Bitcoin Whale Growth Had Previously Been Diminishing With Each Cycle

According to data from the on-chain analytics firm , the current cycle is displaying an interesting deviation from the rule followed during the last few cycles.Here, the cycles or the “epochs” for the cryptocurrency have been defined using the halving events. “Halvings” are periodic blockchain events that permanently cut in half the block rewards that the miners receive for solving blocks.

These events occur every time 210,000 blocks have been mined on the network, or approximately every four years. The reason they are generally selected as the start and end points for BTC cycles is that they carry profound impact on the economics of the market as the production rate of the asset is cut in half following them. This increase in the scarcity of the asset is a narrative so strong that bull runs have always followed the halving events.

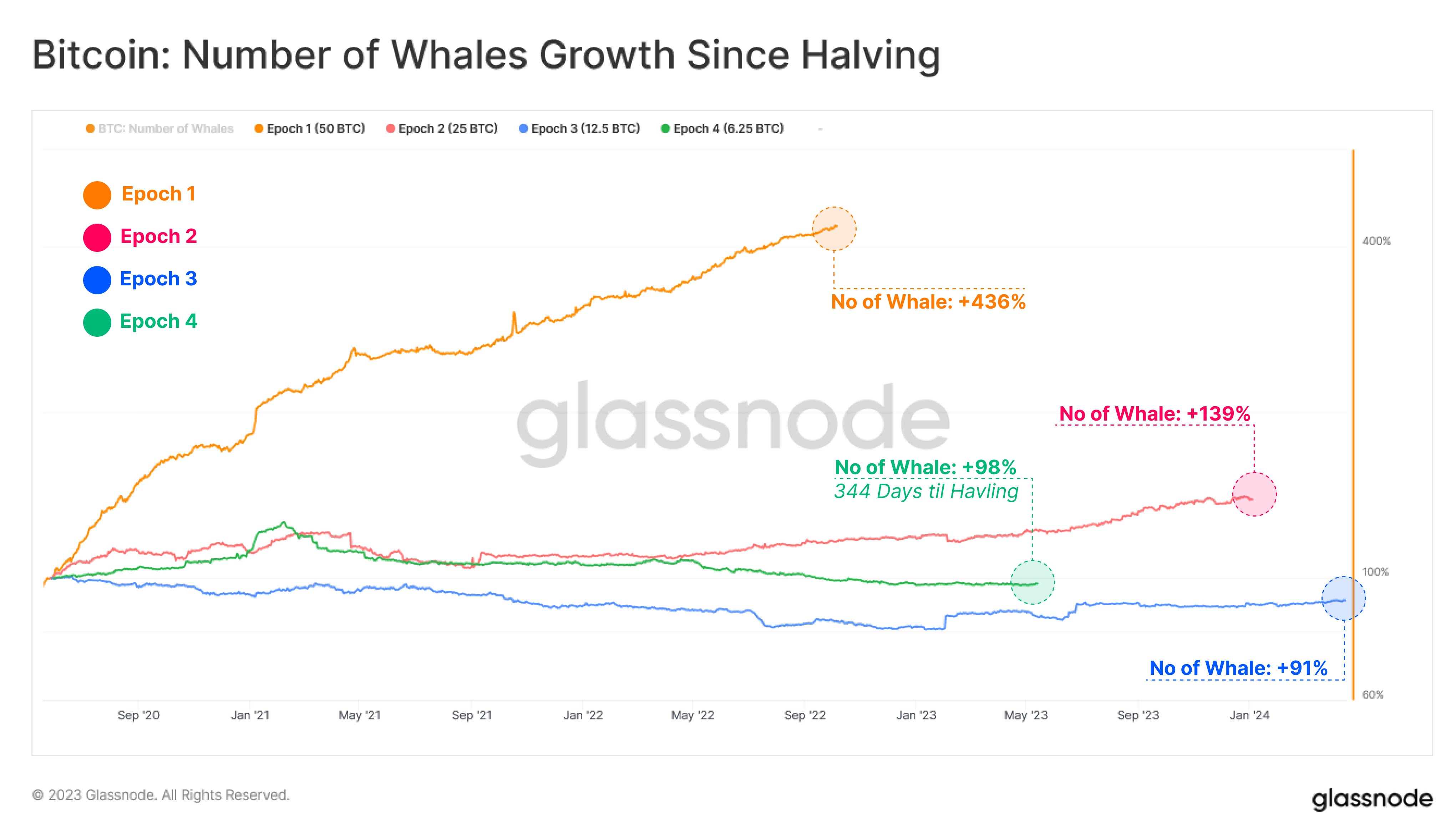

The next halving is supposed to take place sometime in the first half of next year. Currently, miners receive 6.25 BTC for every block that they mine, so following this next event, they will only receive 3.125 BTC in their rewards. Now, there have been many patterns that have held throughout the Bitcoin cycles, but one such trend looks to be breaking down with the latest epoch, as the below chart highlights.The total number of whales seems to have gone up by 98% in the current cycle | Source:

The metric of interest here is the percentage growth that the number of whales have registered during each of the epochs. The analytics firm has defined “whales” as entities that are holding at least 1,000 BTC in their wallets.

Note that entities here don’t just refer to individual wallets, but also “a cluster of addresses that are controlled by the same network entity,” which are “estimated through advanced heuristics and Glassnode’s proprietary clustering algorithms.”BTC Price

At the time of writing, Bitcoin is trading around $27,000, down 2% in the last week.BTC has mostly moved sideways in the last few days | Source: