Bitcoin Has Been Under The $28,700 Level For 310 Days Now

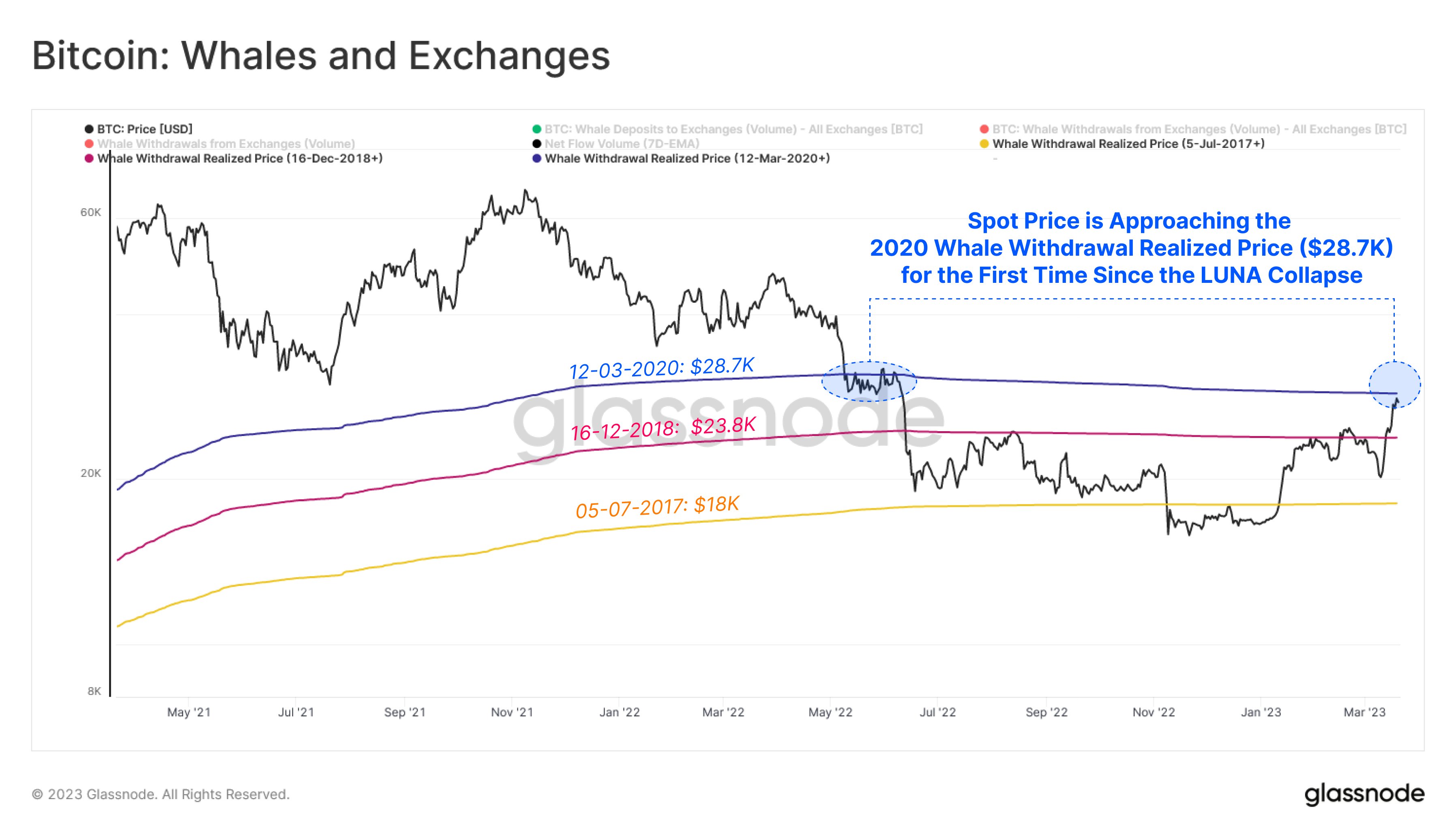

According to data from the on-chain analytics firm , the $28,700 is the cost basis (that is, the acquisition price) of a specific whale group in the BTC market. The relevant indicator here is the “realized price,” a value derived from the realized cap, a capitalization model for Bitcoin.

Instead of taking the value of each coin in the circulating BTC supply the same as the current asset price, the realized cap assumes that the “actual” value of any coin is the price at which it was last transacted on the chain.The price seems to be approaching the highest of these levels | Source:Whales have been put into these three groups based on the period they bought their coins. For example, the 12 March 2020 cohort includes all whales that have acquired their coins between now and then. As shown in the above graph, the 5 July 2017 whale group has the lowest cost basis at $18,000, below which BTC was stuck during the lows after the FTX collapse. Sometime later, the coin attempted to put together a rise and get above this level, but it found rejection.

From the chart, it’s apparent that the asset struggled around this mark for a while until the sharp price surge of the past week took place, and the asset managed to clear this level.

Now, Bitcoin’s price is above the $28,000 mark, and the coin is fast approaching the cost basis of the final cohort, the 12 March 2020 whales. Given that the other two whale groups provided resistance to the price, it’s possible that the $28,700 cost basis of the last group could also cause trouble to the asset.BTC Price

At the time of writing, Bitcoin is trading around $28,000, up 9% in the last week.Looks like BTC has mostly consolidated today | Source: