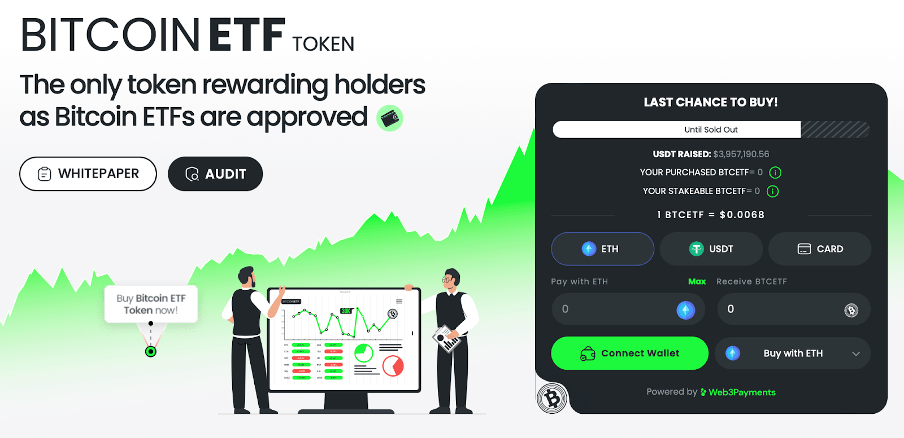

The hottest cryptocurrency of this month is Bitcoin, surging past $40K and reaching for the much-awaited $50K milestone. But close behind is , which has not even launched.

How did the project manage to win a large audience in such a short space of time?

Let’s find out.

The Rise of Bitcoin ETF Token

Although a bull wave has been long due in the crypto market, it goes without saying that the recent uptrend has most, if not everything, to do with the potential approval of BTC spot ETFs.

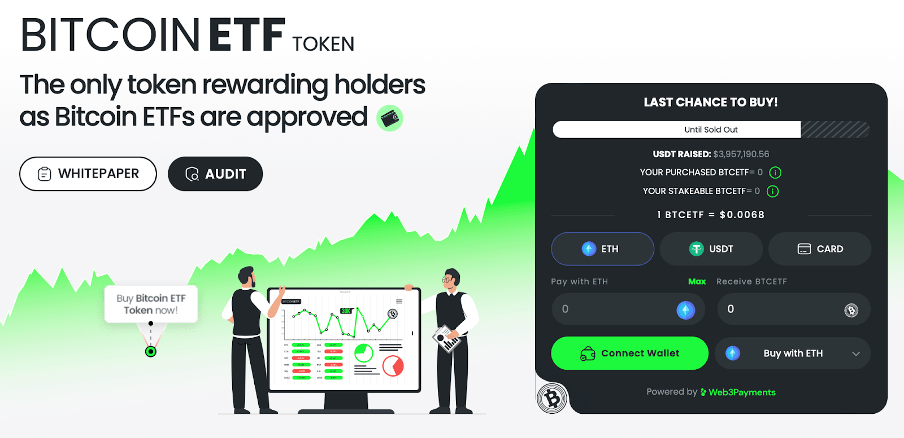

So it makes sense why Bitcoin ETF Token continues to draw traffic to its ongoing presale. Bitcoin’s journey beyond $40K has helped the project win the attention of various crypto communities. Arguably, $BTCETF has higher investment potential than Bitcoin in December.

It gives users better exposure to recent events and upcoming milestones than Bitcoin, which has a massive market cap already.

$BTCETF’s low initial market cap and price are attractive features from the point of view of an investor. It gives the project a larger room for growth, which in turn, translates to higher potential ROI. The heavy traffic to the $BTCETF presale mirrors the growing interest in the project.

One of the key factors driving the presale momentum has been the optimistic price forecasts for Bitcoin. Investors are buying both Bitcoin and Bitcoin ETF to gain big from the upcoming bull runs. While Bitcoin excels in the high-cap category, Bitcoin ETF Token tops the low-cap category.

