Optimism (OP) has been one of the hardest-hit cryptocurrencies over the last week as bearish sentiment around the coin rose rapidly. The reason for this was a massive amount of OP tokens that were unlocked this week, leading to significant buy pressure on the digital asset. However, the bearish trend does not seem to have ended yet given that the altcoin could see more buying pressure.

$600 Million Token Unlock Sends Optimism Spiralling

On Tuesday, Optimism saw . These tokens accounted for around 9% of the total OP supply, which was a significant amount to move into the market, especially during a bear market.

Related Reading

The coins totaling 386 million OP at the time were worth approximately $600 million. This meant that there was now $600 million worth of new potential selling pressure for the token and the altcoin began to respond before the unlock was live.

In the hours leading up to the massive unlock, OP’s price first dropped around 7%. But then the unlock triggered further sell pressure and by the time the sellers were done for the day, the digital asset had already lost more than 20% of the value it began the day with.

OP falls to five-month low | Source:

More Pain To Come For OP Holders?

While it does seem that OP sellers are starting to tire out, the bearish case for the altcoin continues. This is because the $600 million unlock was only the first unlock for core contributors and investors, meaning VCs and others.

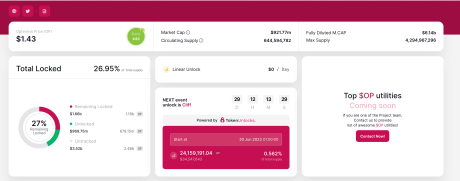

Data from Token Unlocks shows that Optimism has another token unlock coming up at the end of June for a total of 24.15 million tokens. This means that a month from now, another $34.5 million worth of tokens will be unlocked. This 0.562% of supply may be smaller than the 9% unlock that took place in May but it will put selling pressure on the token nonetheless.

$34.5 million in OP set to be unlocked on June 30 | Source:

At the time of writing, the coin is down 10% on the daily chart and 33% on the monthly chart. OP’s price has now fallen to $1.37, a price level that has not been seen since January. This is a 50% decline from its 2023 highs.

Related Reading

If the bulls fail to recover OP’s price this week, then it could fall below the $1.3 support. A fall below this level would be detrimental to holders as the next likely support for the digital asset would sit at $1.2, prompting a further 10% drop.

for market insights, updates, and the occasional funny tweet… Featured image from Coin Culture, chart from TradingView.com