Following a tumultuous start to the month, the cryptocurrency market has yet to shake off the early August blues. The story has not been very much different for the price of Bitcoin, which struggled to make an impact in the past week.

With BTC’s price almost 20% adrift of its all-time high of $73.737, there have been increased calls for the premier cryptocurrency to return to the bull market. Interestingly, a recent on-chain observation shows that Bitcoin has witnessed substantial bearish pressure in the past two years.

Bitcoin Spot CVD Persists In The Negative — What Does This Mean?

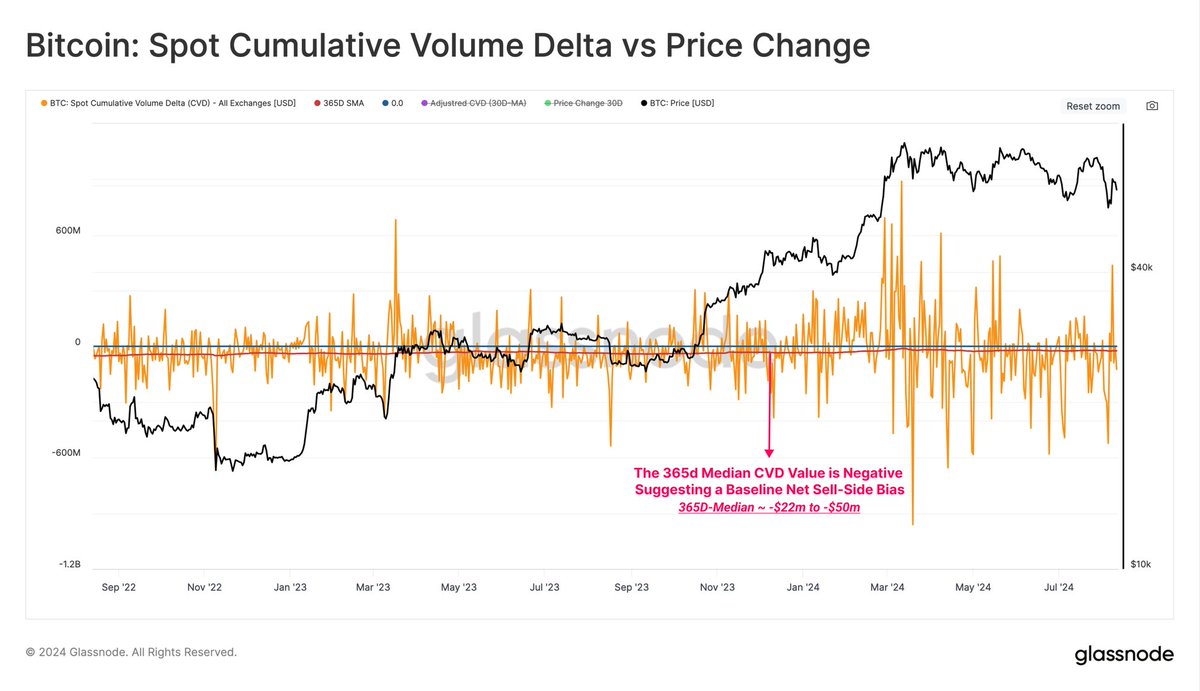

In a recent post on the X platform, blockchain data company Glassnode that the Bitcoin spot market has been experiencing a net-sell side bias over the past two years. This on-chain observation is based on the Spot Cumulative Volume Delta (CVD) indicator, which measures the net difference between buying and selling trade volumes.

The Spot CVD metric is used by investors to assess the current market sentiment. It offers detailed insight into whether the bulls or bears are the dominant market participants. Typically, a positive Cumulative Volume Delta value implies more buying pressure in the market, while a negative value suggests that the sellers are in control.

According to the latest data from Glassnode, the yearly median CVD value has been bouncing between -$22 million and -$50 million over the past two years. This trend suggests a net sell-side bias, with selling volume overshadowing buying volume in the spot market for some time now.

While the persistence of a net-sell side bias suggests investors offloading their coins rather than accumulating, it does not necessarily imply a bearish condition for the Bitcoin market. It rather spotlights a cautious approach by the investors, with an overall decline in spot demand of BTC.

Although it is difficult to say how the spot Cumulative Volume Delta will shift over the coming months, the metric is one that investors should look out for. This is especially relevant because a return of CVD to positive values could signal an increase in Bitcoin spot market demand, which could be favorable for the Bitcoin price.

BTC Price At A Glance

As of this writing, the price of Bitcoin is slightly above the $59,000 mark, having increased by more than 2.5% in the past 24 hours. This recent momentum, though, is not enough to wipe off the coin’s loss on the weekly timeframe. According to data from CoinGecko, the Bitcoin price is down by more than 2% in the past week.