So far, crypto analysts are reassessing their outlook on Bitcoin. Despite no hope of a bullish catalyst in sight, some analysts believe this ongoing plunge could be a temporary setback in a larger bullish trend.

Bitcoin Decline Suggests A Setup For Massive Rally?

Renowned crypto analyst Javon Marks recently his updated perspective on Bitcoin, suggesting that the recent dip may be a short-lived pullback rather than the start of a prolonged downtrend.According to Marks, Bitcoin exhibits several bullish patterns that point towards a recovery back to the $65,000 level. He emphasizes that while the current drop is significant, the broader market structure remains intact.

He further elaborated that on a larger scale, another bullish formation suggests a possible 21% increase from the current levels, potentially pushing Bitcoin’s price to over $73,000. This optimistic outlook is based on historical patterns and technical indicators that suggest Bitcoin may be gearing up for a strong rebound.

One of multiple (BTC)’s bullish patterns in the near term is present here, suggesting the recent pullback to be temporary and a recovery back to the $65,000s! On a larger scale, another bull pattern continues to suggest an over 21% climb from here to $73,000+… — JAVON⚡️MARKS (@JavonTM1)

Was The Dip Something Out Of Ordinary?

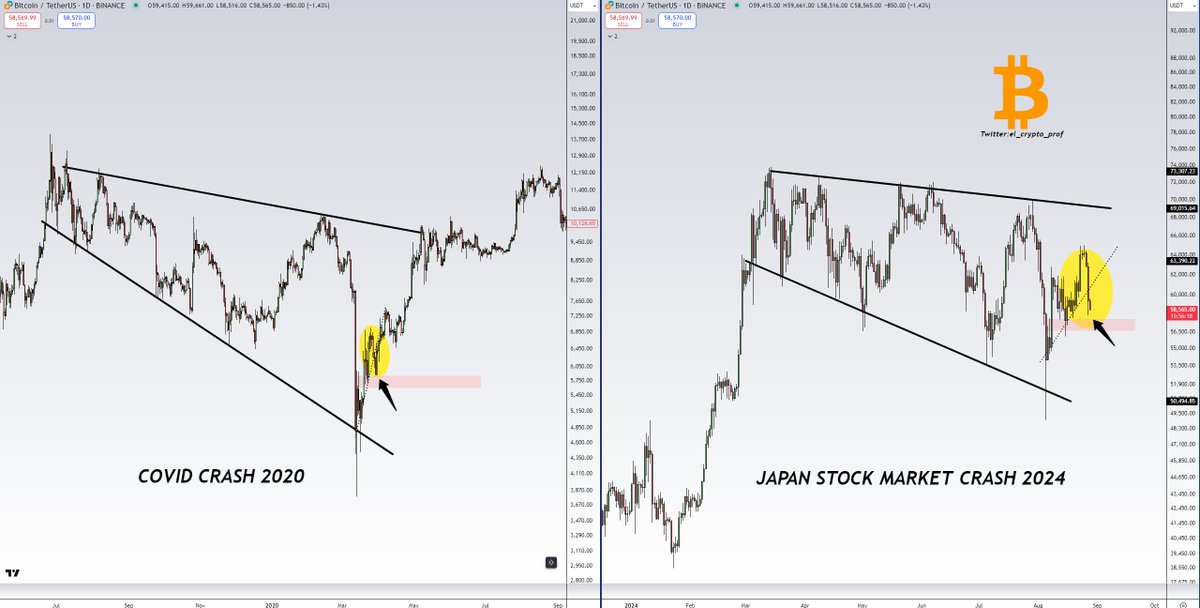

While some investors may be anxious about the recent downturn, other analysts encourage calm. Moustache, a well-known figure in the crypto analysis community, compared the current market situation to Bitcoin’s performance during the 2020 COVID-19 crash.

He pointed out that the current decline resembles the market behavior observed during that period, eventually leading to a significant recovery.