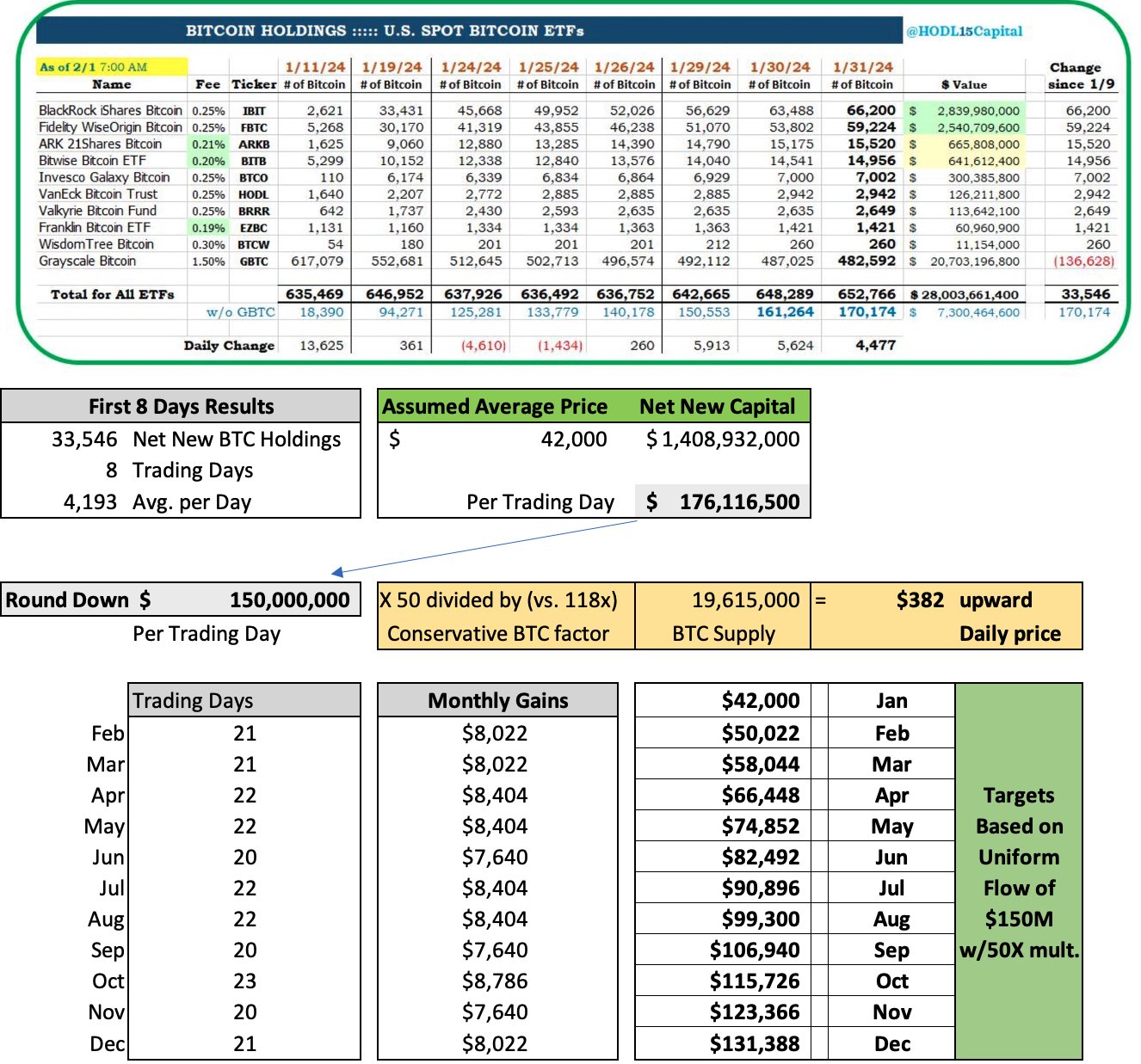

In an released via X, Thomas Young, managing partner at RUMJog Enterprises, is projecting a staggering upward trajectory for Bitcoin’s price by the end of the year, basing his predictions on the influence of Bitcoin Exchange-Traded Funds (ETFs) inflows. As NewsBTC reported, Grayscale’s GBTC outflows have slowed down significantly recently, resulting in constant net over the past five consecutive days,ranging from $14.8 million to $247.1 million.

The 118 Multiplier Concept

The crux of Young’s analysis hinges on the concept of the ‘118 multiplier’, a metric introduced by Bank of America in March 2021. This multiplier posited that an investment influx of approximately $92 to $93 million was needed to move Bitcoin’s price by 1%. At that time, Bitcoin’s market capitalization was approximately $1.09 trillion, corresponding to a unit price of around $58,332.

