Bitcoin STH MVRV Ratio Is Retesting Its 155-Day MA Right Now

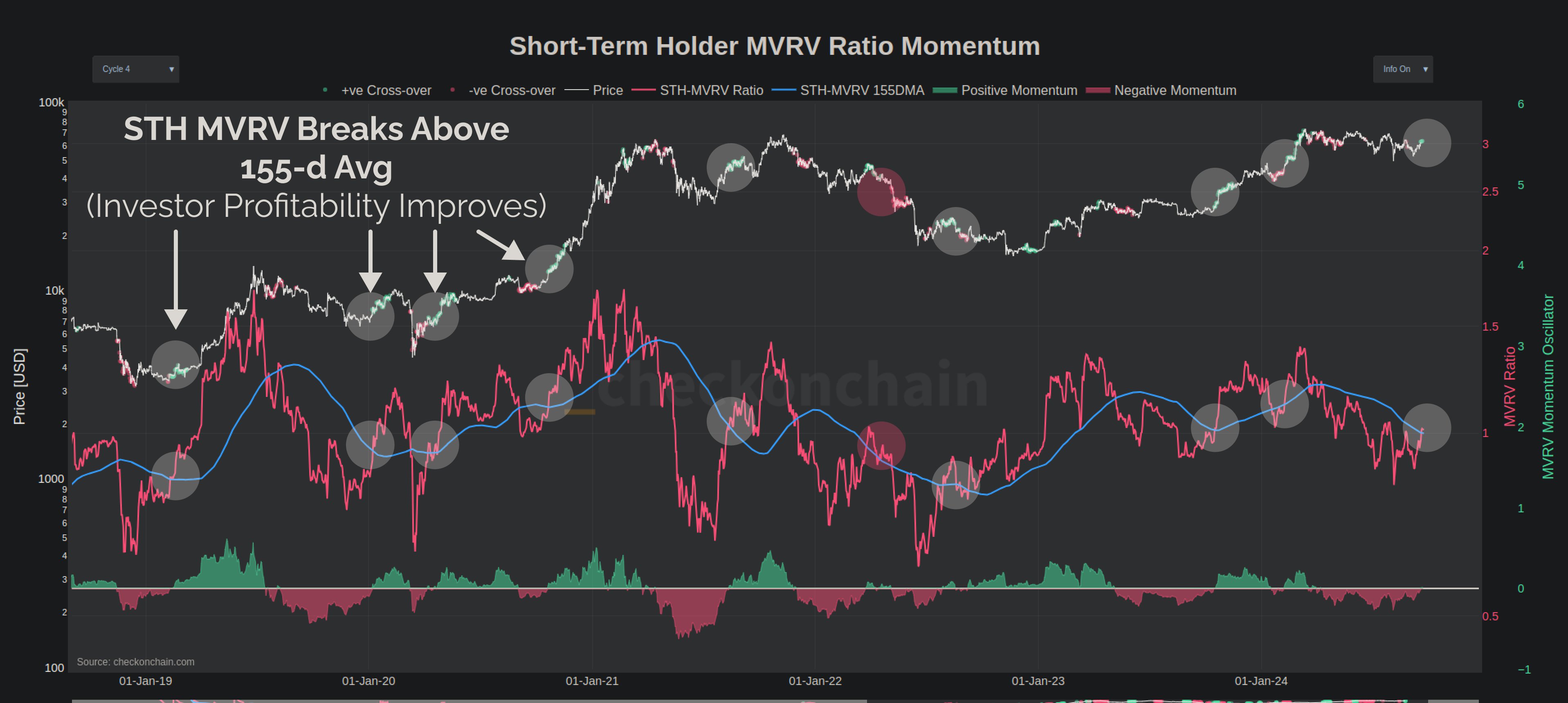

As explained by on-chain analyst Checkmate in a new on X, the short-term holder MVRV Ratio breaking above its 155-day moving average (MA) could lead to bullish action for Bitcoin.The MVRV Ratio is a popular indicator that, in short, keeps track of how the value held by the BTC investors as a whole (that is, the market cap) compares against the value that they initially put in (the realized cap). When the value of this metric is greater than 1, it means the average address on the network can be assumed to be holding a net profit right now. On the other hand, it being under the threshold suggests the dominance of loss in the market.

In the context of the current topic, the MVRV Ratio of only a specific segment of the sector is of interest: the short-term holders (STHs). The STHs include the investors who bought their coins within the past 155 days. Thus, the MVRV Ratio for this cohort tells us about the profit/loss status of the buyers from the last five months.