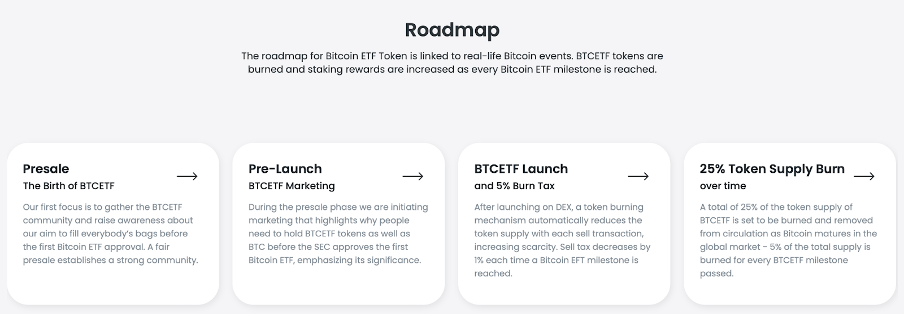

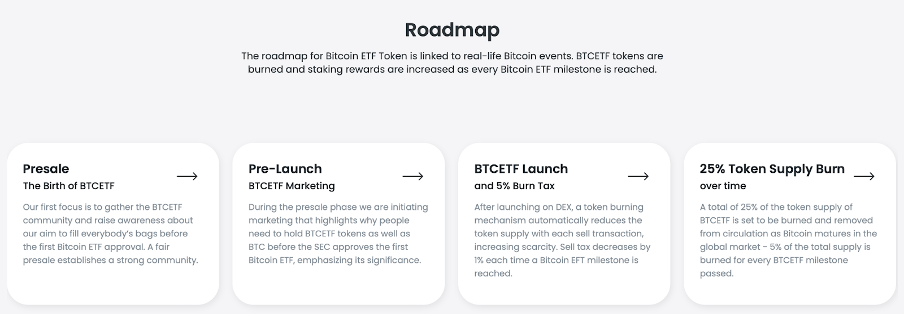

The Charm Lies in the Roadmap that Parallels Bitcoin

Of course, the name Bitcoin ETF Token and the ticker $BTCETF give an advantage to the token when it comes to leveraging the market enthusiasm.

But is that all? In that case, is the token any better than meme coins?

That’s a relevant question. $BTCETF doesn’t plan on being a short-term sensation like meme coins, although it clearly takes advantage of speculation and market sentiments around ETF approvals.

At the same time, it secures its long-term potential and market relevance using a reward system closely tied to Bitcoin. The project doesn’t just plan on capturing the enthusiasm generated by recent developments around Bitcoin, but also in its journey ahead. It gives users substantial exposure to the sentiments around Bitcoin not just now, but also in the future.

This is made possible by the project’s robust DeFi mechanisms that feature stake-to-earn, burning, and tax systems in its operational structure. By positioning itself within the DeFi (Decentralized Finance) landscape, Bitcoin ETF Token stands apart from the meme coin market, while leveraging its speculative capabilities.

The distinctive combination of hype and practical utility explains the surge of interest in the ongoing presale of $BTCETF tokens. The DeFi solution underscores the project’s long-term appeal and sustainable price action.

How Does it Work?

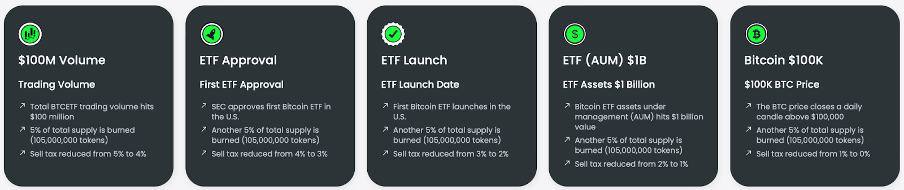

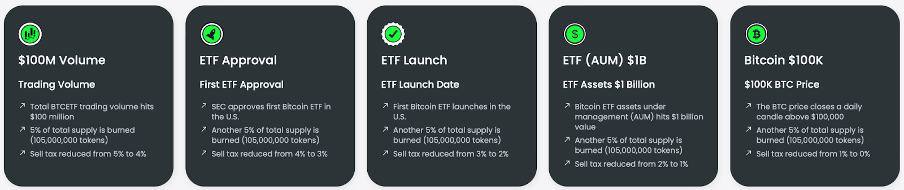

The stake-to-earn system’s role is to incentivize token retention. It makes this possible with a substantial 25% of the overall token supply set aside for staking rewards. It fosters early investment and community involvement.

But it’s important to note that as the staking pool grows, the APY (Annual Percentage Yield) decreases. So early backers of the project have a clear advantage over late-comers.

The stake-to-earn feature temporarily restricts the $BTCETF supply. Since that is not enough, a burning mechanism is also integrated into the DeFi mechanism. It permanently eliminates 25% of the token supply over time.

- Staking incentivizes holding with promising rewards.

- Burning introduces controlled scarcity to the equation.

A sell tax structure is also a part of the roadmap. Its role is to eliminate the risk of abrupt market manipulation by discouraging excessive selling. It will begin at 5% in the first stage and gradually decline by 1% as the project achieves new presale milestones.

The sell tax will conclude on the project hitting its fifth milestone, which will parallel the BTC price touching $100,000.

All sell tax proceeds are directed towards burning.

Traders and Analysts are Optimistic About $BTCETF

The growing social media presence of Bitcoin ETF Token has grabbed the attention of market experts and traders as well. The project has been garnering positive price predictions. Jacob Bury, renowned for spotting low-cap opportunities in the crypto market ahead of time, predicts a substantial 10X surge in $BTCETF’s price after its launch.

One of the key factors that will continue to work in favor of the project is its timing and correlation with the Bitcoin roadmap.

Given that the new ETF assets will inject a large amount of money into the market if approved by Q1 2024, established assets like BTC, ETH, ADA, and MATIC will soon reclaim their previous all-time highs.

Aligned strategically with the trajectory of Bitcoin ETFs and the associated price movements of Bitcoin, $BTCETF has higher growth potential. Each new development is likely to directly impact the price action of the token. The diverse DeFi mechanisms, on the other hand, will help it sustain its price dynamics.