Young’s forecast revisits and modifies this concept, emphasizing its non-static nature. He notes, “The Multiplier is a result of several interacting variables, including the volume and velocity of capital inflow, the readily tradable supply of Bitcoin, and external factors affecting risk metrics in the broader market.” Thus, the 118x multiplier is suggested to be a dynamic, rather than a fixed, indicator.Bitcoin Price Could Reach $131,000 By EOY

Applying a more conservative multiplier of 50x, as opposed to the original 118x or 100x, Young calculates an estimated monthly upward price pressure of $8,000 per Bitcoin. This calculation leads to a year-end price target of at least $131,000 for Bitcoin. Young states, “This $131K represents the lower bound of the forecast, acknowledging that actual capital flow may not be uniform and other factors could increase the multiplier.” The adjusted analysis also takes into account the irregularities observed in January, particularly the one-time selling of GBTC. Young revised the January data to provide a more accurate representation of the trend for the remainder of the year. He suggests, “A rule of thumb: the daily average BTC gain across all ETFs times $2 gives a conservative estimate of the ETF growth’s price effect.”- January: $42,000

- February: $50,022

- March: $58,044

- April: $66,448

- May: $74,852

- June: $82,492

- July: $90,896

- August: $99,300

- September: $106,940

- October: $115,726

- November: $123,366

- December: $131,388

This meticulous analysis from Young not only highlights the potential impact of ETF inflows on Bitcoin’s price but also underscores the complexity and dynamic nature of cryptocurrency markets. However, other events that affect supply and demand dynamics, such as the next BTC halving, as well as macroeconomic developments (Fed rate cuts), among others, are other factors that make price predictions incredibly difficult.

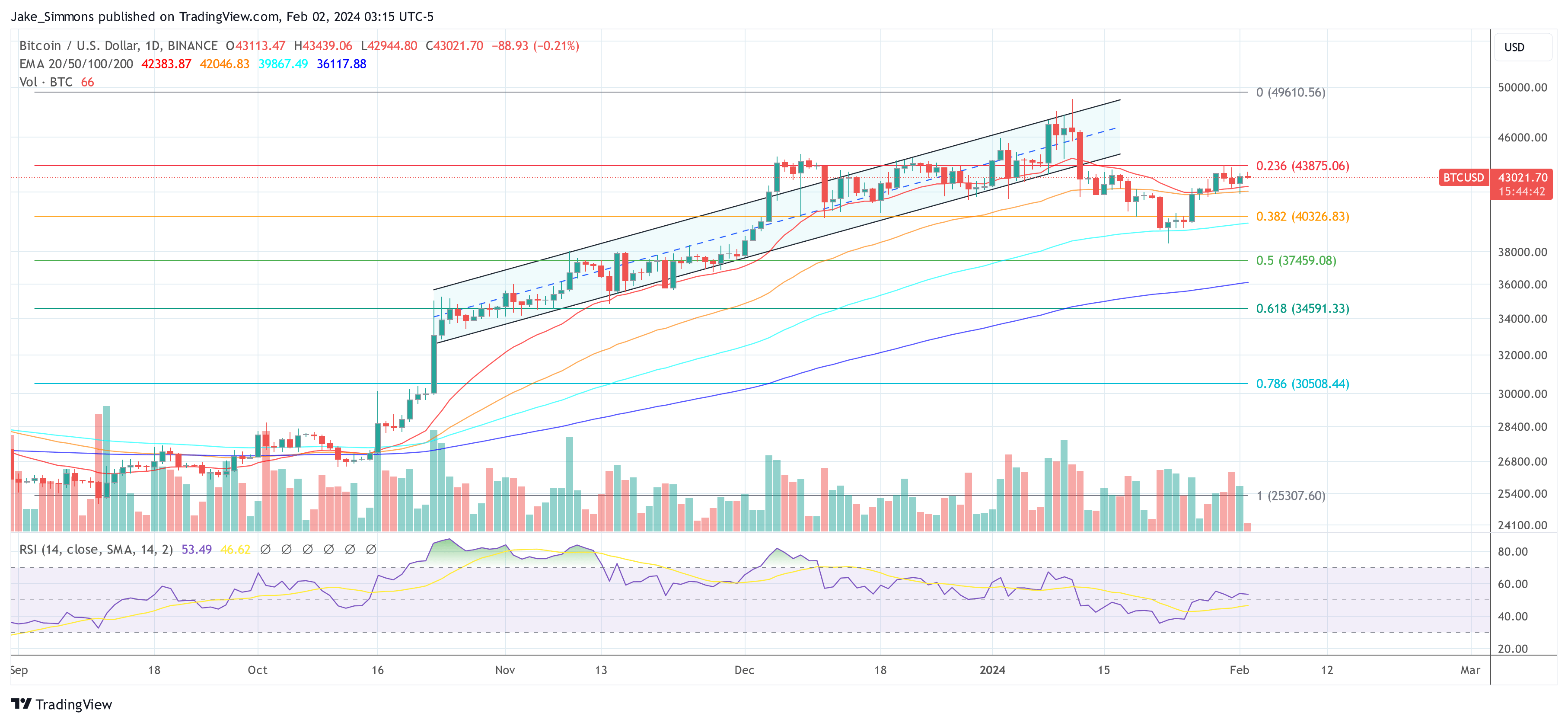

At press time, BTC traded at $43,021.