Now, here is a chart that shows the trend in the Bitcoin STH MVRV Ratio over the last few years:

The last time that this type of crossover had occurred in the indicator was back in the first quarter of this year and what had followed it was the coin’s rally to a new all-time high (ATH).

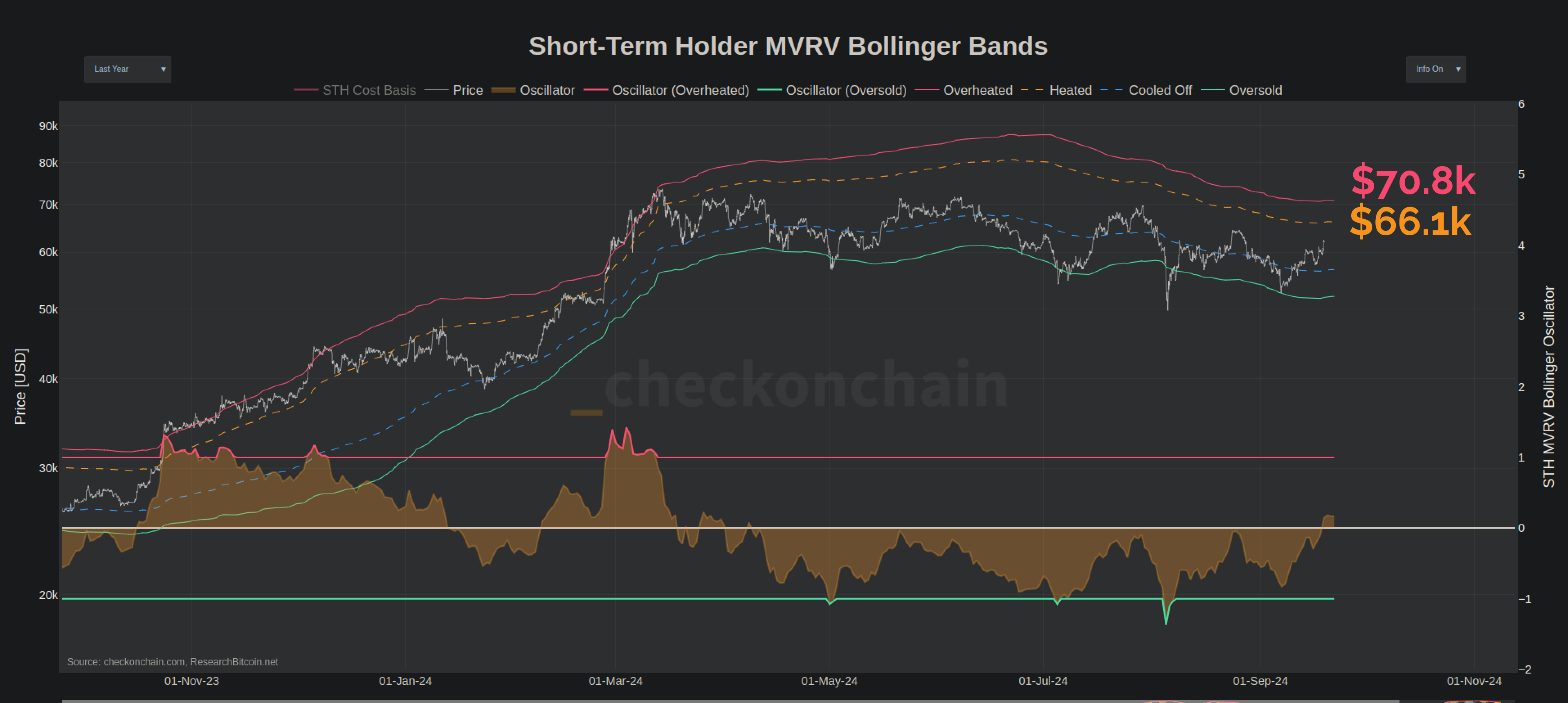

Given the precedence, it’s possible that BTC may once again see a bullish wave, should the STH MVRV Ratio manage to break beyond its 155-day MA. “If the bulls get their way, and we set a weekly higher high ~$65.3k, I’d reasonably expect an attempt to the ATH,” notes the analyst. Checkmate also warns, however, that profit-taking from these investors could be to watch out for once the price reaches the $66,100 to $70,800 range. This is because, these investors, who don’t tend to have a strong resolve, would get into notable profits at those levels.