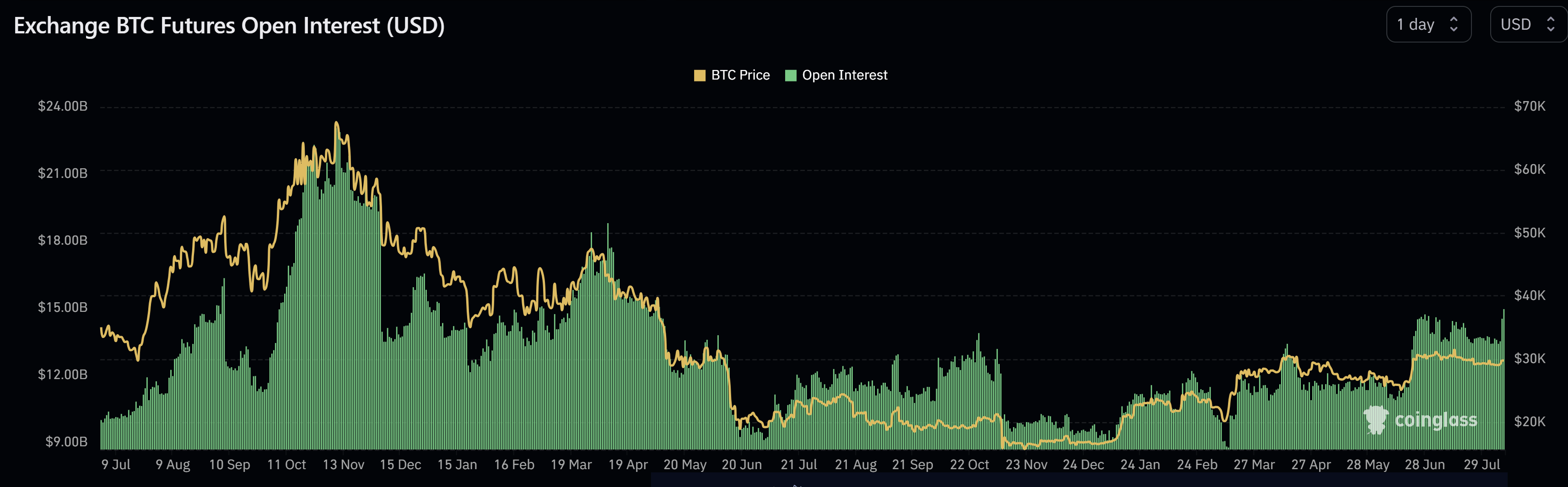

In a market that has been relatively quiet for weeks, Bitcoin (BTC) has suddenly sprung to life, with its Futures Open Interest (OI) reaching levels not seen since the FTX crash. Open Interest, a metric that measures the total number of outstanding futures that have not been settled, provides a glimpse into the trading activity and potential future price movements of an asset. A surge in OI can indicate heightened trading activity and interest in the market.

