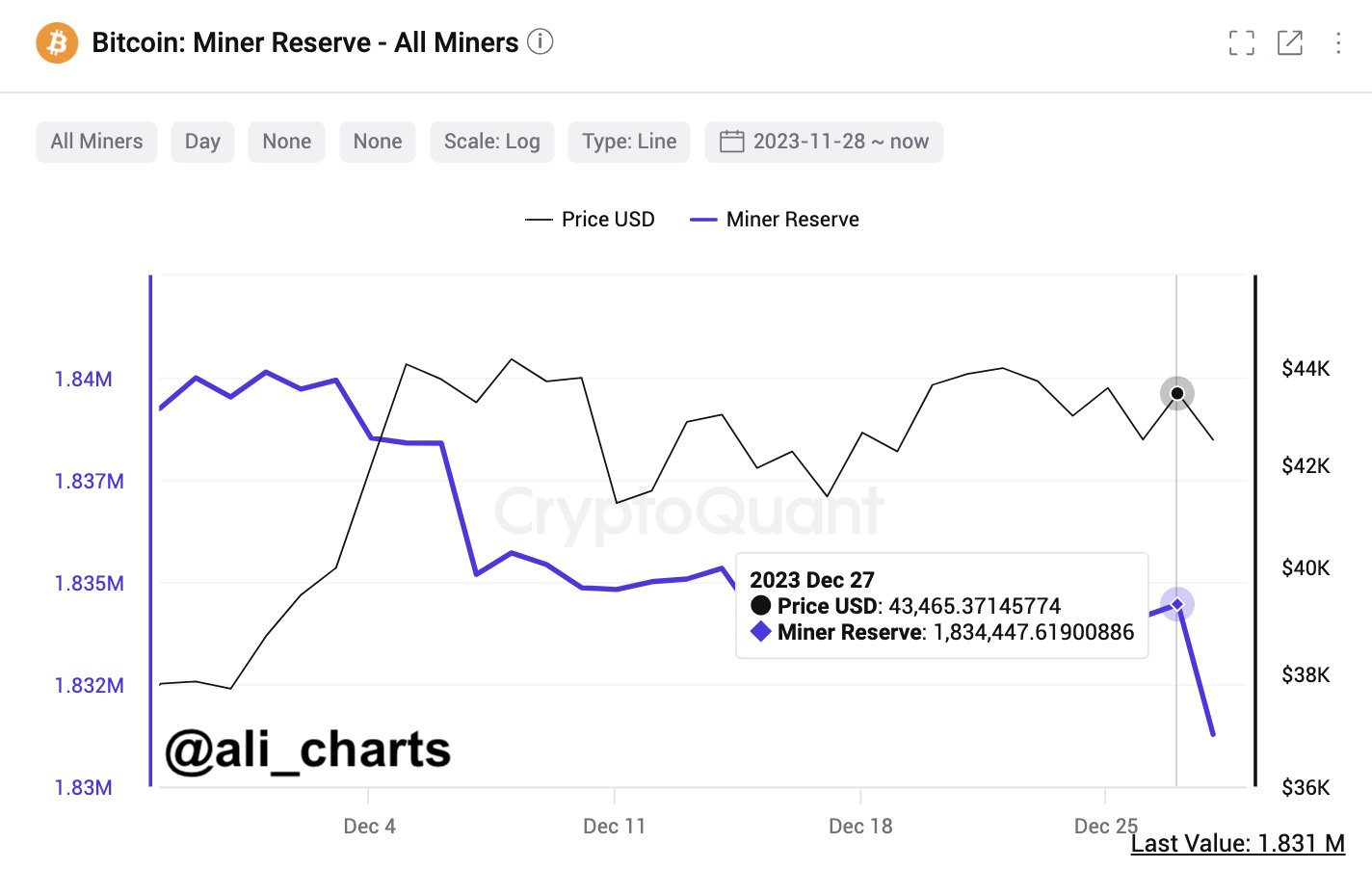

Bitcoin Miner Reserve Has Taken A Plunge Recently

As pointed out by analyst Ali in a new on X, the BTC miners have participated in some selling recently. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin sitting in the wallets of all miners.

When the value of this metric goes up, it means that the miners are receiving a net number of coins in their addresses right now. Such a trend suggests that these chain validators are choosing to accumulate the asset currently, which can naturally have bullish effects on the price.The value of the metric seems to have sharply dropped in recent days | Source:As displayed in the above graph, the Bitcoin miner reserve has registered a sharp drop during the past couple of days. During this withdrawal spree, these chain validators transferred out more than 3,000 BTC from their wallets, worth around $128 million at the current exchange rate.

Bitcoin had recovered to the $43,800 level earlier after news had come out about Microstrategy completing another substantial purchase. As the miners made these outflows, though, the cryptocurrency witnessed a drawdown towards the $42,000 mark.

