Crypto Fear And Greed Index Surges Up, But Remains In “Fear” Territory

As per the latest weekly report from , the market sentiment rose to the best sentiment since April of this year on Saturday.The “fear and greed index” is an indicator that measures the general sentiment among investors in the crypto market.

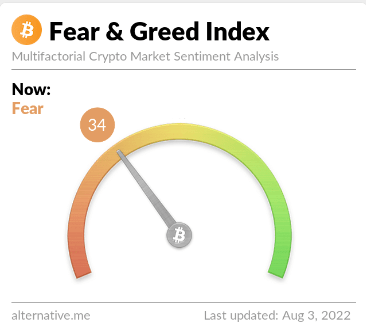

Values approaching the end of the range of above 75 or below 25 indicate “extreme greed” and “extreme fear” sentiments, respectively.

Historically, bottoms have tended to form during periods of extreme fear, while tops have occurred during the other extreme sentiment.

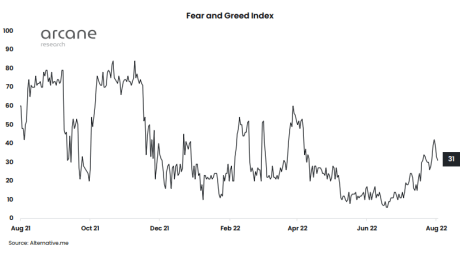

Looks like the value of the metric has been steadily climbing up in recent days | Source:As you can see in the above graph, just a while ago, the crypto fear and greed index had been inside the extreme fear territory for a couple of months, making it the longest ever streak of rock-bottom mentality. But, during the last few weeks the indicator has observed some growth as the various coins in the market have simultaneously seen recovery. At the time the report came out (which was yesterday), the fear and greed index had a value of “31.” This implies a fearful market. Today, the sentiment has slightly improved as the value of the indicator is now “34,” which is however still firmly inside the fear territory.

The value of the indicator is 34 at the moment | Source:On Saturday, the metric came close to stepping out of the fear territory as it attained a value of “42.” This happens to be the highest value the indicator has seen since April. But before a breakout into greed could occur, the fear and greed index slumped back down. The latest trend suggests while the market sentiment has been improving, the investors have remained cautious. This may pave way towards a slower, but more sustained recovery in the market.

BTC Price

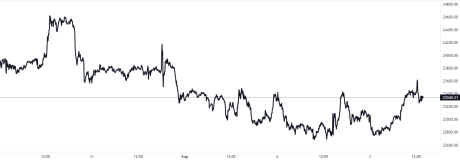

At the time of writing, Bitcoin’s price floats around $23.3k, up 9% in the past week.

The value of the crypto seems to been trending sideways during the last few days | Source:

Featured image from Quantitatives on Unsplash.com, charts from TradingView.com, Arcane Research