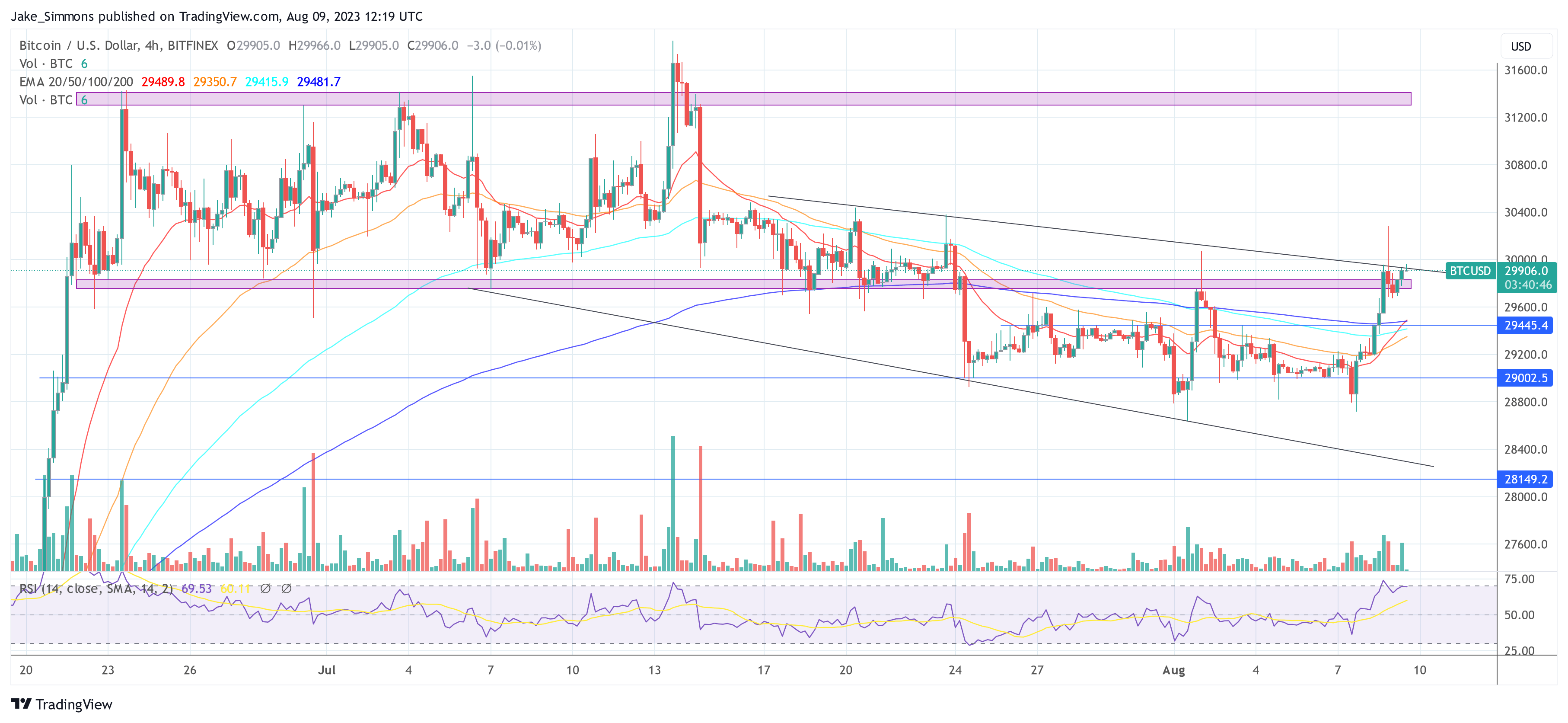

Starting early Tuesday, Bitcoin’s price action surged by more than 3.5%, breaking the $30,300 mark for the second time this month. This movement began around 5 am EST, pushing the price to a 16-day-high. The catalyst behind this surge seemed to be the rumor that insiders at BlackRock and Invesco have confirmed that a Bitcoin spot ETF is not a question of “if” but “when”, suggesting an approval within the next four to six months.“Bitcoin whales opened giga long positions at $29k,” remarked CryptoQuant CEO Ki Young Ju. The Head of Research at CryptoQuant further added, “A lot of talk lately about increasing probability of Bitcoin spot ETF approval in the US. Now Coinbase premium sharply up and moving towards positive territory (implies Bitcoin demand in the US is strengthening). GBTC price discount has continued to narrow.”

Bitcoin Futures Open Interest Skyrockets To Yearly High

Aggregate OI for Bitcoin futures saw a significant jump, increasing by over $1 billion from the previous day to a staggering $14.95 billion, according to Coinglass data.

CPI Release To Take Out The Heat?

Notably, the Consumer Price Index (CPI) in the US is scheduled for tomorrow, Thursday, 8:30 am EST. The release has the potential to cause a mass liquidation of the overheated BTC futures market in both directions. A major move by the BTC price seems imminent.Forecasts suggest a rise in the headline CPI from 3% to 3.3% year-over-year (YoY) for July, marking a significant transition as the positive impacts from the prior year start to wane. Notably, the Cleveland Fed’s Inflation Nowcast model projects a 3.42% headline CPI, marginally surpassing general expectations. Core CPI is expected to slightly decline from 4.8% to 4.7% YoY.

At press time, the BTC price was just below key resistance at $30,000.