted.

As small and large investors alike flock to Bitcoin, it is growing ever more likely that the cryptocurrency will soon begin bearing the fruits of the immense fundamental growth seen throughout the past several years.

Featured image from Unplash.