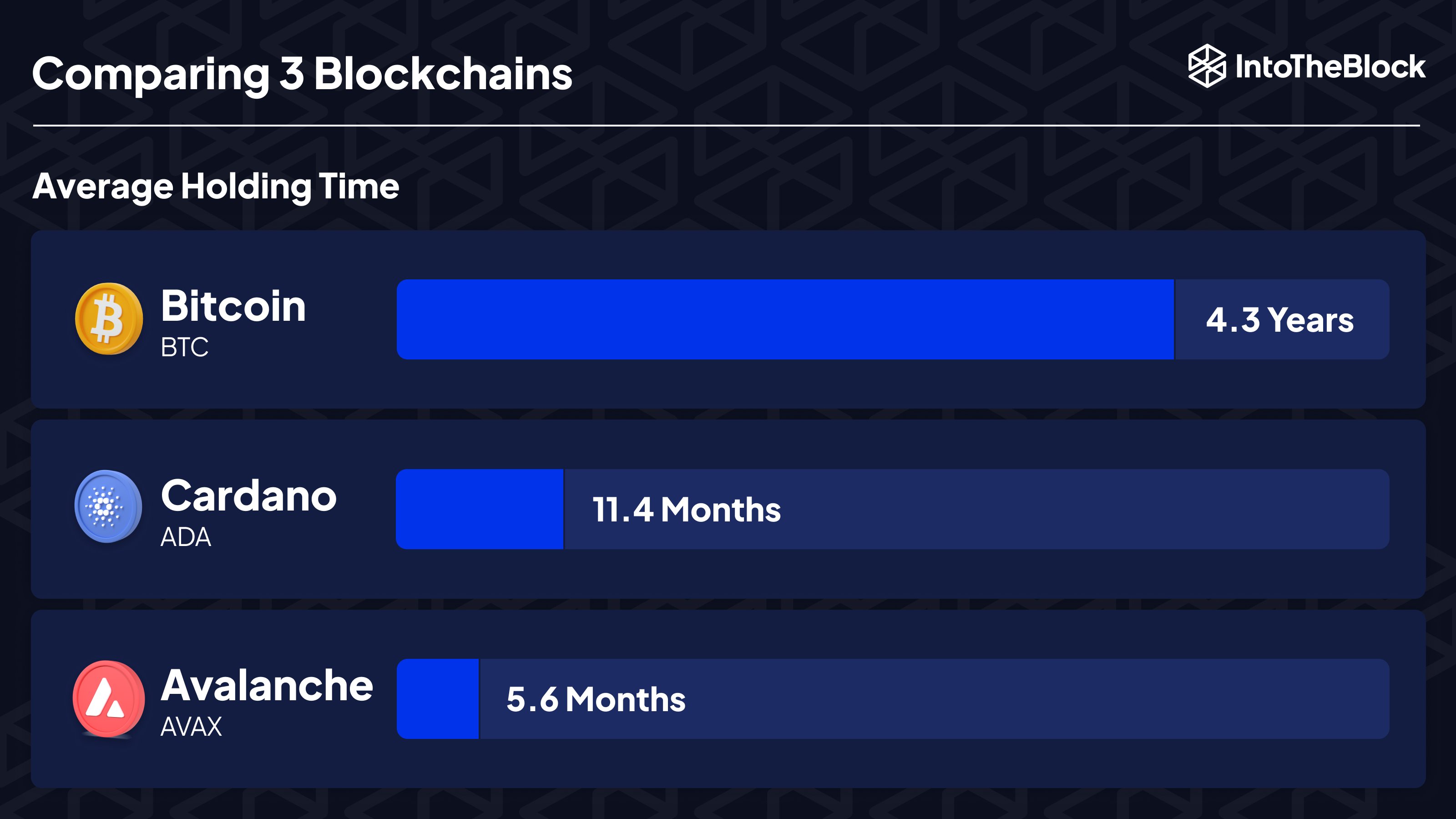

Given the timing, it would appear possible that the miners had made these transfers to cash in on the recovery and this extra selling pressure may have contributed to the decline that the asset ended up seeing.The average holding time across three networks | Source:As is visible above, Bitcoin holders carry their coins for 4.3 years on average, which is far greater than what Cardano (ADA) and Avalanche (AVAX) blockchains observe.

While miners don’t tend to HODL because of their running costs, it would appear that the normal investors on the BTC network are more than making up for it by holding for very extended periods.

BTC Price

The market doesn’t seem to be too discouraged after the drop due to the selling pressure from the miners, as Bitcoin is now once again making a recovery push. So far, BTC has climbed back to the $42,900 level.Looks like BTC has been overall moving sideways recently | Source: